Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowWhen customers pay $300 for a gift card (gift cards captured as "Other current liability"), we give them $315.00 value on the gift card. How do I record this in QB Desktop?

When I do a sales receipt to record this transaction, I do a $315.00 purchase of "gift card" with a $15.00 discount sales item. This makes the sales receipt reflect the correct amount paid, but the amount reflected in my current liability is not accurate (will show $300 instead of $315).

Solved! Go to Solution.

It's great to see you here, @smallfarm,

It's possible that the discount item you're using is tied to the Other Current Liability Account for the gift card. Doing so will result to the reduction item deducting to the current liabilities.

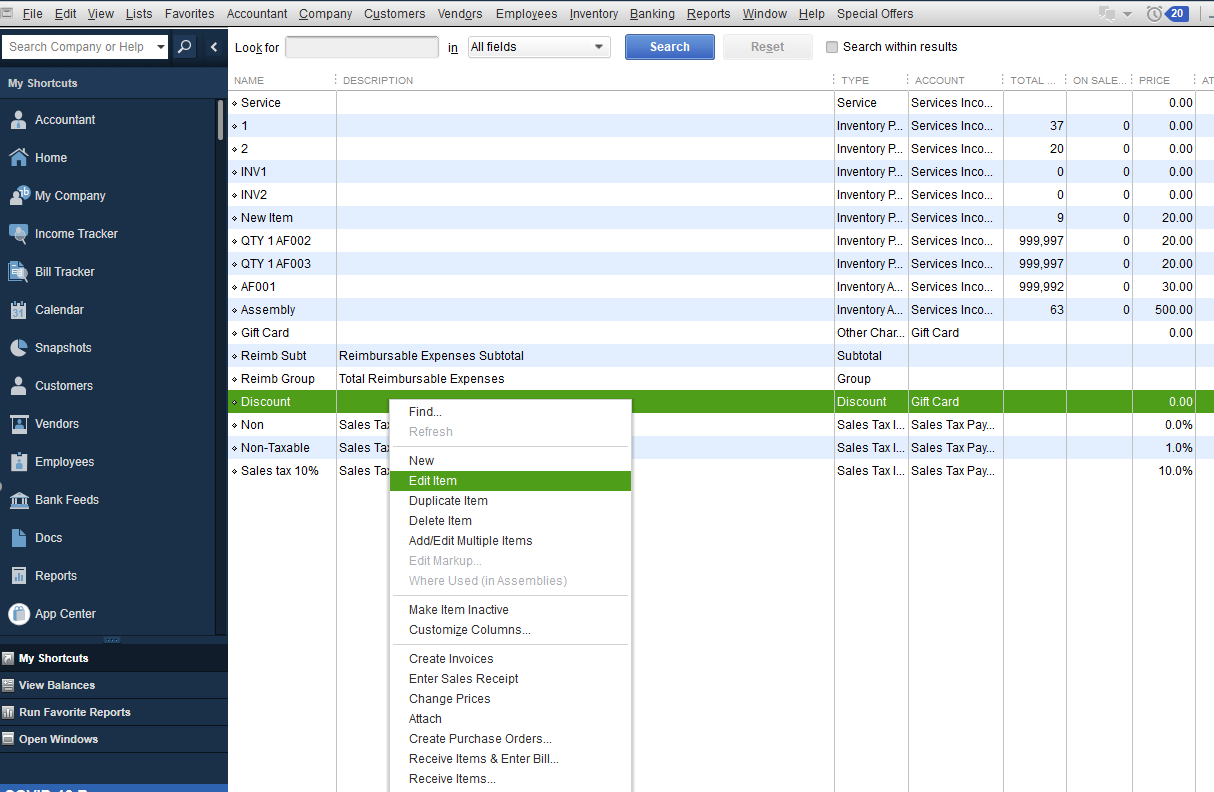

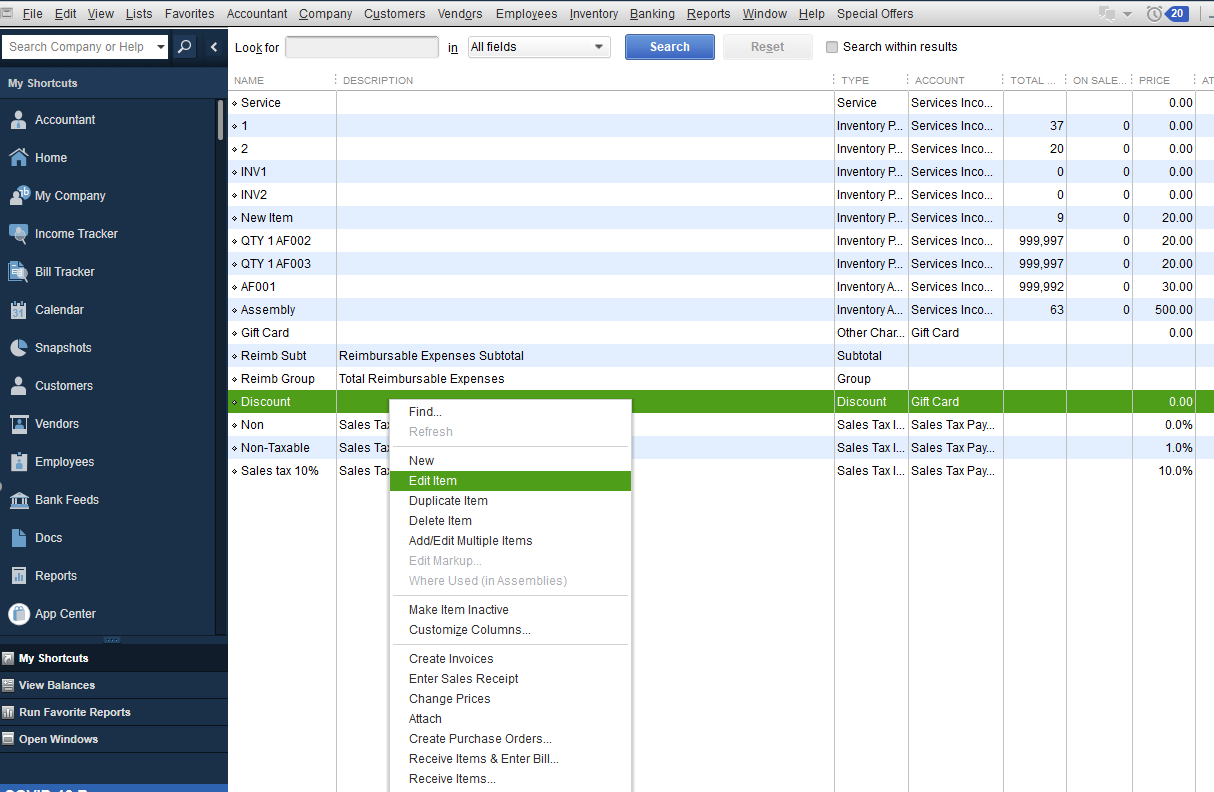

I've replicated the same steps in my end and have come up to the same scenario as yours. Here are some screenshots for you to review:

If you have a company discount, use another account on the item so it won't affect the Other Current Liability Account. Do that by following these steps:

Once updated, the balance on your OCL will also change with the correct amount.

If you have other questions about this topic, please let me know in the comment below. I'll be more than happy to share some insights about gift cards and all other topics about QuickBooks. Have a nice week!

It's great to see you here, @smallfarm,

It's possible that the discount item you're using is tied to the Other Current Liability Account for the gift card. Doing so will result to the reduction item deducting to the current liabilities.

I've replicated the same steps in my end and have come up to the same scenario as yours. Here are some screenshots for you to review:

If you have a company discount, use another account on the item so it won't affect the Other Current Liability Account. Do that by following these steps:

Once updated, the balance on your OCL will also change with the correct amount.

If you have other questions about this topic, please let me know in the comment below. I'll be more than happy to share some insights about gift cards and all other topics about QuickBooks. Have a nice week!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.