Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowSolved! Go to Solution.

sales post to income - always

If you use QB inventory items, then when you purchase you do not use an expense account like COGS

you use the item details part of the purchase, and list each item, qty and total cost - that stocks inventory as an asset, and when sold moves the cost from inventory asset to COGS

if you do not see the item detail part of the purchase screen, in company settings>expenses>bills & expenses turn on the items table and purchase orders

If you are not using inventory items in QBO, let me know and I can explain periodic inventory

sales post to income - always

If you use QB inventory items, then when you purchase you do not use an expense account like COGS

you use the item details part of the purchase, and list each item, qty and total cost - that stocks inventory as an asset, and when sold moves the cost from inventory asset to COGS

if you do not see the item detail part of the purchase screen, in company settings>expenses>bills & expenses turn on the items table and purchase orders

If you are not using inventory items in QBO, let me know and I can explain periodic inventory

On the P&L the number in COGS should be positive ( debit) the P&L does not show debits and credits unless you drill down

see the pic for how an inventory item should be set up

Sales is income, that is a credit to an income account, you do not post both sales and costs to one account if that is what you asking abount

Please help. I was on the phone with QB for over an hour and did not get my issue solved. I have just recently started tracking my inventory. I have all Product set up as "inventory item"like to "inventory asset" account "Income account is "Sales of Product Income" and the expense account is "Cost of Goods Sold". I have a an amount in the "Sale Price" and an amount in the "Cost". Yet when I run a P&L and look at the list of items in "Cost of Goods Sold" all of the items cost is 0.00. How do I get QB to track COGS? Thank you so much for your time.

Hello there, @Carlaleeanne.

Thank you for joining this thread and providing some feedback. Allow me to step in and share some insights about tracking COGS in QuickBooks.

In order for the "Cost of Goods Sold" to show a non-zero amount, you have to make sure that you've entered a sales transaction with the item. Also, make sure to select the correct report period.

For in-depth information, please refer to this article: Understand Inventory Assets and COGS tracking.

Keep me posted if you have additional questions. Just add a comment below or mention my name.

I have the same issue. Update 4/12/19: figured this out. If you don't give a cost, any cost at all, when you create the Product or Service, it will not add in that Cost later. If you put in the cost when you CREATE the Product/Service, it will work as it should: create a COGS on your Income Statement as an Expense, and reduce the value of your inventory. Intuit could help a lot by putting a little help message on the screen when one is setting up a product or service, or a warning before you save a product / service that the Cost is $0 and that if one ever wants to track that one needs to enter the cost OR just letting one add in a cost later.

Hello HoneyLynn, it would be helpful if you could explain what do to rather than referring us to an existing help article. I have been on phone with QB support for over an hour and they are telling me that it is not possible to show the $0. This makes no sense, since COGS and Inventory Value are showing up on the Transaction Detail of any given Invoice. Help would be greatly appreciated!!

Hello, @acgoggin.

I appreciate you reaching out to this thread to search for answers about the zero value for COGS. I'd be glad to help clarify the COGS and Inventory Value showing up on the Transaction Detail report.

When setting up an inventory item with no sales price and cost, it'll also show a zero amount on the Transaction Detail for Inventory Asset and COGS. So even if you try editing the cost and sales price, QuickBooks will still analyze it as zero COGS and Inventory Asset not unless the quantity for that item is zeroed out.

If you want to show the COGS on the report for this item, you'll need to adjust the quantity and recreate the inventory item. To know more about inventory adjustment, you can check out this article: How to adjust inventory quantity on hand.

I've attached some sample screenshots below about the differences between an item with and without cost and sales price. Also, how it would look like in the Transaction Detail By Account.

This should help guide you in the right direction. If you need other helpful references, you can always visit our site: Help articles for QuickBooks Online.

Should you have other questions about COGS and Inventory, please don't hesitate to hit the Reply button. I'm always here to help.

Hi

I am also having the $0 COGS on my P & L. When I drill into the COGS detail some show cost but many do not. All our items are set up with a cost. We do not have a sell price established because sell price varies from customer to customer. We are just getting started wit QB Desktop 2019.

Pat

I can provide how COGS works, Phanley71.

