Welcome to the Community, @ant8806.

You can categorize the Economic Injury Disaster Loan (EIDL) as Personal Income in QuickBooks Self-Employed. However, I still recommend seeking help with your accountant for more guidance on tracking loans and grants.

Here's how:

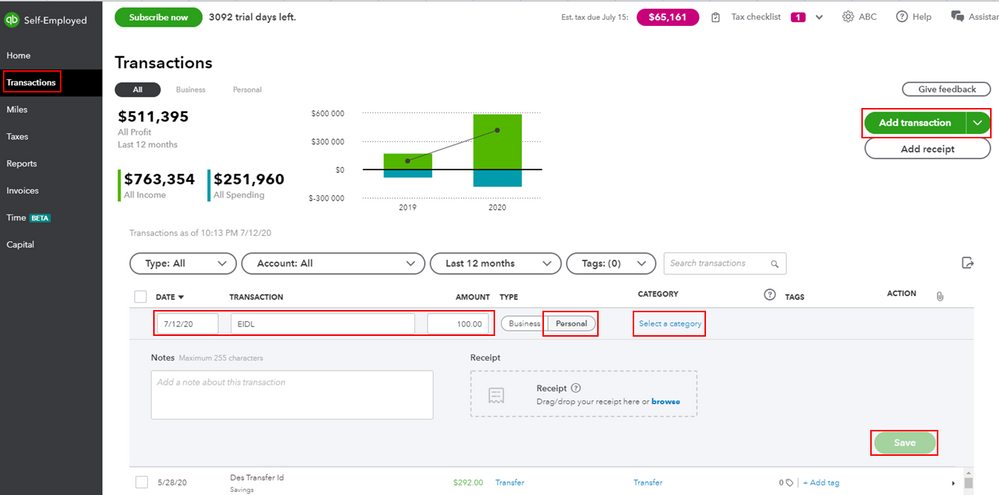

- Go to the Transactions menu, then click the Add Transaction button.

- Enter the Loan details.

- Choose Personal in the Type column.

- From the Category column, select Income.

- Click the Save button.

Once you start paying the loan, the payment for the loan capital will be categorized as Business Loans. Then, assigned Schedule C: Interest for the interest paid.

You might also want to check out these articles to learn more about handling taxes and Covid-19 related loans:

Please let me know if you need clarification about this, or there's anything else I can do for you. I'll be standing by for your response. Have a great day and stay safe.