Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI've got some inconsistencies with my retained earnings balances in QB desktop, and I noticed that QB online makes these entries at the end of the accounting period automatically. I'm wondering if QB desktop does the same, and my GJE's that I've been posting at each close are causing the inconsistencies.

Yes, it does, @ydenterprises.

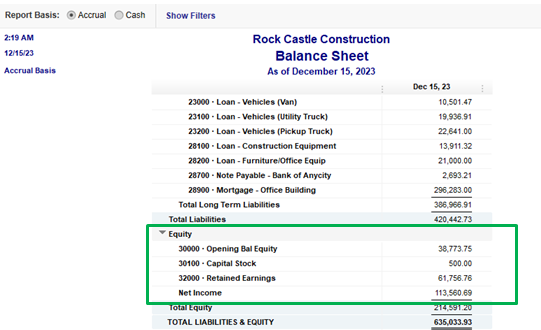

You can go to the reports menu and open the Balance Sheet Standard report. From there you can view the retained earnings of your company. Let me show you how.

In your QuickBooks Desktop (QBDT):

Here's some great articles you can read to learn more about reports in QBDT and how to customize them:

You can also check this great article for reference in case you want to export your reports to MS Excel: Export reports as Excel workbooks in QuickBooks Desktop.

You're always welcome to post in the Community whenever you have other concerns or questions. Our door is always open for you.

Thanks @JasroV . I certainly know how to view the retained earnings balances in QB. My question is actually whether or not QB posts to retained earnings automatically at the end of an accounting period.

i.e. if i have 100,000 in net income on 12/30/2020, will it move that 100,000 from net income to retained earnings automatically on 12/31/2020?

I'd like to add a few more details, Ydenterprises.

Our program will automatically add the income from the previous fiscal year to Retained Earnings. The movement will depend on the fiscal year that's set up in QuickBooks.

For example, if you've set up January as the first month of your fiscal year, QuickBooks will add the income to Retained Earnings on January 1st.

I'll help you check the setup. This way, you'll know when our program will add the income to the Retained Earnings account. Here's how:

Let me know if there's anything else that I can do for you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.