Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHello,

There appears to be an issue with the way the Balance Sheet is displaying/calculating Retained Earnings.

In 2020 my company paid out $12,000 in "Partner Distributions"

In 2020 the Net Margin was $12,392.

So to end 2020 and entering 2021 Retained Earnings should display $392. However it displays $12,392. The program is not subtracting the $12,000 dollars in calculating the Retained Earnings. Giving the impression there is more Equity left in the company than should be.

How or why is this doing this and what needs to be done to resolve it?

I've got just the information you're looking for getting the Retained Earnings account details in QuickBooks Online (QBO), @IRM.

Retained earnings appear under the shareholder’s equity section on the liability side of the balance sheet. Retained earnings are the residual net profits after distributing dividends to the stockholders.

Thus, to calculate retained earnings on the balance sheet, you need three items as per the retained earnings formula:

For more info on how to calculate Retained Earnings on the Balance Sheet report, check out this write-up: Retained Earnings Formula: Definition, Formula, and Example.

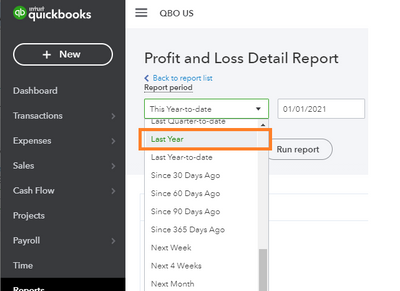

To verify this, I'd suggest running your previous year's Profit and Loss Detail report. This report shows all of the transactions that make up the net profit or loss that QBO automatically switched to your Retained Earnings account.

Here's how:

You can check out our this article for more information: How to view Retained Earnings account details in QBO.

Fill me in should you need further assistance with calculating your Retained Earning account on the Balance Sheet report. I'm always here to help you.

Hello,

While that information was thorough, it is all things I am already aware of. My issue is that on the balance sheet, the distributions is not be subtracted from Net Profit to give me my true retained earnings. (see attached screen shot) as this is ran 1/1/20 - 12/31/20. Note that the company was started in June of 2020 so there is no opening retained earnings balance.

Hello, IRM.

I've checked and there's no screenshot attached. The screenshot will help me identify the issue thou. Though, let me share some insight about Net Profit. The Net Profit or Net Loss in the retained earnings formula is the net profit or loss of the current accounting period.

For instance, in the case of the yearly income statement and balance sheet, the net profit as calculated for the current accounting period would increase the balance of retained earnings. Similarly, in case your company incurs a net loss in the current accounting period, it would reduce the balance of retained earnings.

Since all profits and losses flow through retained earnings, any change in the income statement item would impact the net profit/net loss part of the retained earnings formula.

Also, the net profit or net loss figure of the current accounting period, for which retained earnings amount is to be calculated. A net profit would lead to an increase in retained earnings, whereas a net loss would reduce the retained earnings. Thus, any item such as revenue, COGS, administrative expenses, etc that impact the Net Profit figure, certainly affects the retained earnings amount.

You can also reach out to your accountant to discuss more your accounting books to make sure it's all accurate.

Feel free to leave a comment below if you have any other questions. We're always here to help. Stay safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.