Enter federal Form W-4

by Intuit•294• Updated 2 weeks ago

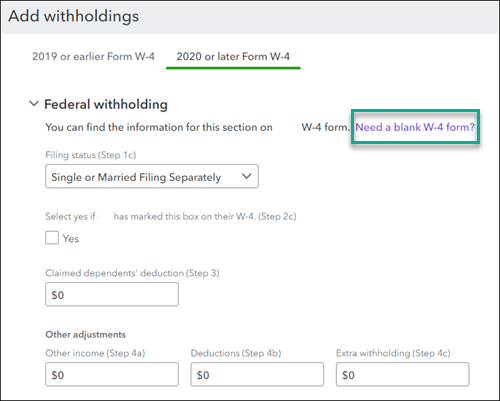

Learn how to print a blank W-4 form from QuickBooks for your employees if needed. You can also add or change the information in your employee profiles. The W-4 is a vital part of the Federal Income Tax calculations on your employees’ paychecks.

| Note: Some changes to the 2020 and later form can impact your employee’s Federal Withholding on paychecks. It can also impact the amount of their refund or taxes owed when filing their personal tax return. Get more info. |

Important info about filling out a W-4

- There are two versions of the federal W-4 form: 2020 and later and before 2020. Your employees can use either of the federal W-4 forms.

- All of your employees should fill out a W-4. Per IRS guidelines, if you don't receive a completed W-4 from an employee, withhold their tax as if they’re single.

- If your employee switches to the 2020 or later W-4 form, they’ll likely notice a difference in Federal Withholding on their paychecks and the amount of tax owed or refunded when they file their personal tax return. Get more info.

- If your employee needs help understanding the W-4, or needs guidance for their tax situation, they should speak with a tax advisor or financial planner. Intuit and employers legally can’t provide W-4 advice.

More like this

- Use the Colorado Employee Withholding Certificateby QuickBooks

- Exempt your employee from Federal or State Withholdingby QuickBooks

- File your W-2 and W-3 formsby QuickBooks

- Troubleshoot no income tax withheld from a paycheckby QuickBooks