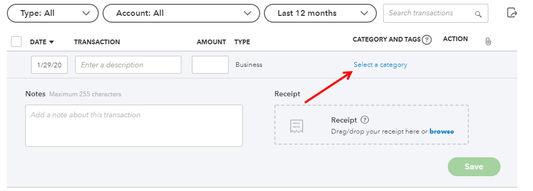

Welcome to the QuickBooks Community, summerhowerton. Once you have added a transaction and categorize it accurately, QuickBooks Self-Employed will add it as an asset after selecting one of these:

- Apps/software/web services (> $200)

- Computers (asset, usually > $200)

- Copiers (asset, usually > $200)

- Furniture (asset, usually > $200)

- Other tools and equipment (> $200)

- Phone (asset, usually > $200)

- Photo/video equipment (> $200)

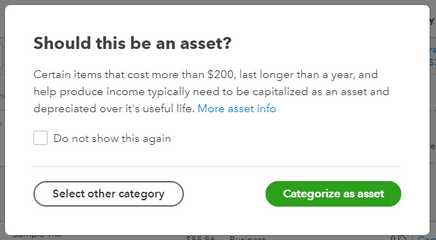

Once you have done that, a message will display on your screen asking you to verify that the transaction is an asset. Click the Categorize as asset to confirm.

You can run the Tax Summary Report to see if the transaction was categorized correctly. Here's how to access that report:

- Go to the Report tab.

- Locate Tax Summary.

- Use the drop-down arrows to add the tax year.

- Select View to open the report.

Once selecting the right tax year, use this report and scroll to the Business Assets section to view these changes. Please let me know if you have any more questions about Business Assets or need clarification by commenting below. The Community and I will do our best to assist you! I hope you enjoy the rest of your day.