Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowSolved! Go to Solution.

Hello again, @Count on Kids Finance. I appreciate your prompt response.

To zero out the balance of the Undeposited Funds account, you'd also need to deposit the sales receipt like what you've done on the credit card credit.

You can follow the steps provided above by my colleague @JaneD to complete the task.

Once done, check the Undeposited Funds account again if it now works.

Get back to me if you have any other follow up questions. I'd be happy to answer it for you. Have a great day!

Hey there, @Count on Kids Finance.

I hope you're enjoying this beautiful day and staying safe.

To record that you paid a company expense, you'll want to do this using a journal entry. I've included the steps to record this below. Please have your accountant look over the steps to ensure this is the best course of action for you and your business.

1. Click the +New button at the top and choose Journal Entry.

2. On the first line, you'll select the expense account for the purchase.

3. Enter your amount in the Debits column.

4. The second line you'll choose Partner's equity or Owner's equity.

5. Enter the same purchase amount in the Credits column, then Save and Close.

Check out: Pay for business expenses with personal funds for more details.

Please let me know if there's anything else that I can do for you. I'm here to help you every step of the way. You can always reach out to the Community or me anytime you find you have questions or concerns. Take care!

Thank you for your response. This doesn't seem to address the Sales Receipts that I entered to record the "charitable donation" that I made to pay the credit card bills. How do I "match" those to the payment so that the Sales Receipts don't just sit out in Undeposited Funds forever? So, just to reinterate what I'm trying to accomplish;

Problem:

I paid for the first two nonprofit credit card payments out of my personal funds AND I do not want to be reimbursed for these payments. Essentially, these are charitable contributions that I made to the nonprofit organization. I created two Sales Receipts to reflect the "charitable contributions" that I made to pay these credit card bills. I want to match the Sales Receipts (Undeposited Funds) to the payments made to the credit card.

Please note that when I click "match" for the credit card transactions, the Sales Receipts do not show up.

Thanks in advance for your support.

It's good to have you back here, Count on Kids Finance.

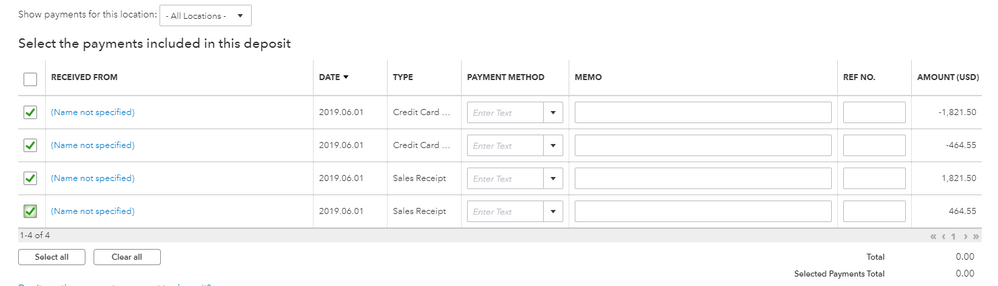

I can help you share additional information about matching the Sales Receipts. Let's make a Bank Deposit to move the money from the Undeposited Funds to your account.

Here's how to do it:

You can learn more information on how to record and make Bank Deposits in QuickBooks Online in this article.

I'd appreciate it if you can update me how this works. I want to make sure this is taken care of. Thanks!

Thank you for your reply. Unfortunately, I'm trying to "deposit" these funds into my credit card account and that is not an option in my drop down list. Is there a solution for this?

Thanks again for your help!

Hi there, Count on Kids Finance.

I've read the whole thread. In this case, you'll want to create a credit card credit first and record a bank deposit. This way, you'll be able to zero out the Undeposited Funds account and match the credit card credit to the downloaded ones.

Once done, let's record a bank deposit by following these steps:

From there, you can match the downloaded credit card transactions to the credit card credit. For more details, check this article: Assign, categorize, edit, and add your downloaded banking transactions. This link provides detailed information to categorize and manage your downloaded transactions.

Let me share this article that will help keep track of your expenses in QuickBooks Online: Record credit card payments. This contains information on how to create credit card payments to maintain accurate financial reports.

We're a post away if you have further questions. Stay safe and have a good day.

Jane,

Thank you for your reply. I matched the Credit Card Credits to the transactions in my credit card list. That said, this still doesn't address how do deal with the Sales Receipt that is recording that the money provided to pay these bills is a charitable contribution. The original Sales Receipts are still sitting out in Undeposited Funds. How can this be resolved?

Hello again, @Count on Kids Finance. I appreciate your prompt response.

To zero out the balance of the Undeposited Funds account, you'd also need to deposit the sales receipt like what you've done on the credit card credit.

You can follow the steps provided above by my colleague @JaneD to complete the task.

Once done, check the Undeposited Funds account again if it now works.

Get back to me if you have any other follow up questions. I'd be happy to answer it for you. Have a great day!

Thank you! I missed one of the steps. It worked!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.