Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHello,

I'm stuck! :smileyfrustrated: Hopefully someone out there can help me.

I invoiced my customer for my services with a total of $1,012. Customer could only pay thru PayPal, so I submitted the invoice thru PayPal. He payed the full amount of $1,012 but PayPal charge me a fee of $54.43 from the $1,012. Now I'm reconciling my bank statement and I see a total of $957.57 was deposited to my account. I want to payed this invoice in quickbooks (RECEIVE PAYMENT for the invoice of $1,012) What should I do if I know my customer payed the full amount $1,012 but PayPal charge my a fee of $54.43.? I basically receive only the $957.57.

Please advice

Thank you.

Solved! Go to Solution.

It's nice to see you here today, @Eve2019,

Thanks for sharing in-depth details about the issue your getting. I can provide you the steps to record the invoice payment with the bank fee in QuickBooks Desktop.

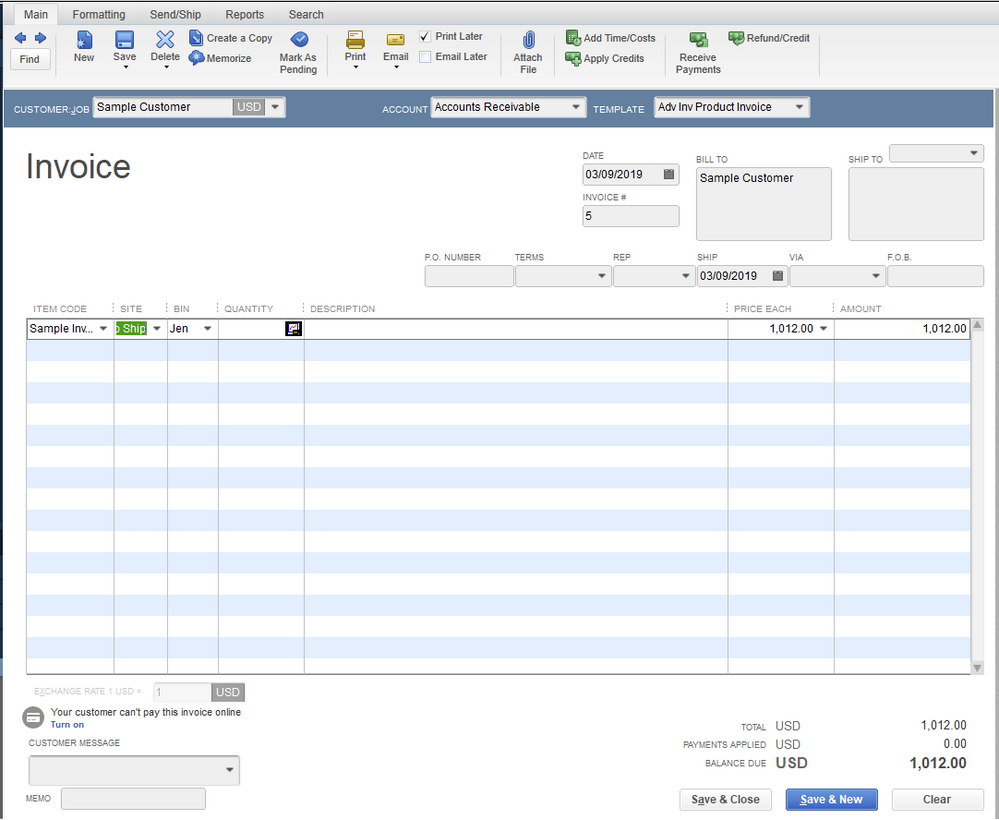

Step 1: Create the customer invoice.

