I can share some information so you can handle it properly, @Val.

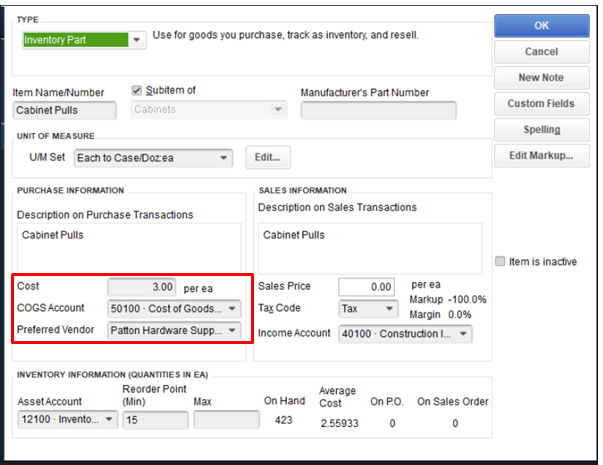

You’ll want to make sure you’re using the Inventory item feature in order for the Cost to show up when the material is sold. Turning this on in the program lets you track everything related to the items.

If it should not be taxable, you can select (Non) Non-Taxable Sales under Tax from the invoice page. Here’s how:

- Go to the Customers menu.

- Select Create Invoice.

- Enter the necessary details.

- Select Non.

You might want to visit this article about inventory accounting. This provides in depth understanding of how to manage certain stages to ensure an accurate representation.

Get back to me here if you need further assistance with your entires. I’ll be here to help anytime. Have a good day.