COGS will only get affected once you have sold inventory items using invoices or sales receipts. If you haven't added any sales transactions yet, it might be the reason why your COGS account shows as $0 in the Profit and Loss report.

One more thing, let's just make sure all items have cost since QuickBooks will calculate the COGS amount from it. Even though sales transactions are created but the item's cost is not set up, COGS will provide a $0 or incorrect amount. You can check this article for more information: Understand Inventory Assets and COGS tracking.

Let us know if you have other questions. We're just here.

We have created invoices and sales receipts all month. The sales amounts show up on the P&L but most COGS do not.

We started the year with QBO and it is a disaster for our business so March 1 we switched and transferred all our data to QB Premier 2019. Something happened in March with COGS in Premier because it was working in QBO. Why some costs transfer to the P&L and some do not is a mystery to us.

As I mentioned in my first post, all our inventory items have a cost assigned to them.

Thank you for the additional details you shared, @phanley71.

Let me chime in and help figure out why your COGS account is showing zero on your P&L.

If you assigned a cost to all your inventory items in QBO, then transferred the data to QuickBooks Desktop, then this is a limitation issue. The COGs and Inventory Asset accounts will have incorrect balances due to different calculation methods used by QuickBooks Online and QuickBooks Desktop.

I'm including this article for more information: Export limitations - QuickBooks Online to QuickBooks Desktop.

I've also mentioned on the above thread about adjusting inventory quantity and recreating the inventory item. This will help show the COGS on your P&L report.

Should you have other questions about your COGS account, please don't hesitate to ask. I'm also here to provide help in any way I can.

@Rustler Can you email me, I have a question regarding the expenses not showing on my profit and loss report. I've got my expenses coded as Cost of Goods Sold.

email me at [email address removed].

Sorry to worry you...so if I am using the item part on the invoice.. The item on sales side goes to sales were must the item on the purchase side be allocate to what expense account.? Not COG ...

Thanks for joining this conversation, Learner girl.

Yes, you're correct! When using an item on an invoice, the sales side goes to the sales account associated with it. For the purchase side, this will depend on how the item was set up. We can verify this by opening its information.

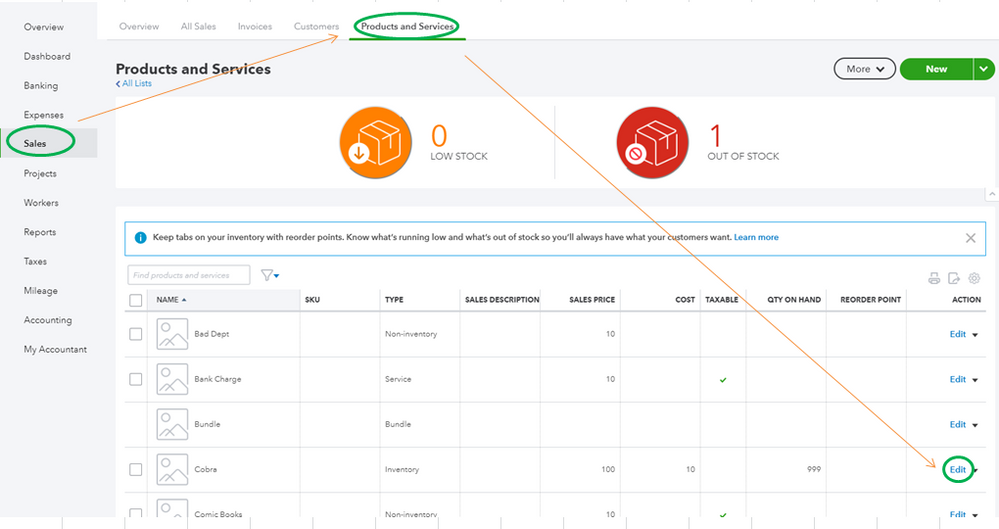

Here's how:

For additional resources, consider checking out these articles for future reference:

Reach out to me if you have any other issues or concerns by leaving a comment. I want to make sure everything is taken care of for you. Have a wonderful day!

Hi there,

I thought maybe FritzF could help me too? I have started with Quickbook Online without inventory tracking while I did import and sold items.

