Good day to you, @YourLifeStyleInteriors.

You'll want to create an expense and make it billable to your client. That way, you can apply the expense towards your client invoice. Let me guide you how to do it in your QuickBooks Online (QBO) account:

First, let’s turn on the billable expense:

- Go to the Gear icon.

- Select Account and Settings.

- Go to the Expenses tab.

- From the Bills and expenses section, select the Edit pencil icon.

- Select the following:

- Show Items table on expense and purchase forms

- Track expenses and items by customer

- Make expenses and items billable

- Then click Save and then Done.

To enter a billable expense:

- Go to the + New menu.

- Select Bill, Expense, or Check.

- Choose a client.

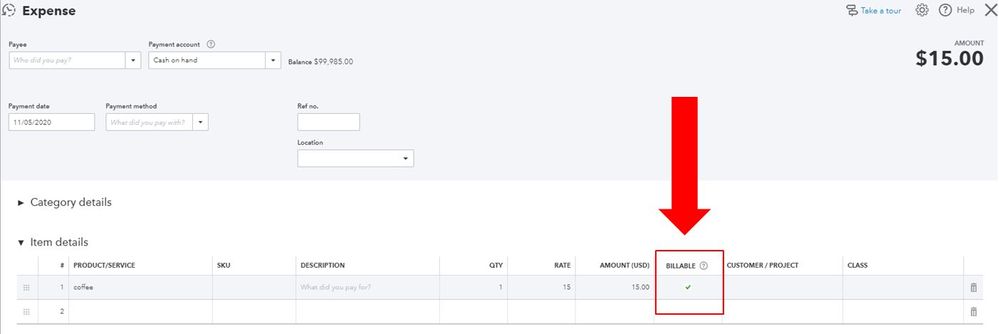

- Enter the description and amount of the expense, then select the Billable checkbox.

- In the Customer column, select the customer you want to bill for this expense.

- Enter the needed details and then click Save and close once done.

Then to add the billable expense to your client’s invoice:

- Go to the + New menu.

- Click Invoice.

- Select a customer you created a billable expense from the Customer drop-down menu. This opens the Add to invoice window.

- Select Add on the billable expense you want to charge to your customer.

- Then click Save and close.

You can also check this article for more details about the process: Enter billable expenses.

Furthermore, in case your client pays their invoice through bank deposits, you can refer to this article on how to record it in QBO: How to link a deposit to an invoice.

Let me know if there’s anything else you need help with managing invoices in QBO. It’s always my pleasure to help you out. Have a wonderful day ahead.