Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowlocation: On vendor information page and report generated thereafter

Not entirely sure what setting I've touched but before payment and credit showed up as positive while bill showed negative (or the other way around)

but now both payment and bill is showing up negative on amount column, making it very difficult to see.

Is there a way to fix this? I looked everywhere on preference setting

Solved! Go to Solution.

What you are seeing is Fine. What you should learn, here, is "Source and Target" accounts.

When you see Transactions like the listing in Vendor Center or in Reporting, you are seeing the Source account. Example:

Write Check is Source = Checking, as the Credit Side of an entry

Enter Bill is Source = AP, as the Credit Side of an entry

Enter Credit Card Charge = CC, as the Credit Side of an entry

For all of these transactions, the Expenses tab and items entry are Target. So, Write Check to buy Office Supplies = Debited Supplies expense and Credited Bank.

That's why they show negative = the Source account. This is the Accounting Formula:

Assets = Liab + Equity

Credit to check Decreases Checking. Credit to AP or CC (types of Liability accounts) will Increase them, as they are on the Right Side of that Equals sign.

Then, you see positive, such as Vendor Credit = Debit AP. Again, a Debit to banking, such as Deposit = Increases bank (an Asset). You Debit a Liability, such as Vendor Credit = Decreases that Liability (it's on the other side of the Equals sign). So that shows as a Positive.

You have No Problem in this file.

Pleased to see you here, @seong.

Welcome to the Community! I appreciate you for sharing a screenshot of what you're seeing on your end. Allow me to share some information on why you're seeing negative amounts on your Vendor's information.

For starters, negative figures on your vendor's transactions list indicates something that you've paid to them. This will show on the Amounts column. However, if there's negative balance in Accounts Payables can sometimes mean that bills were entered. And checks were written against it, but the original bills somehow got deleted or voided. The bill-payment checks are left “hanging” in the system, creating a negative balance in A/P.

If you notice a negative balance in A/P, or even if you have certain vendors who show a negative balance in the Vendor list, here's how to fix it:

If you need further help on the steps above, I’d recommend reaching out to our Customer Care Team. A specialist will be able to access your account in a secured environment and further assist you via remote access session.

Here's how to contact us:

Feel free to drop a comment below if you have other questions about any unexpected behavior in QuickBooks while managing your income and expense transactions. I’ll be here anytime you need my assistance.

What you are seeing is Fine. What you should learn, here, is "Source and Target" accounts.

When you see Transactions like the listing in Vendor Center or in Reporting, you are seeing the Source account. Example:

Write Check is Source = Checking, as the Credit Side of an entry

Enter Bill is Source = AP, as the Credit Side of an entry

Enter Credit Card Charge = CC, as the Credit Side of an entry

For all of these transactions, the Expenses tab and items entry are Target. So, Write Check to buy Office Supplies = Debited Supplies expense and Credited Bank.

That's why they show negative = the Source account. This is the Accounting Formula:

Assets = Liab + Equity

Credit to check Decreases Checking. Credit to AP or CC (types of Liability accounts) will Increase them, as they are on the Right Side of that Equals sign.

Then, you see positive, such as Vendor Credit = Debit AP. Again, a Debit to banking, such as Deposit = Increases bank (an Asset). You Debit a Liability, such as Vendor Credit = Decreases that Liability (it's on the other side of the Equals sign). So that shows as a Positive.

You have No Problem in this file.

In your response, even though it is "correct" because both sources are credits show as negative numbers, it is still confusing to read. Is there a way for the bill to be a positive nd the payment of it to be a negative?

Hello there, @JSmith092653.

Let me share with you how you can make a negative amount in the expense transactions into a positive figure.

Bill transactions will show up as a negative expense if you haven't applied them to a payment yet. Once you've paid the bill, the bill-payment will display a positive amount on both Account Payable (A/P), and into the bank accounts transactions when you run vendor reports.

On the other hand, if this is an inventory item, make sure to select an asset account as the posting account and not the expense account.

You can also verify if the bill-payment was linked to the correct bill, since it may lead to a negative expense. If not, you need to delete it and apply the payment to the accurate one so figures will appear as positive.

Additionally, I'll reference these articles to give you more details in paying bills and understanding the Chart of Accounts in QuickBooks Desktop:

Feel free to leave a comment if you have more questions in mind. I'll reply as fast as I can. Have a great weekend!

