Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI will be using QB Essentials to track income, expenses but I will not be using it to track individual customer accounts or invoicing. We use an industry-specific 3rd party software that handles customer and invoice management. How are payments deposited in the bank recorded and categorized? Should we place it in an A/R category? Thanks!

Solved! Go to Solution.

Thanks for getting back to us here, @alneville.

Let me add some insight about getting your deposits recorded in QuickBooks. If you're not using QuickBooks for your invoices, you don't need to choose the A/R account or category. You can use your income account directly. Select the income account where to keep track of your sales. This way, you can keep track of your income and expenses correctly.

To know the other reports in QBO, check out this gudie: Reports included in your QuickBooks Online subscription.

If you need help with other tasks in QBO, you can browse for specific topics here and look for responses that fit your concern.

Feel free to message me anytime if you still have questions or concerns with your account. I'm always here to help. Take care and stay safe.

Which 3rd party app do you need to use? Doesn't it support QBO?

https:// quickbooks.grsm.io/US

https:// quickbooks.grsm.io/us-promo

As another option, you may import data (e.g Invoices, Receive Payments) into your QBO account by using an importer tool.

https:// transactionpro.grsm.io/qbo

They have a general ledger (that you configure) that brings in service revenue, payments, and any adjustments. The program is servicepro which is used by thousands of companies globally. It doesn't carry in customer information or invoices and I'm not sure we'd want that anyways to avoid any possible duplicate entries.

I'm grateful for the clarification that you gave, @alneville.

It's my priority to ensure that your records are accurate so you can reconcile them smoothly.

To track and categorize your payments correctly, I suggest reaching out to your third-party provider to verify if there's a way to sync the application's data into QuickBooks Online. This way, transactions will be imported automatically, and you can categorize them easily.

