Hi there, mkmenge.

For the Tax payments, both Sate and Federal are usually tagged as Business as they are company expenses. In this scenario, recording funds can be tagged as Personal and then exclude the refunded payment in your QuickBooks Self-Employed (QBSE) account.

Here's how to tag the transaction.

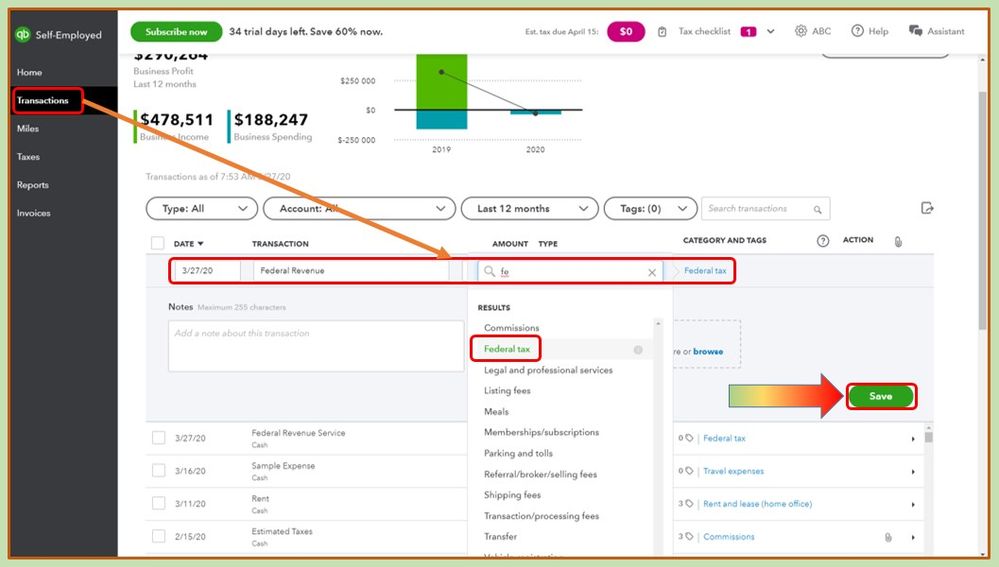

- In your QBSE company, go to the Transactions tab.

- Click Add transaction.

- Enter the Transaction in the box and the amount.

- Select Federal Tax for the Category.

- Verify the details and hit Save.

I added a screenshot for your reference.

Then if you have connected to your bank and received the refund, you can manually change the category type as Personal.

For more information about handling taxes in QBSE:

If you need a helping hand with handling your taxes, you may reach out to our QBSE Customer Care Team.

Let me know if you need further guidance on this topic. I'll be glad to share additional help to you any time. Have a good one.