Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowIf the $14,000 had not been previously shown as income then there is no write off. Any actual expenses that were incurred for the event would be deducted the same as for any other event.

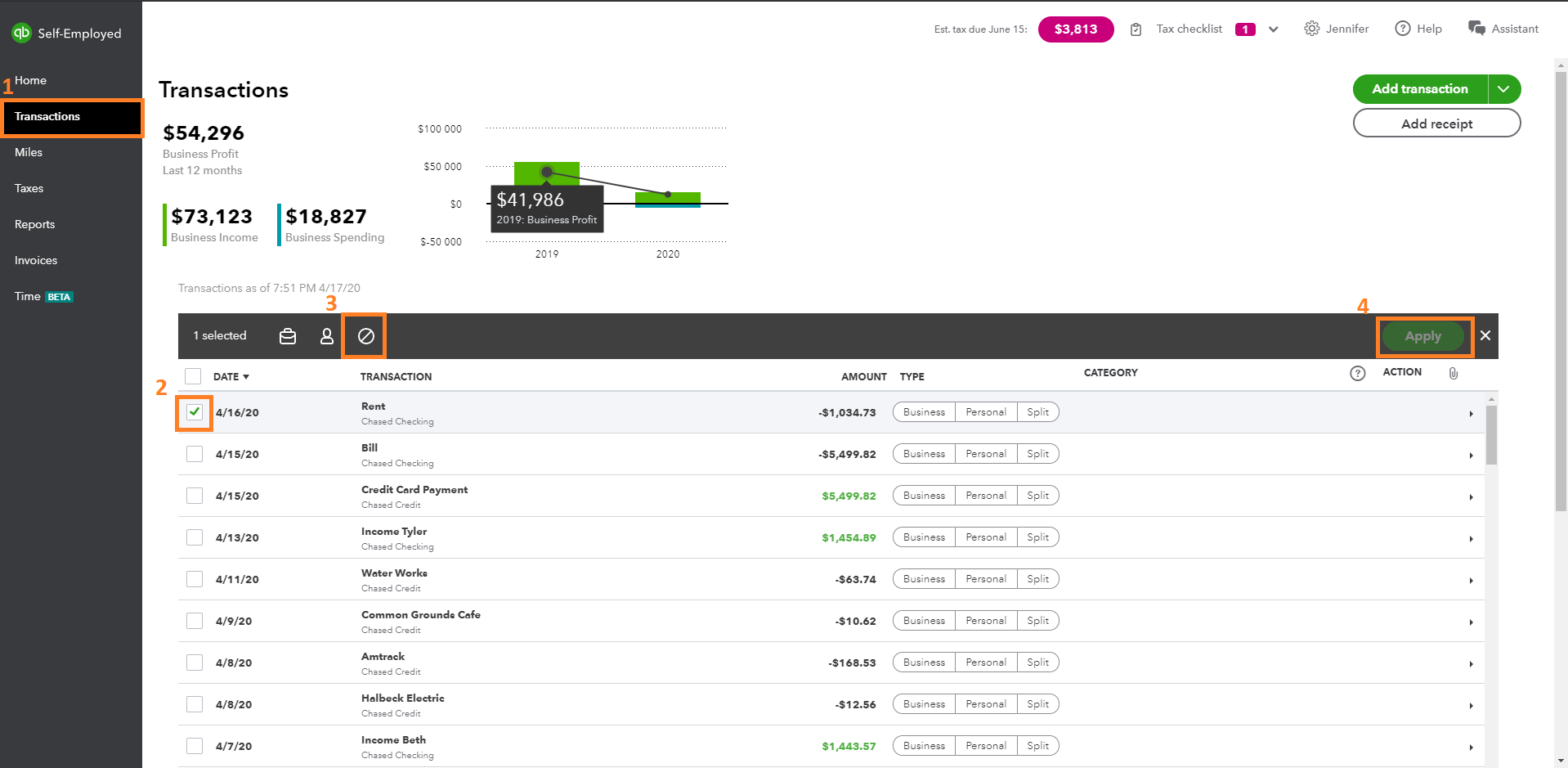

Hi brchapman65. As btks stated, if you didn't record the $14,000 of income yet, then no action is needed. However, if the income was accounted for but never actually occurred then you will need to delete the transaction. Here's how:

No the income will no longer be accounted for in your books. Let me know if there are any other questions or concerns.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.