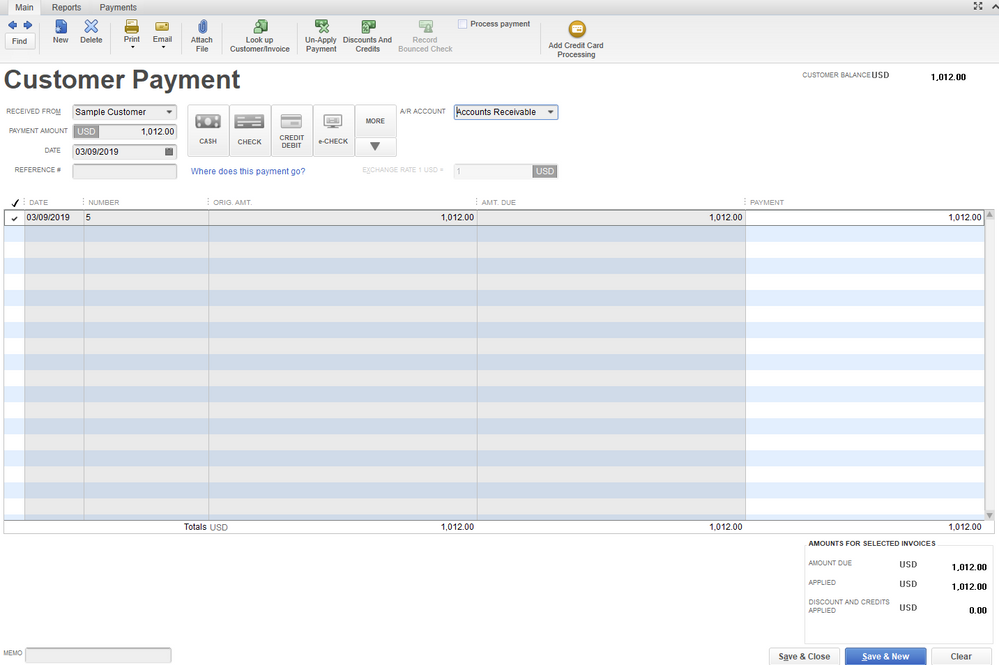

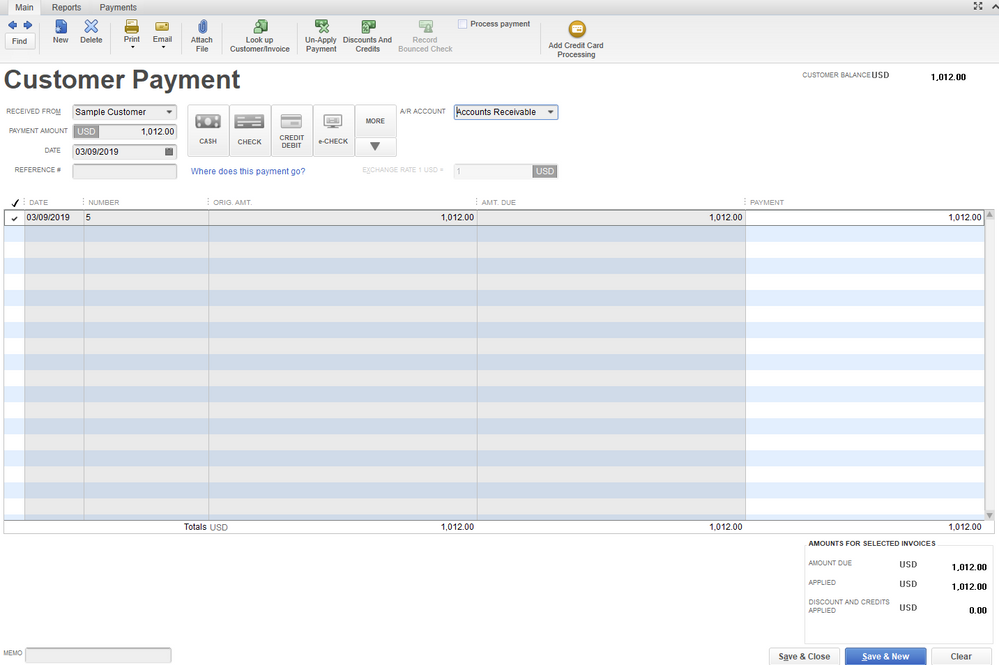

Step 2: Receive the full invoice payment to remove the A/R balance.

