Hello there, 808sweetshack.

I appreciate you for reaching out to us here in the Community. I'm here to help you handle the EIDL loan in QuickBooks Online.

You can create a liability account to record the loan amount and its payments. It will help track what you owe to SBA.

Here's how:

- Click the Gear icon in the upper-right corner.

- Select Chart of accounts.

- Press New.

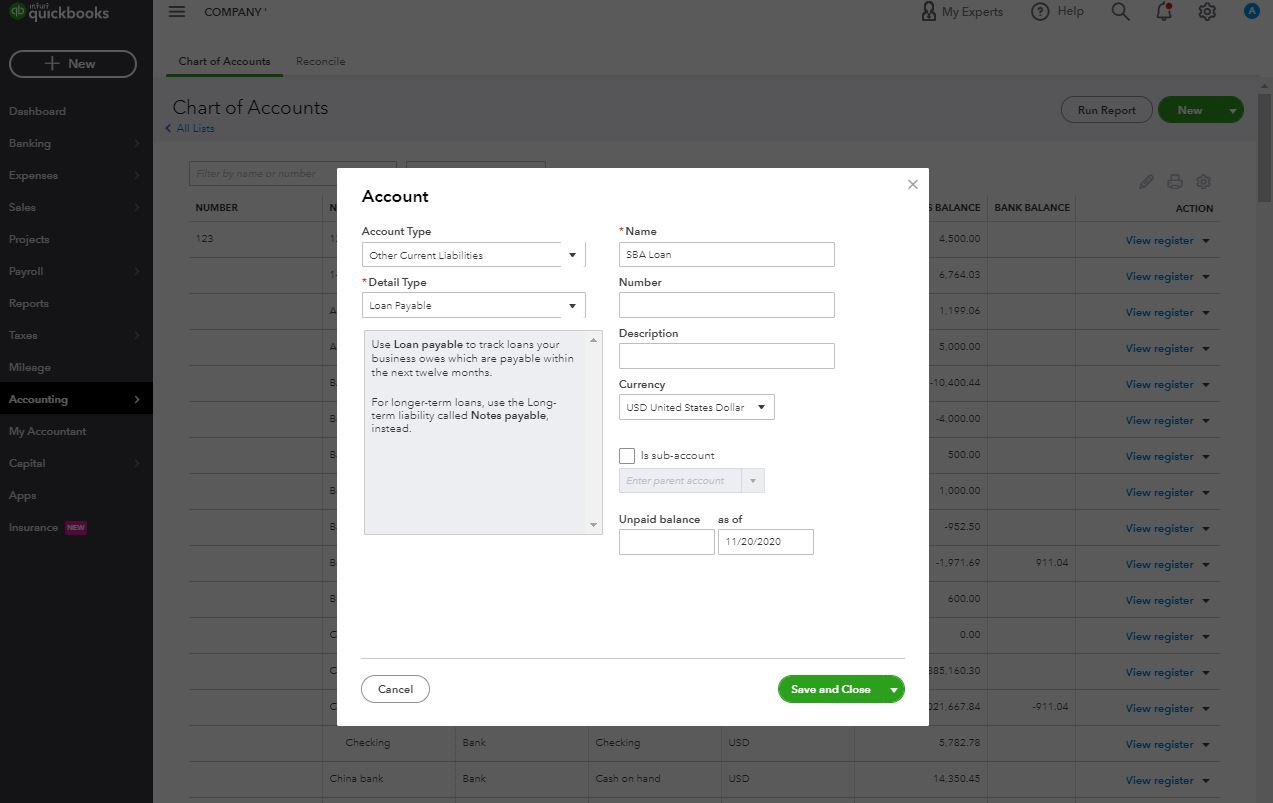

- From the Account Type ▼ dropdown menu, select Long Term Liabilities or Other Current Liabilities.

- From the Detail Type ▼ dropdown, select Notes Payable or Loan Payable.

- Give the account a relevant name, like "SBA loan".

- Enter the necessary information.

- Hit Save and close.

Since the loan money was deposited directly into your bank account, I recommend creating a journal entry for the amount. Please follow these steps:

- Select + New.

- Select Journal entry.

- On the first line, select the liability account you just created from the Account dropdown. Enter the loan amount in the Credits column.

- On the second line, select your bank account from the Account dropdown. Enter the same loan amount in the Debits column.

- When you're done, select Save and close.

If the bank account is linked to QuickBooks via bank feeds, you can match it to the journal entry. Please refer to the steps in this link (scroll down to Match an existing transaction): Categorize and match online bank transactions in QuickBooks Online.

Also, if you want to utilize the memo section on an expense, you can do it. This way, you'll be able to track and identify the transactions much easier.

For more information, as well as how to record a loan repayment in QuickBooks, I recommend the following article: Set up a loan in QuickBooks Online.

Fill me in if you have additional questions about setting up a loan in QBO. I'm always here to help. Take care always.