Hi jlparso-aol-com!

Thank you for choosing QuickBooks Online. I'll be glad to guide you in recording your transaction.

If you paid for the service, you can record the payment as an expense or a check transaction if you wrote a check.

- Click the +New button on the left side.

- Choose Expense or Check in the VENDORS section.

- Choose a CATEGORY for the payment or scroll up to the top of the category list and click +Add new if you want to create one. In my example below, I used an expense category (account). You can ask your accountant for the right account for your scenario. I also added a service item called Maintenance Labor.

- Click Save and close.

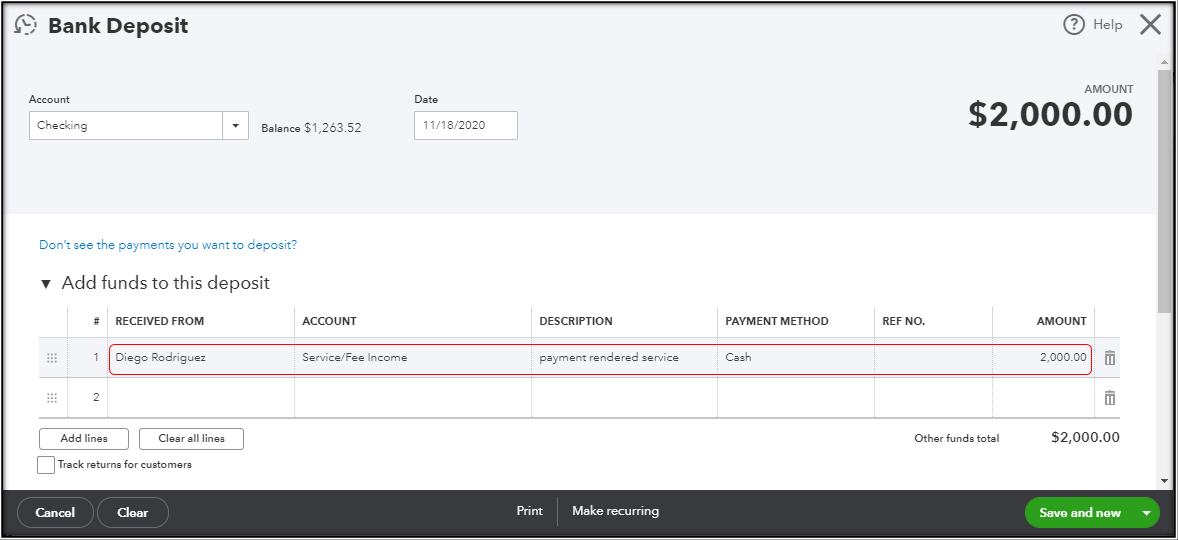

If you received the payment, and it's not a sale of a product, you can record it as a deposit to your business or petty cash account.

- Click on +New and hoose Make Deposit.

- Enter the name of the date, the payor, the category, the description, the payment method, and the amount. In this example, I used an income category since a received money, but you can ask your accountant about yours. We're unable to provide accounting advice.

- Click Save and close.

That's it. If you need more assistance with your transactions, just comment below. I'll be happy to help you again.