Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowFirst of all, thank you for any response.

I use QB Desktop Pro (not online)

I am a first time business owner (with my brother). We outsourced an app development, for which my brother and I paid from personal accounts and got reimbursed from company accounts. I am very new to accounting & quickbooks.

1. Should I setup a personal account on QB?

2. How do I record the bill payment from personal account? (Have a vendor invoice)

3. How do I record the reimbursement from business account to personal account?

Thankyou.

I saw many related Q/As. But they were not directly related OR appeared to be for a seasoned accounting person. Your help is appreciated.

-jrPig

Thanks for the details and welcome to the Community, @jrpig.

Allow me to share some insights and steps about recording business expenses paid with personal funds in QuickBooks Desktop (QBDT).

Generally, it's a good practice to avoid mixing business and personal expenditures. However, there are times when you have to such as in your case.

First, there's no need to make a personal account in QBDT. You'll have to retain the current opening business account you've created.

Second, you'll need to create a journal entry to track the business expense you paid with personal funds. As always, it would be best to consult an accountant on what accounts to use to ensure your books are accurate. Here's how:

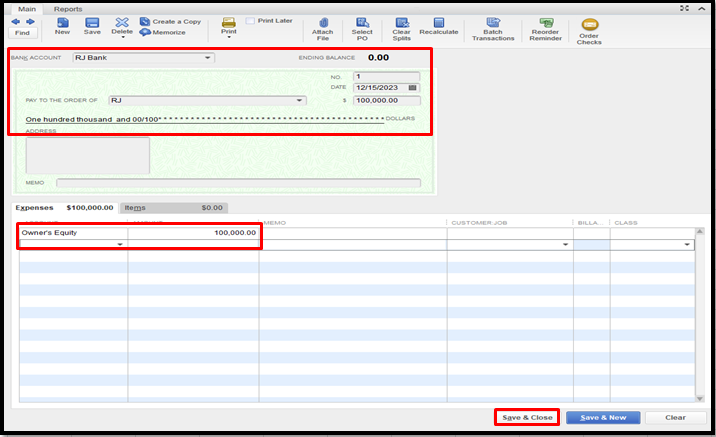

Third, you can create a check to reimburse the payments from business to personal account. Here are the steps how:

Also, I'd recommend entering a memo in these transactions, so the other members of your business can easily identify them.

You'll want to modify and print checks in QBDT. This way, you'll have the info you need and save a copy on hand.

I'm always around to lend a hand for more QuickBooks-related concerns you may have. Take care and have a great day.

I was also seeking answers to the above questions about recording business expenses with personal funds. I have an additional question along the same lines. It has to do with the 2nd part of the conversation..being reimbursed or writing a check for the amount assigned to owner equity. What if the owner does not want to be reimbursed (primarily because there hasn't been enough income yet to fund a reimbursement) but only wants QB to reflect the expenses for tax purpose?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.