Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowLet's get your deposit link to your paid invoice so you can get back to working order, @db85.

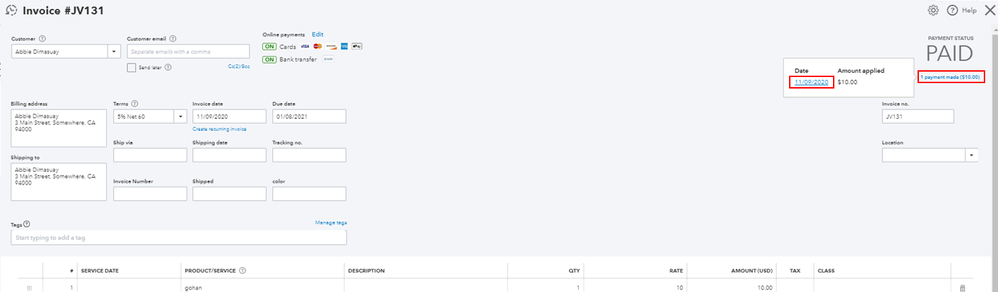

The possible reason why you have two (2) income on your Profit and Loss is that you received the payment from the invoice and make a deposit associate with the Accounts Receivable (A/R) account. In that case, your deposit will be an Unapplied Cash Payment Income, and the payment you received from the invoice will be a Sales of Product Income.

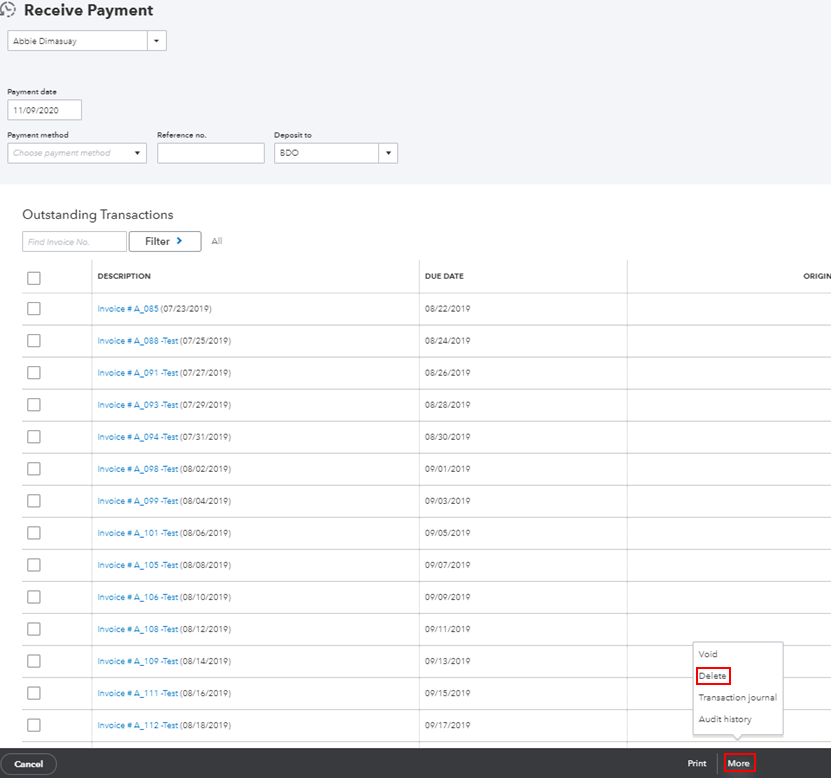

To link the deposit to the paid invoice, you'll want to delete the payment connected to the invoice first. Here's how:

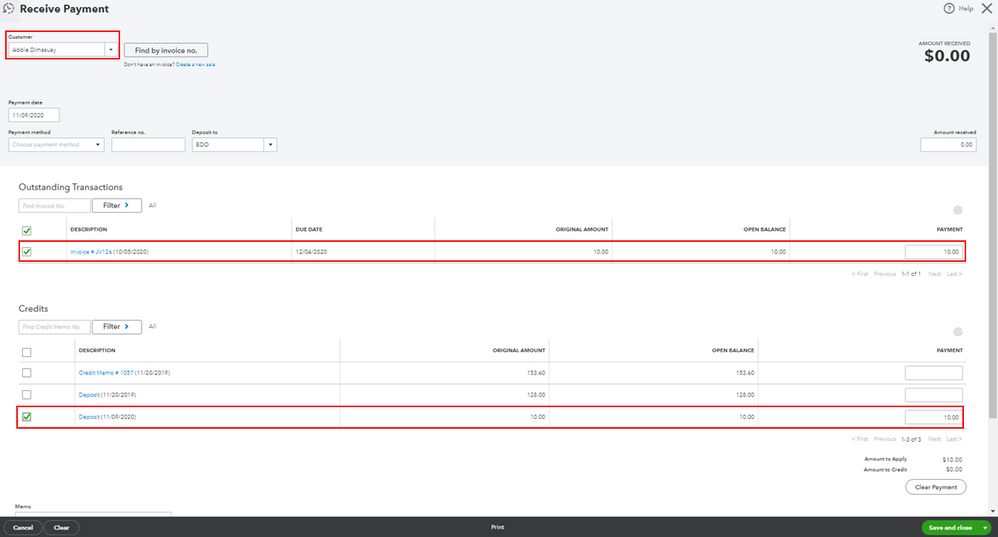

Once done, you can now link the deposit to the invoice.

I'm adding this article for more details: How to link a deposit to an invoice.

Moving forward, you don't want to create a deposit to the invoice payment once it's already paid. This way, we can avoid unapplied cash payments in your QuickBooks Online.

If you need any additional assistance while managing your invoice transactions, you can leave a comment below. I'll be sure to get back to you.

I'm back to ensure everything on your concern was discussed, @db85

Were you able to link the deposit to the invoice after the information and steps I provided? If you need further assistance with the process, don't hesitate to leave a comment below. I'll be sure to get back to you.

Thanks for coming to the Community, wishing you continued success.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.