Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowSolved! Go to Solution.

Hi mrizvi,

I'd like to jump in to add some insights about the incorrect posting of your accounts. Let me share them with you to get this fixed.

The duplicate accounts can be caused by the posting of the same account name on both reports (Profit and Loss and Balance Sheet). The amount posted on each account (Profit and Loss and Balance Sheet) are transactions associated with them.

You'll want to pull up Profit and Loss Detail and Balance Sheet Detail reports to verify these transactions.

After that, go back to your Chart of Accounts and then search the account name. This way, you can see the duplicate account name and number and work from there.

I've added our page about reports and accounting for additional resources of your future tasks.

Don't hesitate to swing by anytime if you have other concerns. We're always here to help.

It's possible that a balance sheet account was affected when you recorded the transaction, mrizvi.

You'll want to check the transaction journal to see what accounts are affected.

Here's how:

I've got a sample screenshot of a sales receipt for reference:

For more information about the balance sheet report, check this article: What is a Balance Sheet report?.

I'm here if you have any additional comments. Thanks.

Thanks for prompt response Jenjolyn C.

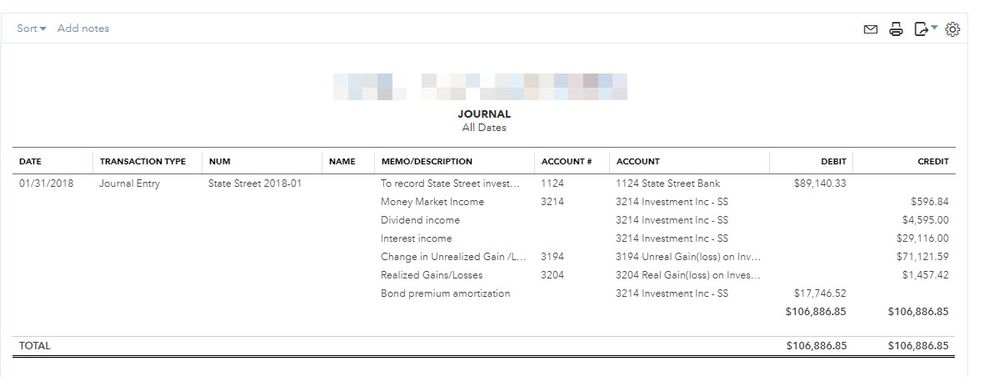

Only one income accounts was used for booking the credits. Income account 3214 is defined as “Income” in chart of accounts.

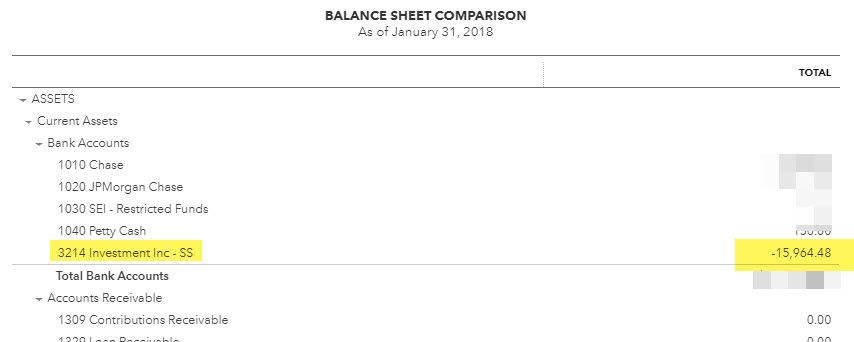

In BS, I see account 3214 included under section of "Bank Accounts" with a credit balance and also see the same account 3214 in Income Statement as Income.

I posted 12 JEs in 2018 for recording income. Each JE had 3 income line items (credits), that is, Money Market ,Dividends, and Interest income, all credits to 3214 income account. The offset was one debit line item to Bank account 1124.

First income line for each JE for the month somehow got posted as income to P&L and others as credit to “Bank Deposit” in Balance sheet via the same account # 3214-Investment Income.

Thank you.

Hello there, @mrizvi.

The steps provided by my colleague to check the transaction journal is used for normal transactions in QuickBooks. Since you enter JE, I recommend consulting your accountant for further guidance in recording your journal entry, as well as to verify what accounts to use.

Additionally, the transactions you see on the reports depend on the information you entered and the accounts selected.

You can check the following link to view all the JEs and print it: Journal Entry report.

Let me know in the comment section below if you have any other questions. It'll be always my pleasure to help.

Thank you for your response. I am an account myself. JEs that I have pasted are basic. Please see the screen prints.

Thanks for clarifying that out for me, @mrizvi.

Similar account names are likely the reason why the 3214 Investment Inc-SS is showing as an asset. When creating the entry, there's a possibility that an incorrect account was selected.

To verify this out, have the Chart of Accounts checked and see if it's duplicate. If so, change the name of the account to avoid confusion on your future transactions. If the account isn't necessary to use, you can make it inactive.

Know that I'm still to assist you if you need anything else. Just leave a reply below, and we'll take it from there. Have a good one!

Hi BettyJaneB,

Before posting a canned response, you should have at least looked at the screen prints and Journal Entry screen print in particular. Is it not clear that I am using only one Income Account (3214)?

Either I am inadvertently activation some criteria that is causing the same account to be mapped as an Asset (BS) & Income (IS) or there is some bug in software!

Could you or someone else in the team please study the screen prints and post a logical reply?

Thanks in advance.

Hi mrizvi,

I'd like to jump in to add some insights about the incorrect posting of your accounts. Let me share them with you to get this fixed.

The duplicate accounts can be caused by the posting of the same account name on both reports (Profit and Loss and Balance Sheet). The amount posted on each account (Profit and Loss and Balance Sheet) are transactions associated with them.

You'll want to pull up Profit and Loss Detail and Balance Sheet Detail reports to verify these transactions.

After that, go back to your Chart of Accounts and then search the account name. This way, you can see the duplicate account name and number and work from there.

I've added our page about reports and accounting for additional resources of your future tasks.

Don't hesitate to swing by anytime if you have other concerns. We're always here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.