Hello there, @leannfisher,

There isn't a need to track your PayPal fees since you're depositing the net amount. Otherwise, you can add another line item for the fees, however you'll need to enter the gross amount.

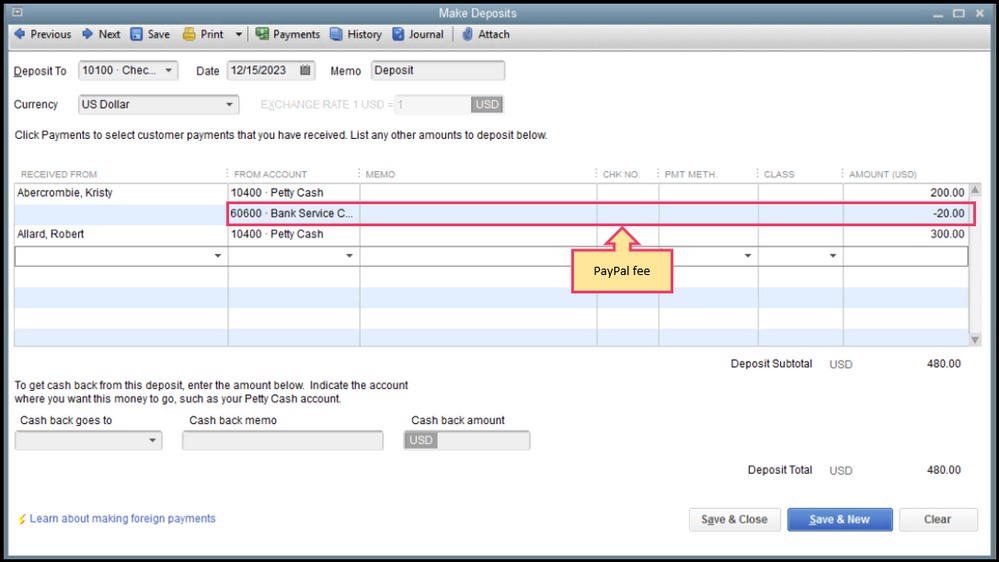

Here's how to make a bank deposit:

- Open your QuickBooks Desktop account.

- Go to the Banking menu, then select Record Deposits/Make Deposits.

- On the Make Deposit window, select the bank account where the payment will be deposited to under the Deposit To drop-down.

- Enter the date and memo (optional).

- Complete the table for your entries.

- Click Save & Close.

I've added these articles for additional information with making bank deposits:

Please get back to me if you need clarifications with recording bank payments in QBDT. Just leave a comment below and I'll get back to you.