Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowQB Online is not fit for personal finance. You should consider Mint or QB Desktop with a non subscription license.

Hi there, azita.

Thank you for contacting us regarding tracking household expenses and setting them up correctly in QuickBooks Online. I'm here to guide you through the process and help you make the most of our platform.

To effectively track your household expenses, it is recommended that you set up a separate bank account specifically for this purpose. This will help you keep your household expenses separate from your business finances. Consider opening one if you don't already have a dedicated account for household expenses.

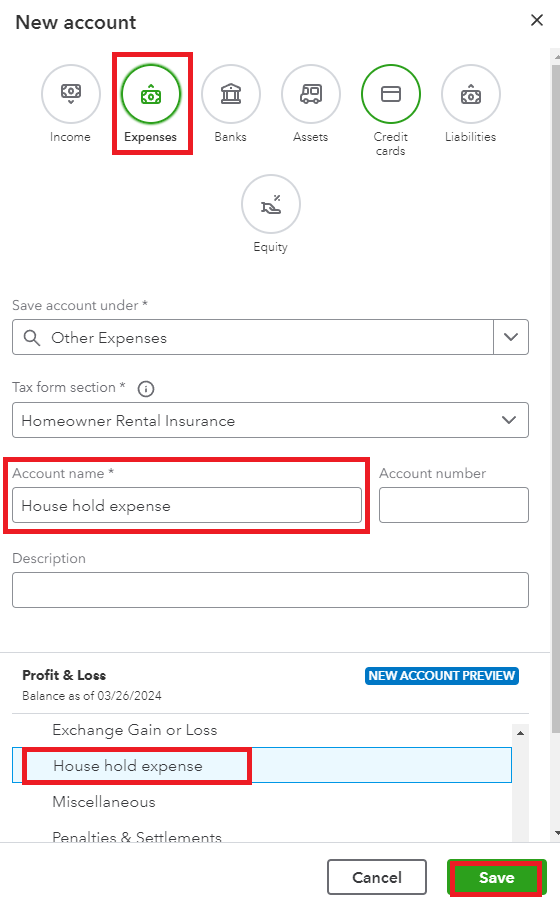

Once you have a separate account, creating appropriate expense categories is essential. In QuickBooks Online, you can customize your expense categories to track your household expenses accurately. Some common categories include groceries, utilities, mortgage/rent, insurance, transportation, and more.

After setting up your expense categories, you can begin categorizing your transactions in QuickBooks Online. This can be done manually by reviewing your bank statements and assigning the correct category to each expense. Alternatively, you can connect your bank account to QuickBooks Online, which will automatically import and categorize transactions.

To classify your household expenses further, you can utilize tags or classes in QuickBooks Online. These allow you to add details or labels to your expenses, such as differentiating between personal and shared expenses or tracking expenses by family member.

Lastly, to ensure accuracy, it's important to reconcile your bank accounts in QuickBooks Online regularly. This involves comparing your account balances in QuickBooks Online to those on your bank statements and making necessary adjustments or corrections.

Additionally, I recommend generating reports in QuickBooks Online as it offers a wide range of reports that can help you gain insights into your household expenses. You can run reports such as Profit and Loss, Expense by Category, or even create customized reports to suit your needs. These reports will enable you to analyze your spending patterns, identify areas where you can save money, and make informed financial decisions.

Remember, keeping your personal and business expenses separate is crucial for accurate financial tracking and reporting. By following these steps and utilizing the features available in QuickBooks Online, you can easily manage your household expenses. However, I suggest consulting with your accountant for specific requirements or guidance to handle the appropriate account type. If you don't have an accountant, I can help you find one. Feel free to visit this page to find an accountant for your business: Find a QuickBooks ProAdvisor.

If you have any further questions or require additional assistance, please don't hesitate to reach out to me. We are here to support you every step of the way. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here