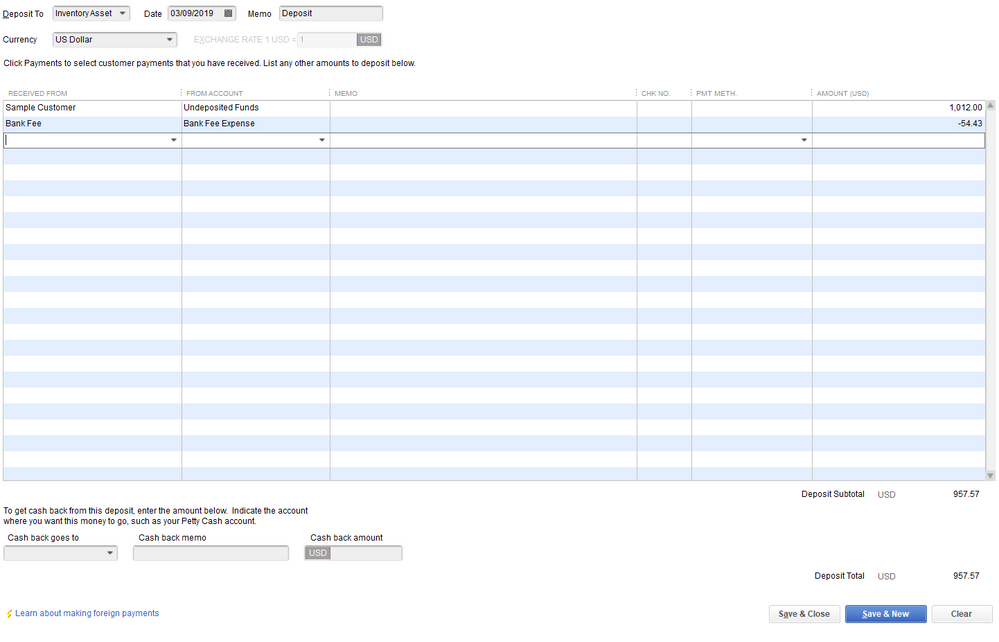

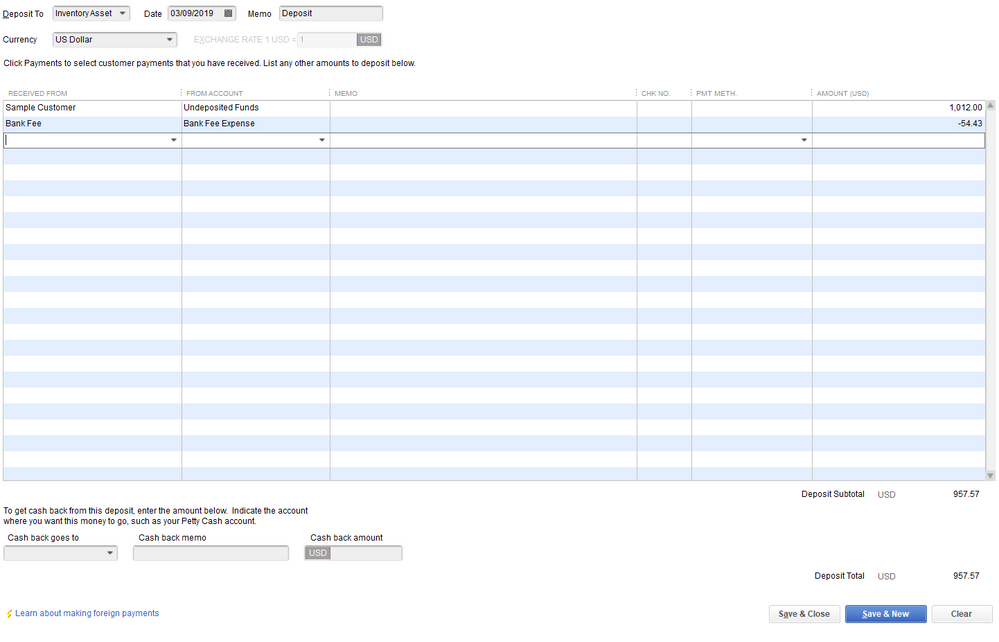

Step 3: Enter a Bank Deposit for the bank fee to relieve the balance from Undeposited Funds account. (See screenshot)

Once done, you can now match your bank statement with the $957.57 payment you received. That should get you on the right track, @Eve2019. Please let me know if you need further assistance with recording the bank fee. I'll be available to help you anytime. Have a great day!

It's nice to see you here today, @Eve2019,

Thanks for sharing in-depth details about the issue your getting. I can provide you the steps to record the invoice payment with the bank fee in QuickBooks Desktop.

Step 1: Create the customer invoice.

Step 2: Receive the full invoice payment to remove the A/R balance.

Step 3: Enter a Bank Deposit for the bank fee to relieve the balance from Undeposited Funds account. (See screenshot)

Once done, you can now match your bank statement with the $957.57 payment you received. That should get you on the right track, @Eve2019. Please let me know if you need further assistance with recording the bank fee. I'll be available to help you anytime. Have a great day!

My screen looks different from your screen. I have QB 2018. There was some steps I skipped because couldn't find them not sure if it has to do with me having QB2018. anyways I went along with your steps and now my numbers match. So I think I did it right.

The account I received from was- MY BANK and from the Account column I entered the account I created which was PAYPAL- as an Expense and then in the AMOUNT column I entered the negative amount which is the fee paypal charged me.... so I did these steps which I think is basically the same as your steps and and my account balanced out. Thank you so much!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.