Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowAssuming the expense has already been recorded elsewhere, how do I record a payment to a business credit card using personal funds? Can I just assign this to Owner's Draw or Owner's Equity?

Thanks for posting to the Community, @jjgfromnj.

It isn't advisable to mix personal and business funds whereas the nature of the transactions determines to commingle.

However, you may encounter situations that will require you to do so. Assumed that you've recorded the expense, to record the business expense using personal funds, you can follow these steps:

Here's an article as your source: Create a journal entry in QuickBooks Desktop.

For more details on how to record a payment to a business credit card using personal funds, you can refer to this article: How to Record Expenses Paid by Paid by the Owner's Personal Funds.

Please feel free to leave a message to this post or tag me (@Jovychris_A) if you need further help. I'll be around to guide you. Have a good one!

Thank you. I have a follow-up questions. Let's assume that the individual expenses were entered into QB via a feed from the CC bank. And further assume they are in the CC register, and I've assigned expense categories to each of them

If I then enter a J/E where the debit side is the expense account and the credit side is Owner's Equity, won't that "counterbalance" (or cancel out) the original expense? Is there anything wrong with me just entering a transaction into the CC register that comes from Owner's Equity? For what it's worth, I use QBD, not QBO.

@Jovychris_A Wouldn't using the expense account in a journal entry zero out the expense that is entered elsewhere? Any reason I can't just enter a transaction into the CC register that uses Owner's Equity as the account, to make the CC account balance 0?

I appreciate your response a lot, @jjgfromnj.

Yes, it has to be dedicated CC for the business. Whether it is personal funds or business at the CC makes no difference to your accounting.

What is important is that it starts with a zero balance and only business transactions are paid with it.

I also suggest consulting your tax CPA for help. They know how to do it very well and what the CPA tells you makes some sense.

Just in case, I've already updated my answers above, including the articles for reference in doing so.

Please let me know if you have more questions in QBDT. I'll keep my notifications open. Stay safe!

Hey, I'm just getting started on QB. So what I did was make a "bank" under my name and my partner's name. I would record all CC payments as "record as a credit card payment" made by A or R. However, 2022 and moving forward, I will move my personal funds to pay for these business CC directly to the business checking. So the business checking account will pay for all my business CC. Hope that helps.

Hi A and R,

Although we recommend not to mix business and personal funds, we know it happens sometimes that'll require you to do so. With your client's scenario, you can either record a credit card transaction (as directed by my colleague) or enter a Journal Entry (JE) using the Owner's Equity account.

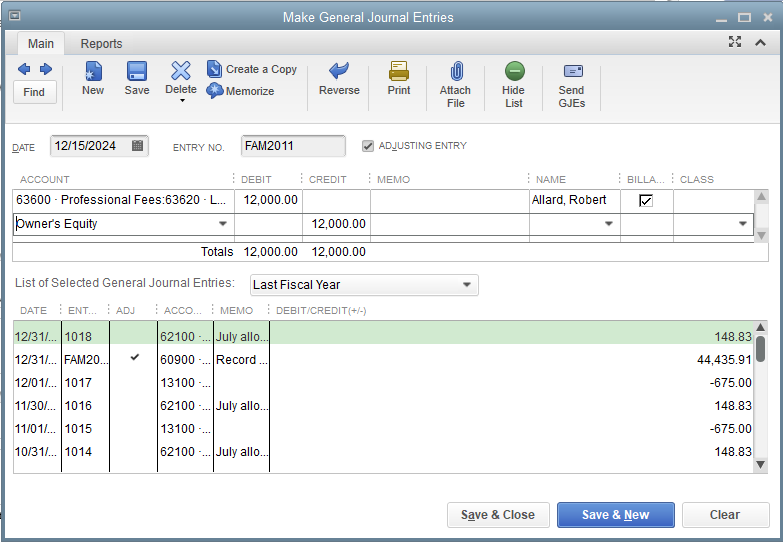

To account for your client's payment through JE, here's how:

To learn more about recording JEs in QBDT, you can refer to this article: Create a journal entry in QuickBooks Desktop for Windows or Mac.

Also, to learn more about recording expenses paid by the owner's funds, I'd recommend checking out this article: Pay for business expenses with personal funds.

Let me know if you have any other QuickBooks or banking questions. I'll always be here available to help

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.