Thanks for reaching out to the Community, @dschloss39. You've come to the right place.

No worries, I'm here to guide you through the process of matching your Deposit to your Invoice. Let's begin:

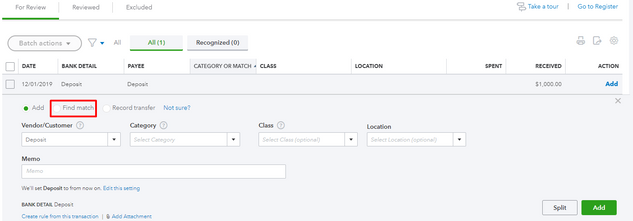

- If you click Add on the Deposit in the For Review tab, then you moved the transaction to the register. Here's how you can bring the transaction from the register to the For Review tab:

- Go to Banking, then Review tab.

- Locate the Deposit. Mark the checkbox next to the transaction (left-hand side of the row), then press the Batch drop-down menu at the top of the list and select Undo.

- Navigate back to the For Review tab. Click on the Deposit to show more details. Hit Find Match and mark the Receive Payment or the Invoice on the list, then hit Save.

That's it! For more information on how to link a Deposit to an Invoice, click here.

To keep your account balanced, Reconciliation is the process of a matching transaction entered into QuickBooks against your bank statements. This should be done regularly, once a month at the very least when you receive your statements. Here's an article to walk you through the process: Account Reconciliation in QuickBooks Online.

Let me know if this works for you! I'll be here. Have a beautiful day!