It's nice to have you here on the Community page, @joannasain.

Contractors earned above the threshold should get a 1099 and their names must show up when preparing the form. Since some of your contractors aren't appearing in the list, you have to map the accounts used for the transactions of these contractors.

Here's how:

- Click on Workers at the left pane, then select Contractors.

- Tap on Print 1099s.

- Select Continue your 1099s.

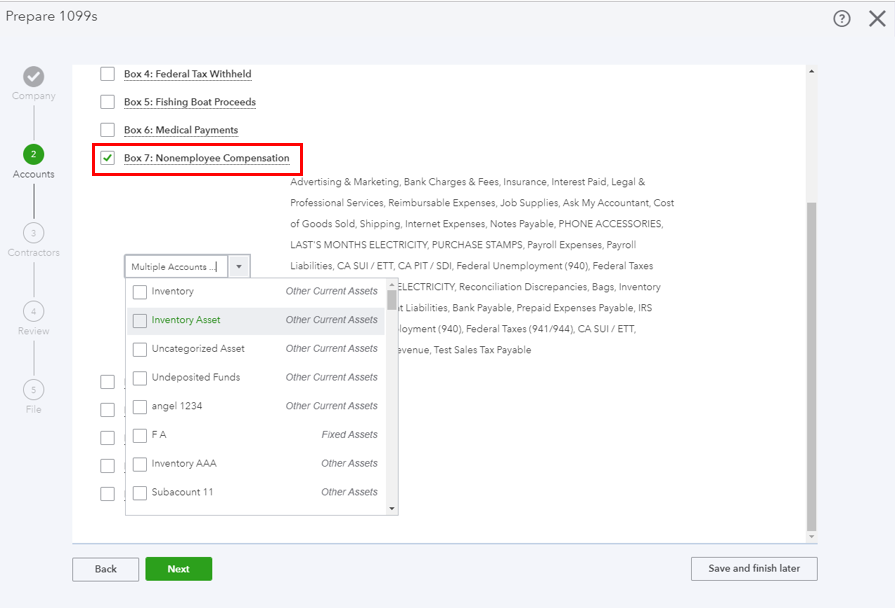

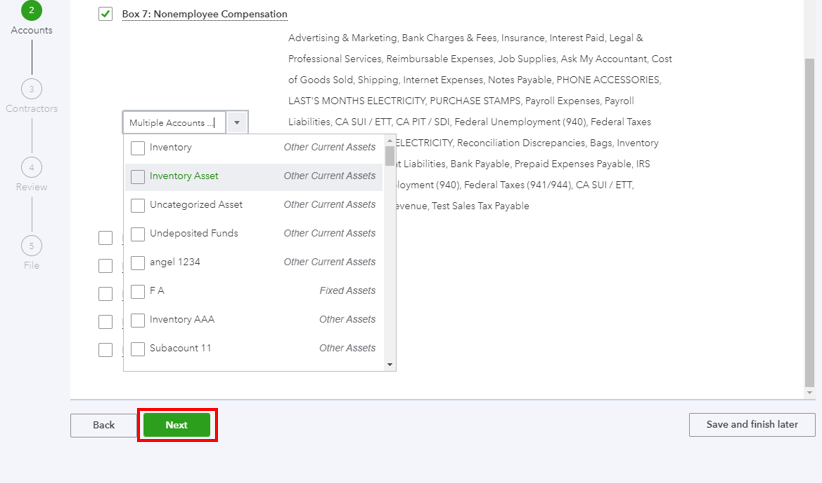

- On the Accounts section, put a check-mark on Box 7: Nonemployee Compensation. Choose the accounts used by clicking the drop-down arrow beside Multiple Accounts. (Map the accounts correctly.) Or, select the box for the types of payments you made under the Categorize payments to contractors (or 1099 vendors) window.

- Hit on Next.

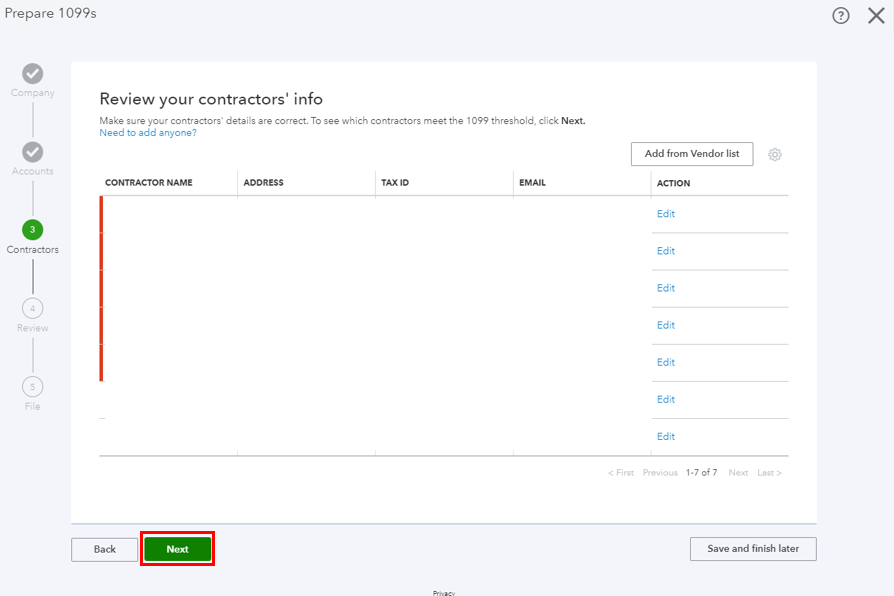

- Review your contractors' information, then Next.

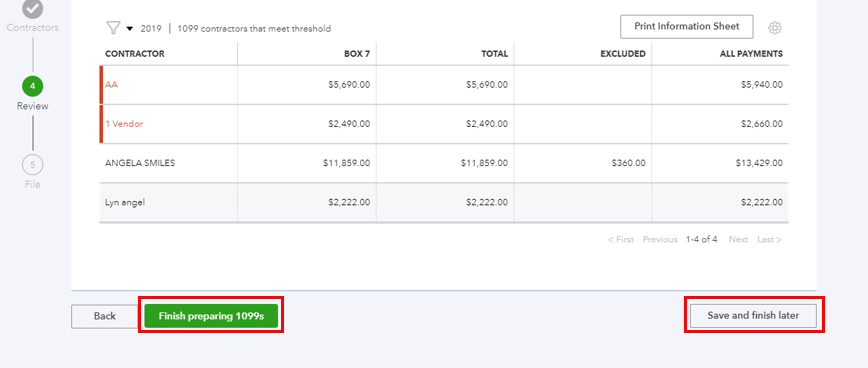

- The vendors/contractors that meet the threshold will now show up under the Check that the payments add up page.

- Choose either to Save and finish later or Finish preparing 1099s.

After following the steps provided, you should be able to prepare 1099 correctly. For additional reference, you can check out these articles:

Click the Reply button if you have any other questions. I'm a few clicks away to help. Have a good day!