As you might guess I found that the currents assets (I used this ledger when I put the purchase invoices in the system) remain the same even though items are sold. No cost of sales because there was simply no tracking. So Quickbooks advised me to use the inventory option. But still they do not know how to solve the issue for the previous months....

Maybe you have an idea? I have administered the purchased items as a bill without product specification on the ledger account Type: Current Assets. Details type: Inventory. And sold the items by invoicing (and sales receipts) the products which were non-inventory as I did not use inventory tracking yet.

How can I correct the error? And make sure the currents assets have the correct ledger value as well as the cost of sale ledger?

- Should I count all the inventory and insert it in the system as of today?

- Should I correct manually the past entries with a journal entry? Current Assets/Cost of Sale?

- What to do with the purchase invoices of the past?

Would be really happy if someone could help me out and tell me what to do.

Annie

Allow me to answer your question on behalf of Fritz, Annie.

We can change the type of the items from Non-inventory to Inventory. However, its effect is not retroactive. For this reason, you'll gonna have to delete and redo all entries (sales and purchases) to reflect them to Current Assets (Inventory Asset) and Cost of Sales accounts.

I would recommend consulting an accountant. They might have a better way to handle this without deleting and re-entering your transactions. A journal entry, perhaps.

If you have other questions regarding your past entries, you can always go back to this thread. We'll be happy to assist you further.

Thank you for the answer. I might get back to you with further questions while re-entering.

Hi Jess,

Before I start changing all the re-entering. Can I make a backup of the system the way it is now? I only see you can import/export data but not really a backup.

Kind regards,

Anita

Thanks for getting back, Annie159.

QuickBooks Online (QBO) will automatically back up your data with the same level of security used by banks. That means you don't need to worry about saving your data on a flash drive. For more details, check this out: Do I need to back up my data with QuickBooks Online?

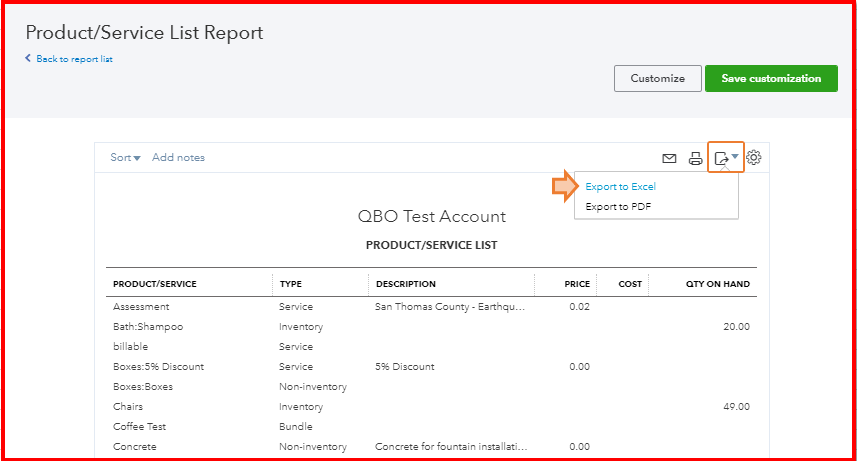

You can export data to Excel and save them to your computer. Doing this will provide you a copy which you can import later.

Let me show you how:

If you need to export products and services, here's how:

If you need to export a different report, check this out: Export your reports to Excel from QuickBooks Online for the detailed steps.

There are also apps where you can continuously backup your data. That being said, you can visit the QuickBooks App store and select an app from there.

Keep me posted if there's anything else you need with backing up your data. I'm always around to help you out.

Much like the original questioner, i purchase diesel from a supply terminal and load it into trucks, the price changes daily, for YEARS my COGS would not show a total cost on my P&L, drove me nuts! I put a price in of .01 (go to List-> Item List-> chose item to edit, put .01 in item cost) and all cost have finally appeared giving me a better overall picture of my business. Thank you so much.

Hi QB Experts,

I am having the same issue of COGS showing zero in P&L reports. I purchase the products and resell, so cost price and sell price have been set up, and the invoices are generated and can be matched with the payments I receive. I cannot figure out why COGS is showing zero and this has direct impact on the Profit reported. Is there any help in the form of example or a video of resolving this. Please please help. Thanks Yam

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.