Thanks for dropping by here in the Community, @rgambone.

Let me get you pointed in the right direction to help you in adding Employee Retention Credit (ERTC) for 2020.

Payroll adjustments concerns are best handled by our Customer Care Team. They have the necessary tools that can guide you in editing your paychecks to fix this issue.

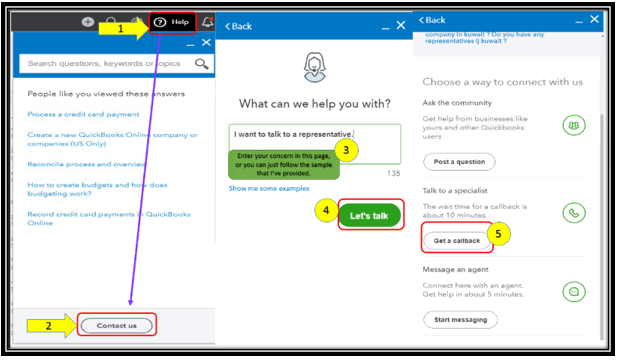

On the other hand, we've recently updated our customer care experience. The best way to reach our support team is to sign in to your account, select the Help icon on the top right, and then Contact Us at the bottom of the panel.

Please see the steps and snips below for your reference:

- Click on Help at the top menu bar.

- Hit on the Contact Us button.

- Enter a brief description of the issue in the What can we help you with? box.

- Press on Let's talk.

- Select on Get a callback.

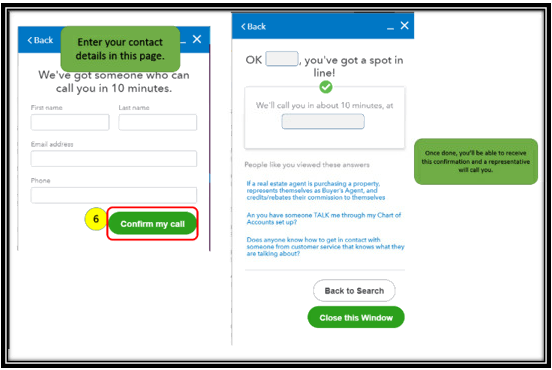

- Key in your contact details, then tap on Confirm my call.

Lastly, I'm adding this link that you can utilize in the future, which talks about editing paychecks that are not yet processed in QBO: Edit a payroll paycheck.

Let me know how how things turn out in the comment, I want to make sure this is resolved for you. I'm also here to provide further assistance with your payroll. Keep safe!