Hello, Plally.

I'll show the way to help you correct the income amounts from the Balance Sheet report.

You'll want to use a journal entry to move the amounts from the two income types to your fund balance account.

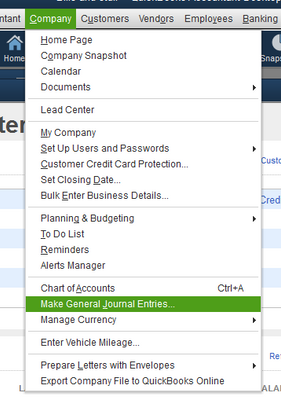

To create a journal entry, simply go to the Company menu, then select Make General Journal Entries.

This will definitely affect your books, so I would highly recommend consulting an accountant before doing this. They can guide you on what accounts to use for the debit and credit sides.

After correcting the amounts and the Balance Sheet report, you can work on other areas in QuickBooks. Don't forget to read our articles for guides and pointers.

Do you have any other questions like running other reports or managing your transactions? Do let me know in the Reply section below. I'm here to help again.