Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI do construction and remodeling. My daughter is remodeling her home. I made a personal check deposit into my quickbooks account as a gift to her to cover some of the job materials. How do I record the deposit and apply it to her job as the check did not come from her.

Solved! Go to Solution.

I'm sure your daughter would be happy to receive the gift, @CB601.

Rest assured I can guide you on how to apply your gift to cover some of your daughter's job materials.

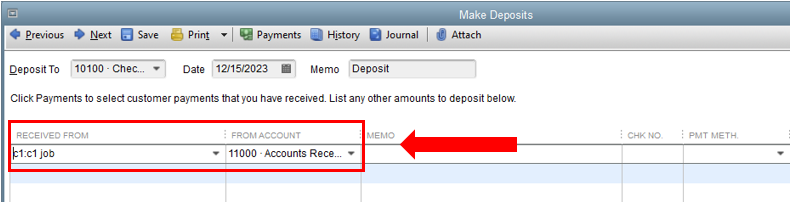

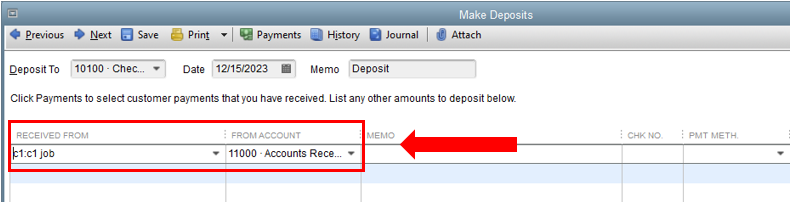

You can record a bank deposit and use the Accounts Receivable A/R account in the line item to serve this as customer credit. This way, you can apply the credit as invoice payment to your daughter's job materials. Let me show you how:

You can also check this link for more details: Record and make bank deposits in QuickBooks Desktop.

Once done, you can now create an invoice for your daughter's job and apply the credit to record the payment. You can refer to the Option 3 section in this article for guidance: Give your customer a credit or refund in QuickBooks Desktop for Windows.

I'd also suggest working with your accountant for further guidance on other ways to record this. Furthermore, I'm adding this resource that serves as your guide in making sure your accounts stay accurate: Reconcile an account in QuickBooks Desktop.

If you need more help recording gifts and jobs in QBDT, you can also tag me in your reply. I'll be more than happy to work with you again. Have a good one and keep safe!

I'm sure your daughter would be happy to receive the gift, @CB601.

Rest assured I can guide you on how to apply your gift to cover some of your daughter's job materials.

You can record a bank deposit and use the Accounts Receivable A/R account in the line item to serve this as customer credit. This way, you can apply the credit as invoice payment to your daughter's job materials. Let me show you how:

You can also check this link for more details: Record and make bank deposits in QuickBooks Desktop.

Once done, you can now create an invoice for your daughter's job and apply the credit to record the payment. You can refer to the Option 3 section in this article for guidance: Give your customer a credit or refund in QuickBooks Desktop for Windows.

I'd also suggest working with your accountant for further guidance on other ways to record this. Furthermore, I'm adding this resource that serves as your guide in making sure your accounts stay accurate: Reconcile an account in QuickBooks Desktop.

If you need more help recording gifts and jobs in QBDT, you can also tag me in your reply. I'll be more than happy to work with you again. Have a good one and keep safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.