Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI appreciate for posting your concern here in the Community, @lynnaeburns. I'll be happy to share more information about billable expenses.

There isn't a need to recreate those transactions in QuickBooks Online because you have an option to manually edit those expenses you've recorded to make sure everything is accurate. I'll show you how.

For additional information, you can check this great article:Enter, edit, or delete expenses in QuickBooks Online.

In regards to the dummy invoices, I would suggest creating the exact transactions since this would be reported in your expense accounts.

For future reference on how to record and remove a billable expense charge in QBO, check these articles:

Let me know if you have other questions in your account. I'm always here to help. Have a fabulous day ahead!

Got it. Is creating a dummy invoice the best way to deal with this or should I create a sales receipt instead. These have been paid already and I don't want to inadvertently send an invoice to clients for work done and paid almost a year ago.

Follow up question. Does it make sense for me to create dummy invoices or should I create a sales receipt instead since I have already been paid. In any case, I don't want my clients to receive anything since the work was done and paid for almost a year ago.

It depends on how you want to record them in QBO. If you have the transaction data in XLS, consider using an importer tool to migrate the real of Invoices data and Receive-Payment data into QBO.

https://transactionpro.grsm.io/qbo

https://partners.saasant.com/affiliate/idevaffiliate.php?id=5051_2

Just my 2 cents.

Good day, @lynnaeburns.

Thank you for reaching back to the Community.

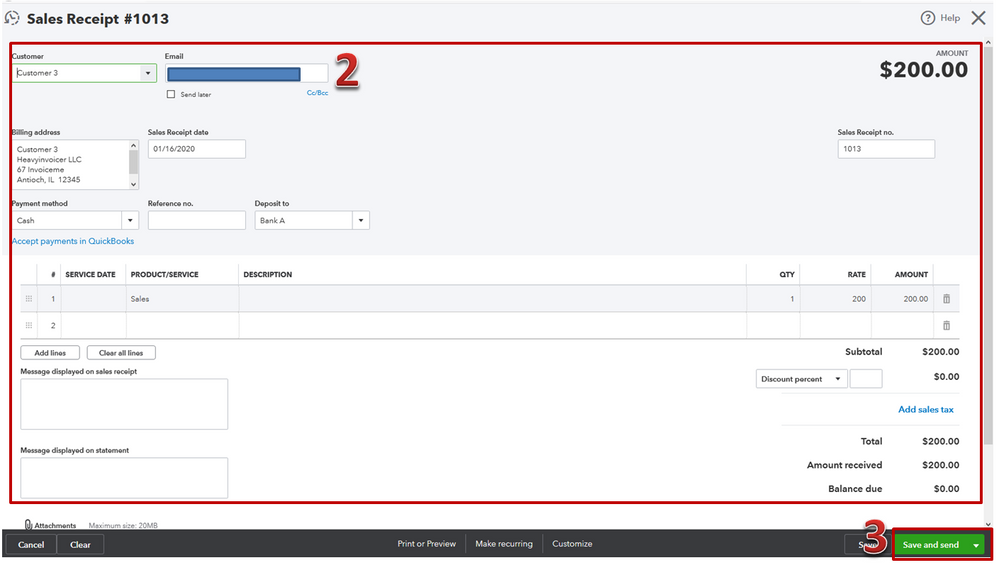

I recommend creating sales receipt since this already been paid. The Sales receipt use for the transactions which has already been fully paid by the customer.

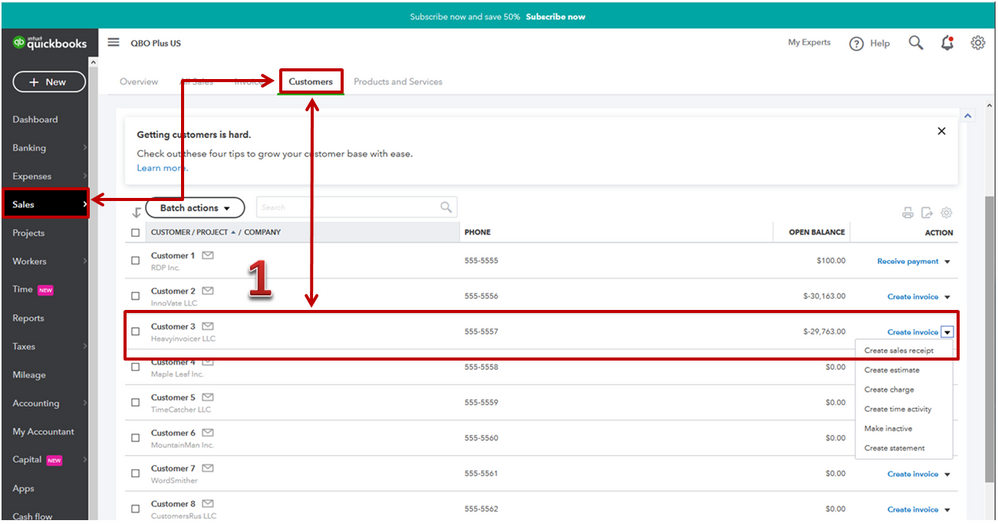

Let me show you how to create sales receipt:

You can view the Sales Receipt created under transaction List.

For additional details and informations you can check out this articles:

Add a discount to an invoice or sales receipt in QuickBooks Online

Please get back to me if you have other questions. I'm here to lend you a hand. Have a great day ahead of you!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.