Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHello there, @bookkeeping23.

I can help you record a refund transaction successfully in QuickBooks Online.

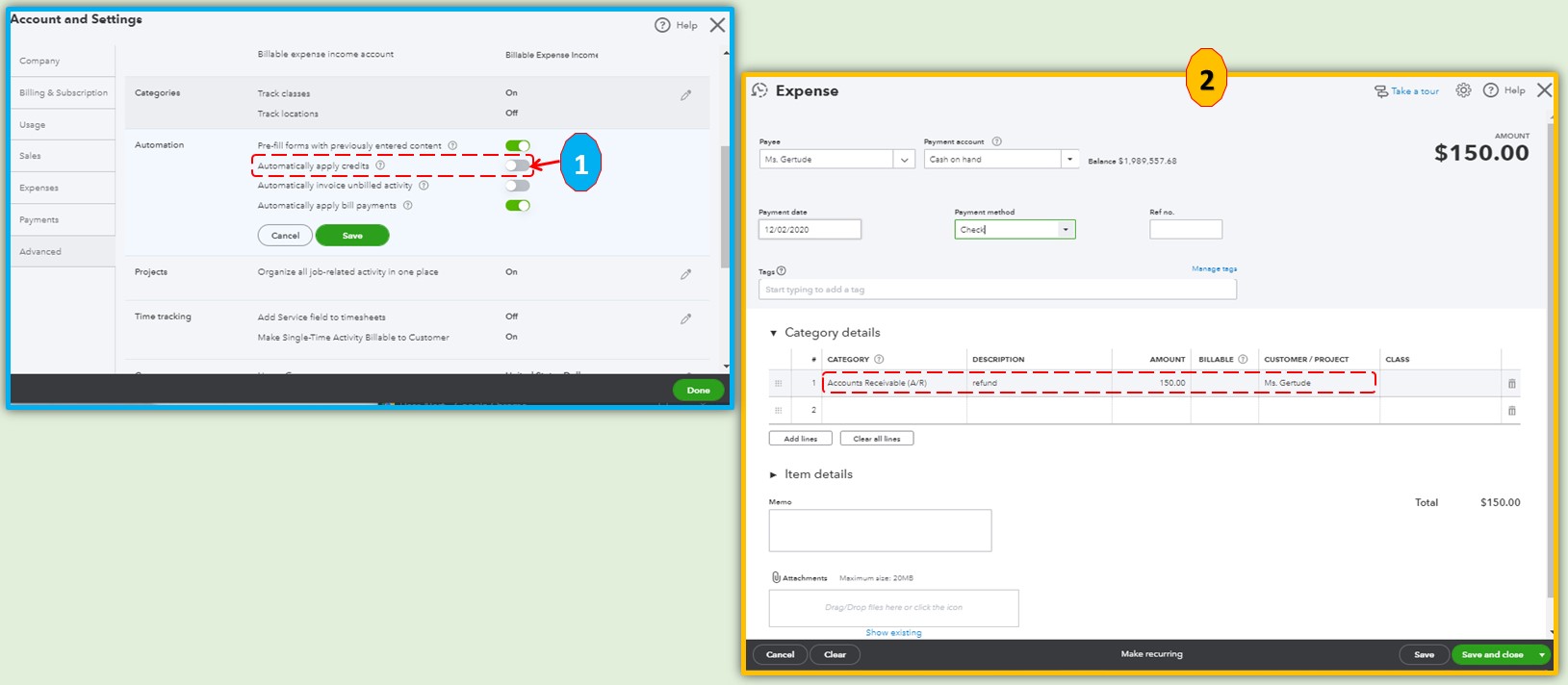

To make sure it's not applied automatically to a credit on the next sales transaction, you'll have to turn off this feature. Then, create an Expense transaction and use an Accounts Receivable Account, and assign it to the customer you want to give a refund.

This is how it looks like:

You may consider checking out this article to know more details about giving your customer a refund: Record a customer refund in QuickBooks Online.

I've added a reference you may check in case you want to assess specific aspects of your business: Run reports in QuickBooks Online.

I'll be here if you need further assistance or questions. I'd be to lend a helping hand. Take care and have a wonderful day.

Thank you for your reply. But I still not sure if this works for what I need to do. I had researched before sending my request and found the same answer you gave me. And it seems this explanation only addresses a specific scenario - for example giving a refund for a return. And that will work on that specific scenario but not for what I need.

What I need is to refund a customer the credits and/or overpayments posted in QBs. Before you sent me your answer I created the Expense, used A/R and selected the customer but the overpayments were still unapplied. The amounts won't clear. BTW the feature to automatically apply a credit is off. My question is: how can I create a refund for a customer using only specific amounts shown as overpayments? How can these overpayments be removed and show as refunded to the client? Thank you again.

Thank you for reaching back out to us, bookkeeping23. You have done the first half by recording the refund for the customer's overpayment, such as creating the expense, using the A/R account, and adding the amount correctly! The next step would be to link the refund to the customer's credit or overpayment. Here's how:

Please let me know if you need additional help once doing this. For future reference, you may check out this article: Apply a credit memo, credit, or refund to a customer. The Community and I are here to assist. Have a lovely day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.