Is this something new?? This just started happening intermittently between 2 of the systems in my office. Where an invoice shows up as a negative, a few days later goes back to a positive amount...... We have been utilizing QuickBooks for over 20 years. This has never happened prior to about 2-3 weeks ago.

Why would this all of a sudden happen, also today showed my main liabilities as a huge negative amount and some of the other liability payments an very large amounts, when the amount in reality is a $50 weekly payment amount.....Are my reports I am generating showing correct amounts? Are my liabilities and A/P reports correct? Who knows??

Thanks for joining this thread, sheylasr.

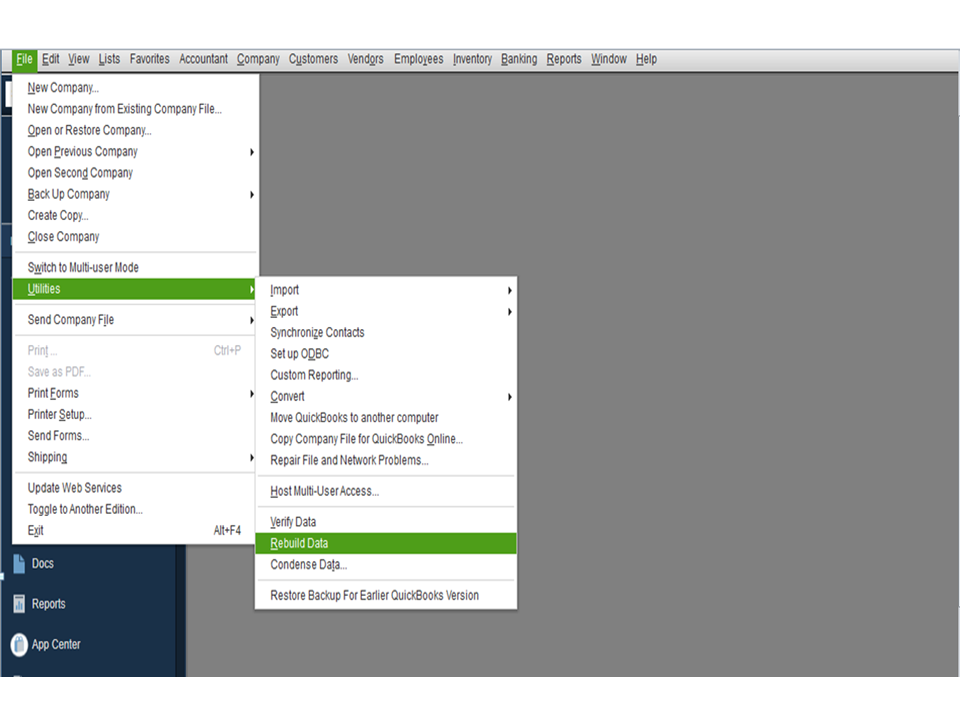

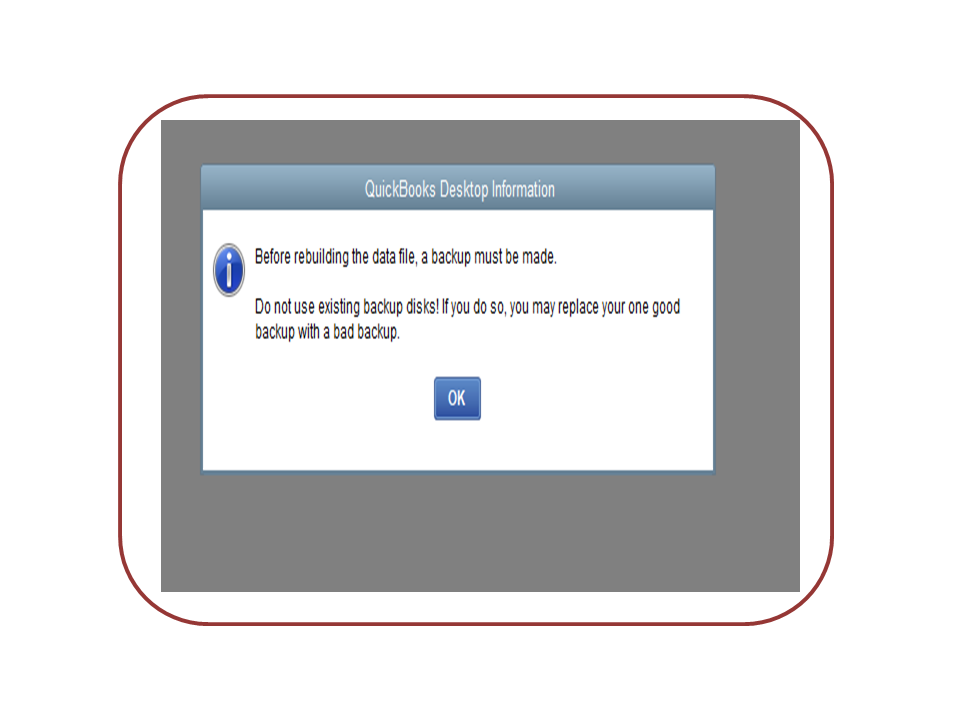

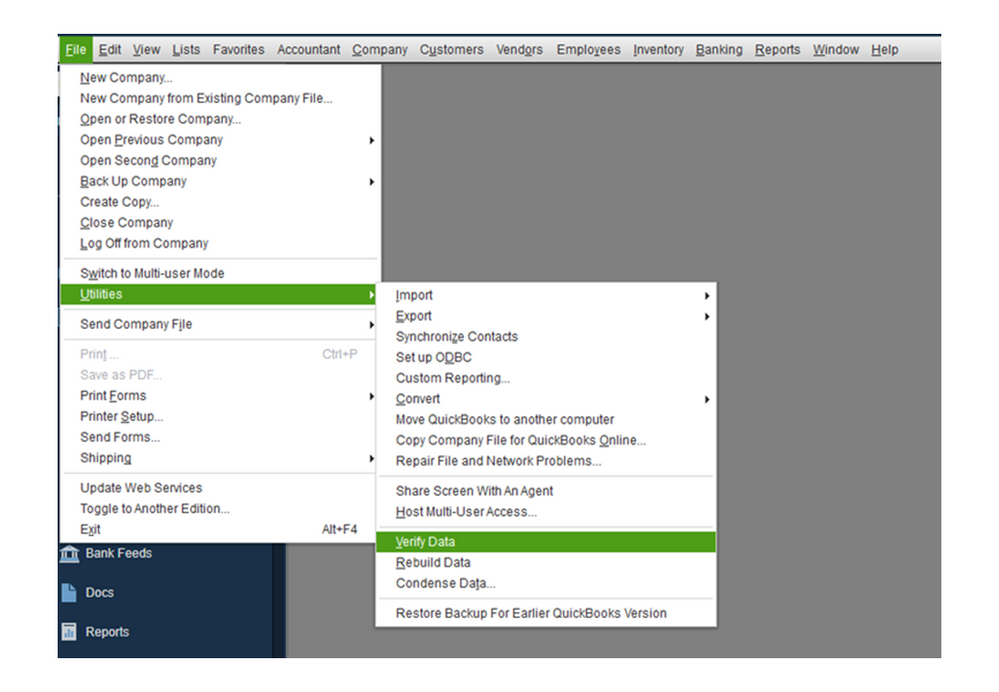

Let’s run the Verify and Rebuild Data Utilities to fix the incorrect data showing in your QuickBooks. The former identifies any potential data damage. While the Rebuild Data utility repairs damaged transactions in your company file.

Here’s how:

If it finds an issue, click Rebuild and perform Steps 2-3 in the following article: Fix damaged transactions in QuickBooks Desktop.

For additional resources, this guide provides an overview of the steps on how to resolve data issues: Fix data damage on your QuickBooks Desktop company file.

Keep me posted if you need further assistance performing with any of these steps. I’ll get back to make sure you’re taken care of.

Are you still here. I have exactly this problem now.

It started in 2021 when I paid several bills for a particular vendor and Liabilities turned -ve. This vendor does have a -ve amount in the Unpaid Bill Details - where I see a Check paid.

How can I correct this?

Thank for reaching out to us, @stockman.

My colleagues have share some helpful information to help you review where the negative entry comes from. You can also run some reports and compare the balances. Another option is to toggle the payment, by removing and applying it again.

If that doesn't fix it after the recommended troubleshooting from this thread, I do recommend reaching out to our Support Team. To get a live representative, use the following steps in your account:

You can also use this link to contact us and see our support availability: Contact QuickBooks Desktop support.

I want to make sure you're taken care of, please come back here anytime for updates and additional questions. I'll be right here if you need other help.

This issue with entering a Bill is that that bill will be on the books forever and cannot be paid since it will affect the bank account balances - especially, in my case, where it was entered over 10 year ago.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.