Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowGood afternoon everyone. It is the first time I have asked a question in this forum. I am doing the accounting to a small nonprofit and I have the following question. The nonprofit wants to know who made the donations and they also want to know which program it belongs to and which unit it belongs to. they want to know how much money was spent on program A in residence # 1. As I can only use Locations for donations with and without restrictions, I do not know what I should do in order to obtain a report that goes out for programs and another for residences

It's nice to have you here in the Community, @Tavares!

I've got a couple of ideas on how to track donations for non-profit in QuickBooks Online.

You'll want to use the class tracking feature as another option. You can label each class as programs or units/residences to track them.

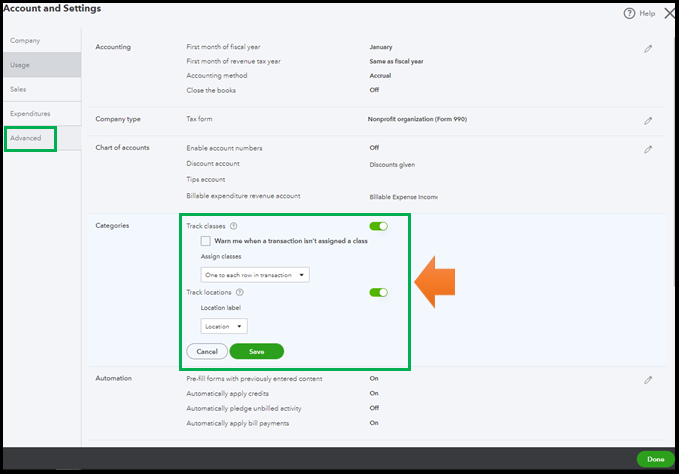

First, let's turn on the said feature on the settings page. Let me guide you how:

Once done, it's time to create class lists and name them as programs or units (see screenshot).

After that, you can now associate them when creating transactions like a pledge, sales receipt or bank deposits. Just make sure to indicate the "donor" name. This way, you'll know who made the donations.

To monitor the money spent, you can create expenditures and linked the said classes as well.

Then, you're now ready to run the Statement of Activity by Class report to keep track of these transactions. Please ensure to select the right filters to see the details you need (Tip: Choose Donors or Classes from the Display columns by drop-down).

You can also memorize this report to save its current customize settings. This way, you can access it anytime for future use.

Get back here in the Community if you need more tips about handling your transactions in QuickBooks. You can always lean on me anytime. Have a fantastic day!

Thank you for your response. I have already done all the steps, but when the deposit or sales receipt is entered I would like to be able to enter under class, the program and also be able to enter the unit that belongs to. So When I want to know how much I spent and received in the programA for unit #1 I am able to do so.

Let me share some details on how to properly track the donations, Tavares.

I agree with using the class to track the program. Then, you can set up a sub-class to track the unit. Location tracking is best for the residence.

Follow ReyJohn_D's steps on how to turn on the class tracking. Then, here's how to set it up:

To add a sub-class for the unit, check the Is a sub-class and select the main class or the program. You can nest up to five classes. This should be how it looks like:

Here's how to track your transactions and run reports by class.

The location tracking is almost the same as the class. You can follow the detailed steps here: Set up and use location tracking.

Keep your posts coming if you need anything else. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.