Hello, megan5.

I can help you set up a health insurance deduction for your employee in QuickBooks Online.

You may want to check and see if the deduction is set up correctly.

Here's how:

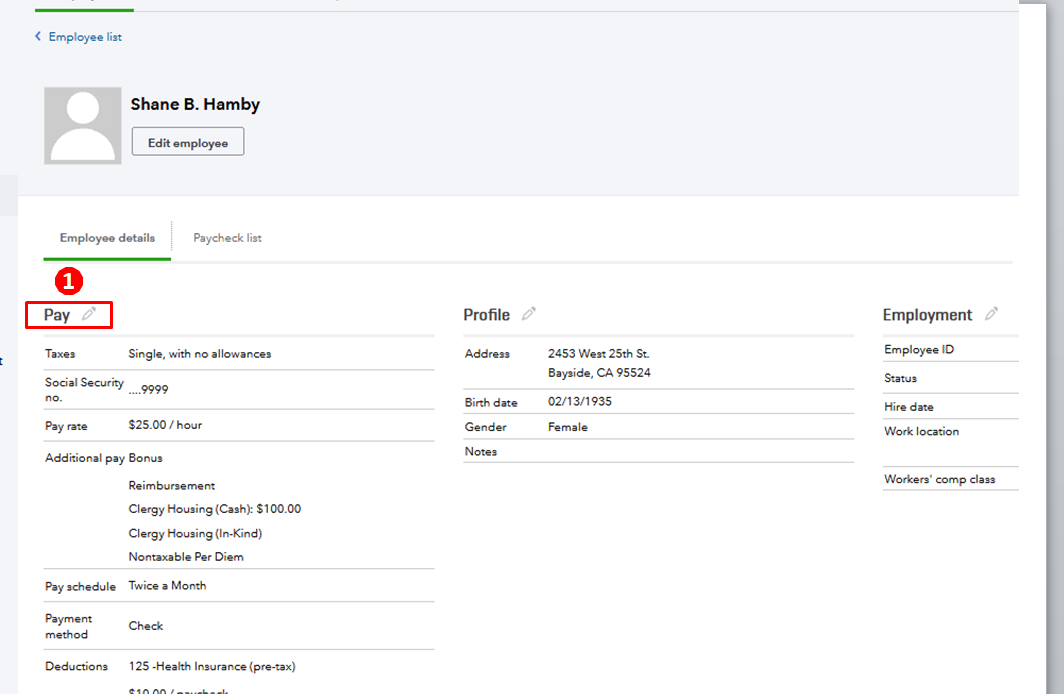

- Select the employee and click the pencil icon beside Pay to edit.

- Go to number four and click Add new deduction.

- Click the drop-down arrow and select New Deduction/contribution.

- Choose Health Insurance.

- Choose Medical Insurance.

- Enter the insurance provider.

- Under Employee deduction, choose None.

- For Company-paid contribution, select % of gross pay then enter the percentage amount and enter the Annual maximum amount.

- Hit OK and Done.

You can follow these steps in setting up the pension fund.

Also, you may find this article helpful: Set up health insurance deductions and contributions.

To code the expense deduction here's how:

- Click the Gear icon at the upper right corner.

- Under Your Company, click Payroll Settings.

- Go to Preferences, and click Accounting Preferences.

- Go to Company Contribution Expense Accounts and choose I use different accounts for different groups of company contributions.

- Look the insurance deduction you created and choose an account.

Please know that always here to help you out if you need anything else.