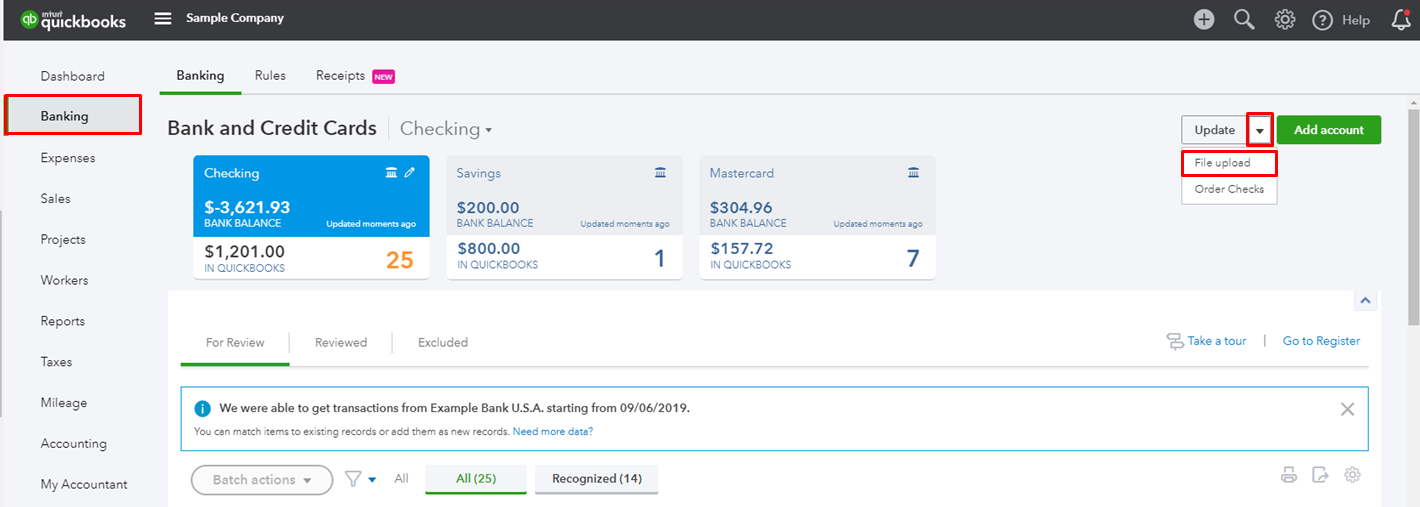

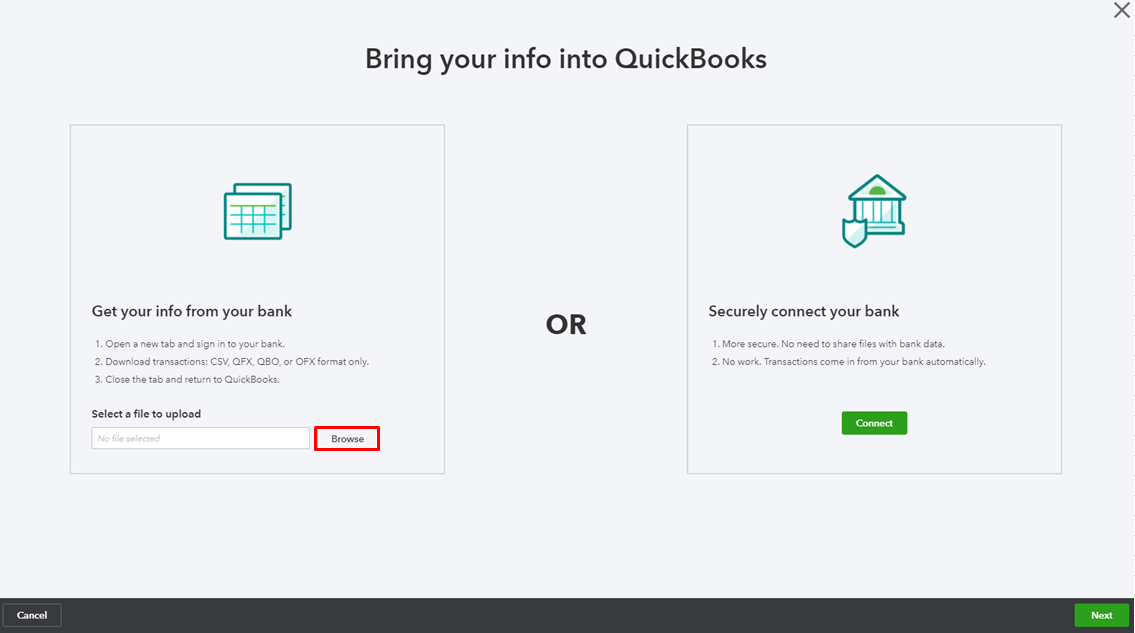

For now, to get your work done, you may manually upload the entries in the system. This way, you'll be able to categorize the entries and match them successfully.

Here's how you can upload them:

For the information and steps on importing these files, see this article: Manually upload transactions into QuickBooks Online.

After that, you can start categorizing and matching the transactions.

Keep in touch if you need further assistance while working in QBO. I’m always here to help and make sure you’re taken care of. Enjoy the rest of the day.

Although I appreciate the reply I don't think it addresses the original question. The software we use (servsuite) doesn't sync with QuickBooks and has no plans of doing so which isn't uncommon. What they do offer is the ability to pull and download a general ledger in the QB format with service/production revenue, sales tax collected, payment made, credits, adjustments, etc. It sends in all of the financials and is identified based on the account numbers that we set up in both QB and servsuite. All I'm really trying to figure out how do we categorize the deposits funds we've made that populate in our bank feeds, do we move them to an AR (payments received) catagory so it will deduct from the service/production we bring in through our other software? We really only want to use QB as accounting software that tracks our income and expenses only and not get tied into invoicing, payment processing, and customer management. Thanks!

Thanks for getting back to us here, @alneville.

Let me add some insight about getting your deposits recorded in QuickBooks. If you're not using QuickBooks for your invoices, you don't need to choose the A/R account or category. You can use your income account directly. Select the income account where to keep track of your sales. This way, you can keep track of your income and expenses correctly.

To know the other reports in QBO, check out this gudie: Reports included in your QuickBooks Online subscription.

If you need help with other tasks in QBO, you can browse for specific topics here and look for responses that fit your concern.

Feel free to message me anytime if you still have questions or concerns with your account. I'm always here to help. Take care and stay safe.

Thank you!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.