Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowYou can either enter the info manually or let the contractor fill out the form, Lauren-walczakde. I'm here to guide you.

You're unable to upload the form. You'll want to email the contractor the form so they can fill it out. Here's how:

The contractor will receive an email from Intuit with an invitation to enter their W-9 information. For more information, you can check this blog: You can do WHAT in QuickBooks? Collect contractor W-9s.

You can get back to this thread if you have other questions. Or, you can also tag me. I'll reply as soon as I can.

Hello, this did not answer my question. I already have in my possession all contractor W9s. I don't want them to be harassed by QuickBooks to fill one out electronically. How do I turn it off or manually enter the info on my admin account?

Hello, this did not answer my question. I already have in my possession all contractor W9s. I don't want them to be harassed by QuickBooks to fill one out electronically. How do I turn it off these emails to them?

Thanks for the clarification and prompt reply, @lauren-walczakde.

I’m here to share additional details on how to get around this.

In QuickBooks Online (QBO), you have the option to send an email to your contractor and let them enter their information electronically. If you’ve already emailed them a request, the option to undo or turn off this option is not available.

Don’t worry though, they’ll only receive one email request. Since you already have their W9's information, you can talk to them personally and let them ignore the email.

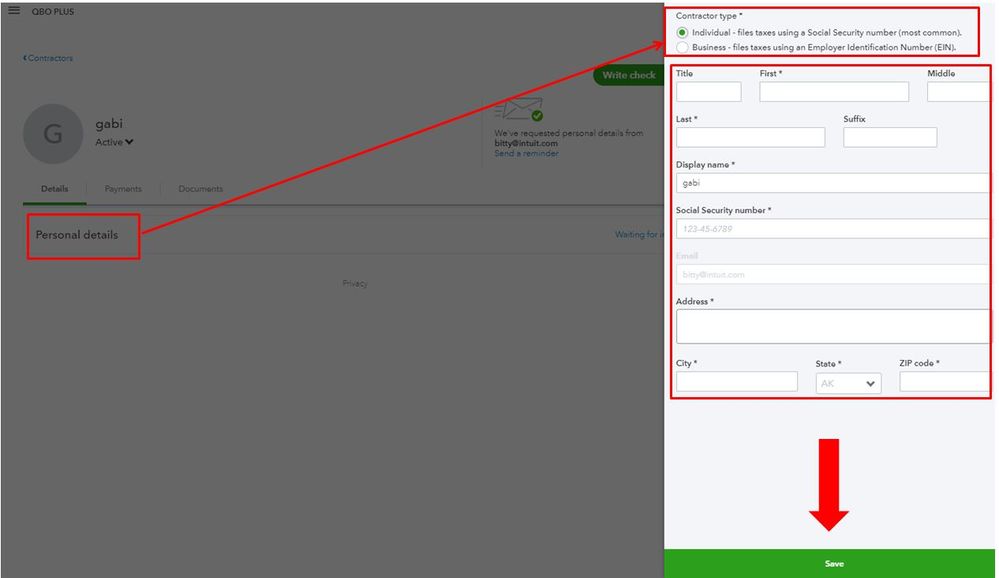

Then, to manually enter their information in QBO, you can follow these steps below:

You can also refer to this article for more details: Add, edit and inactivate contractors.

I’ve also collected this article that you can use for future guidance. This link provides detailed steps on how to file and prepare your 1099 seamlessly: Create and file 1099s using QuickBooks Online.

Let me know if you have other concerns managing your contractors in QBO. It’s my pleasure to keep you in working order. Keep safe and stay well.

i filled out the form as shown in the reply but it still says waiting on w9 info. i cannot file the 1099 or move on.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.