A warm welcome from the Community, @Fmnconsulting.

I’ll be helping you out on how to categorize expenses in QuickBooks Self-Employed.

It's important to categorize transactions whether you download them from your bank or enter them manually.

Here are the steps on how to categorize transactions:

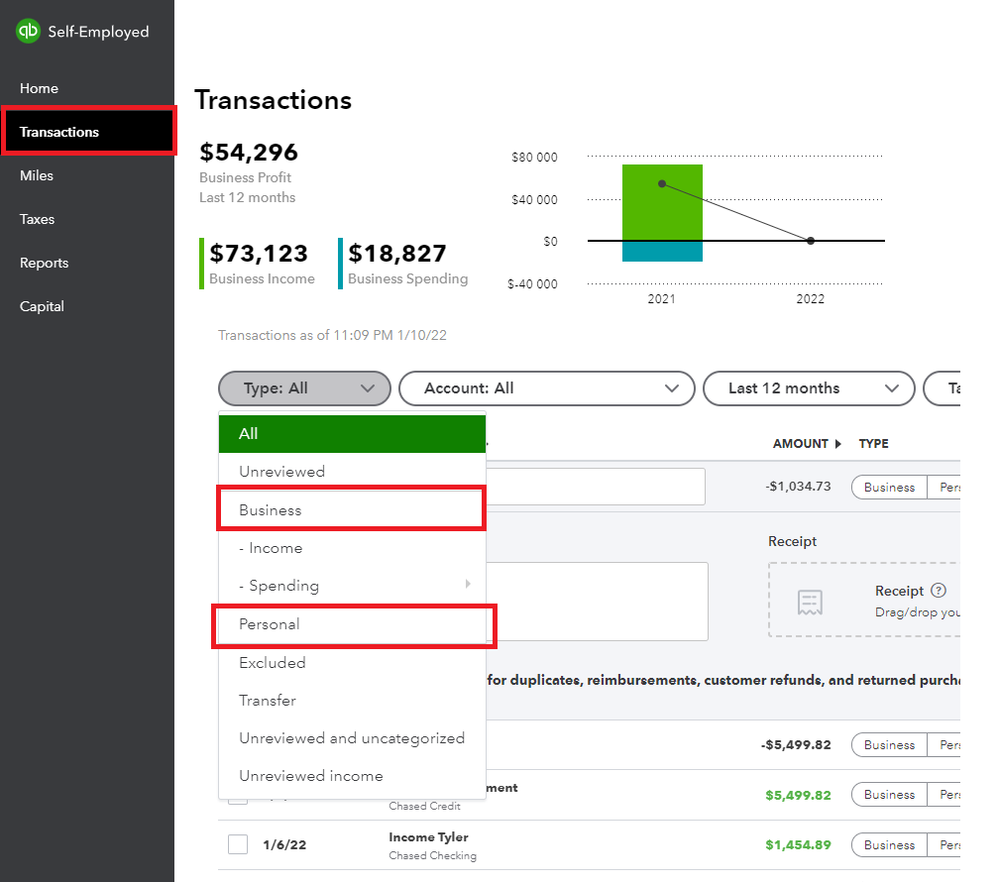

- On the left navigation bar, Click Transaction.

- Sort the data and account for the specific transaction.

- Click the dropdown for the Type: All tab, choose if it is for Personal or Business.

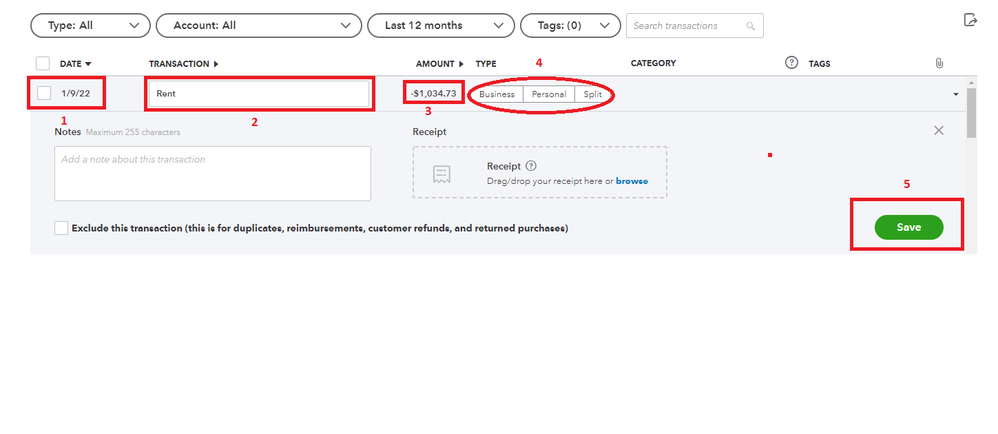

- Double click transaction, input the Date, the Schedule type, Amount, Notes (Optional) Split if you are doing both in one transaction.

- Click Save.

For more information, have this article for your guide.

Additionally, earn about schedule C. This also arranges your earnings and expenses so you can see which aspects of your self-employed business have the most influence, check this link.

Let me know if you have any more concerns about categorizing transactions, I am always here to lend help. Have a wonderful day!