Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowCould you please clarify something for me....

I use qb online and have my bank account linked to the account.

When I apply 'receive payments' for outstanding invoices the money goes in towards my sales. For example, if there are $5000 in outstanding invoices and I mark those payed, the $5000 now goes towards my total sales.

My question is, when my banking shows there was a $5000 deposit of sales into my bank account (due to physically depositing $5000 worth of checks into the bank) do I confirm this payment or will it add the $5000 again towards my sales as I have already applied it to the outstanding invoices? Is this double entering the sales?

I’m here to provide information that will surely clear things out for you, @Ellie16.

Since the amount was deposited in your bank account and you've used the Receive payments to clear the outstanding invoice, yes, it will add up your sales and results to have doubled entries.

Once the open invoice was paid through bank transfer (ACH) or checks, you don’t need to use the receive payment feature to apply for the payments. Instead, match it to the downloaded transaction (deposit) to clear the outstanding amounts.

The Receive payments option is only applicable if someone paid you through cash. That way, you can apply the said payment to settle the events.

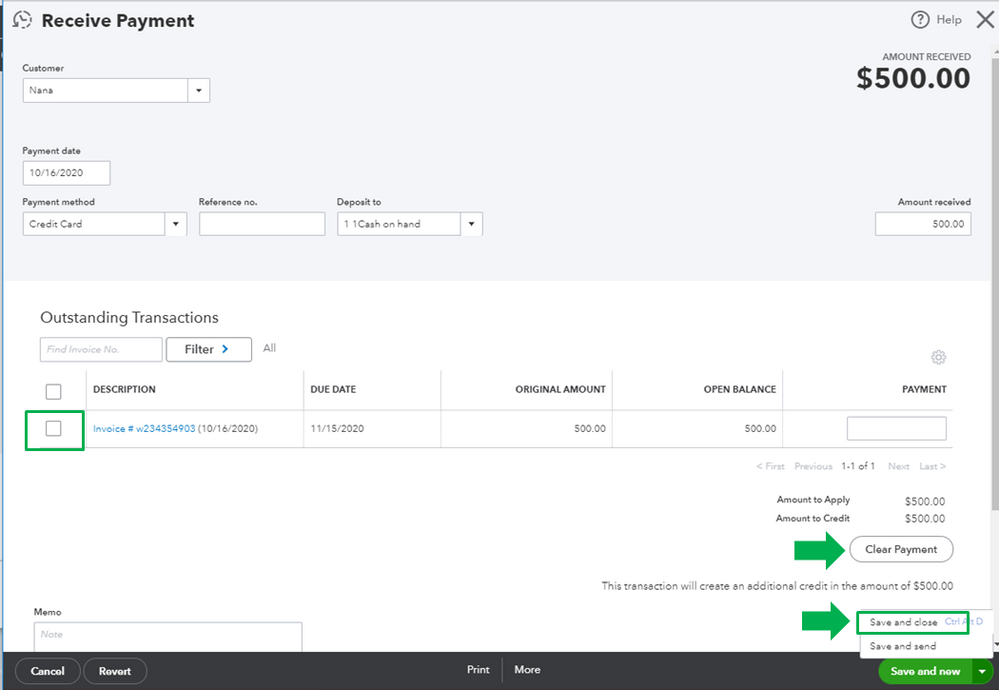

You can delete the payment you’ve created to get rid of duplicate transactions. Let me show you how:

Doing this process will make the invoice open again. Then you’ll have to go to your Banking page to match it to the deposit. Here’s how:

You can use this reference for additional information about categorizing and matching online bank transactions in QBO.

Moving forward, have this as a guide when you reconcile your account. It contains complete instructions to ensure everything is balanced and accurate.

Let me know if you other concerns or follow-up questions about your entries. I’ll be here to help you out.

If Receive Payments is for cash sales, than how do I close out an invoice when a check was payed? I prefer to close the invoice before I deposit the checks into the bank and wait for it to appear in my banking.

Thank you for your help!

@Ellie16 wrote:

Could you please clarify something for me....

I use qb online and have my bank account linked to the account.

When I apply 'receive payments' for outstanding invoices the money goes in towards my sales. For example, if there are $5000 in outstanding invoices and I mark those payed, the $5000 now goes towards my total sales.

My question is, when my banking shows there was a $5000 deposit of sales into my bank account (due to physically depositing $5000 worth of checks into the bank) do I confirm this payment or will it add the $5000 again towards my sales as I have already applied it to the outstanding invoices? Is this double entering the sales?

"My question is, when my banking shows there was a $5000 deposit of sales into my bank account (due to physically depositing $5000 worth of checks into the bank) do I confirm this payment or will it add the $5000 again towards my sales as I have already applied it to the outstanding invoices? Is this double entering the sales?"

On the Banking tab, you should never ADD deposit to sales, if you have created an invoice. Adding a deposit will create duplicate income for the same transaction. On the Banking tab, you should Match or find a match for that $5,000 invoice.

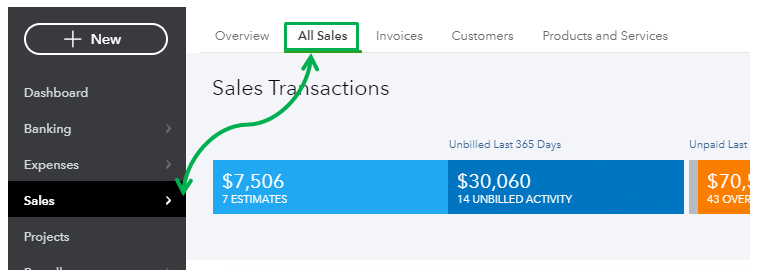

These are the steps to follow in QuickBooks.

1. Create Invoice

2. Receive payment on invoice (when you the payment from the customer and show invoice as paid)

a) Select Payment method: Cash > Select payment date and select Deposit to Cash on Hand account (or deposit to the bank account if you are depositing to the bank exactly the same amount. For example, you created an invoice for $5,000, received payment for $5,000, and deposit the same $5,000 to the bank account).

b) Select Payment method: Check > Select payment date and select Deposit to Undeposited Funds account — if these checks are not immediately deposited to the bank or you will be deposited in batch with checks from the customers. In this case, on the banking tab, when you see the deposit, try to match/confirm or select find a match.

This is how to avoid duplicate sales for the same transaction. Hope this helps!

I understand what you are saying in the banking tab and by accepting that deposit I will double the sale. I realize you are saying I would need to find the match for the that deposit. However, the deposit is a combination of invoices, not just 1 invoice which would make it very difficult to break down with finding matches. I believe the answer here is just exclude it.

Thank you for your help, I appreciate it!:)

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.