Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowHello there, mkr7,

If you are using online banking and automatic sync feature this creates duplicate transaction entries. To avoid this, you can match the bank feeds transactions to the transactions synced from Clover.

Here's how:

For the transactions already recorded in QuickBooks, you can undo the process by following these steps:

To undo multiple transactions at once, you can select the checkboxes for all of the transactions and select Undo Selected from the Batch Actions drop-down menu.

The transaction is moved from the In QuickBooks tab to the For Review tab where you can select it and assign an account for it from the drop-down list in the Category or Match field.

If you manually recorded the transactions you can void or delete them by following there steps in this article.

Let me know how it goes.

Thanks,

Marc_m

Can you still help with this problem?

Yes, as mentioned by my colleague above, if you have a bank connected with QuickBooks and an automatic sync feature with Clover, it will create duplicate transactions, @mitchm24.

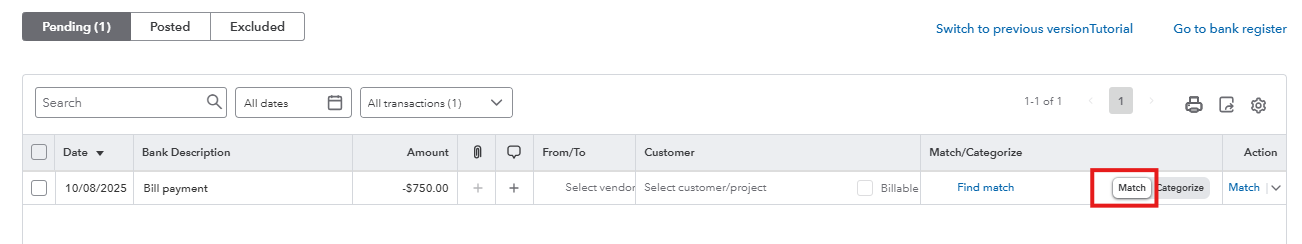

Here are the updated steps for matching bank transactions:

To reverse transactions already recorded in QuickBooks, follow these steps:

If you have any other questions about your bank transactions, don't hesitate to comment below.

Do these instructions work on Quickbooks Online?

Yes, mitchm24, the steps my colleague Ethel_A shared are specifically for QuickBooks Online.

Have you had a chance to try them out yet? Let us know if you ran into any issues along the way. We’re happy to help!

And if you need anything else, just swing back by the forum. We’ve got your back!

I have a number of transactions that don’t match up. My suspicion is that AMEX doesn’t always deposit in 2 days as the other cards do plus I don’t make Daily Cash deposits. What is my solution for this?

Hey there, anastasiadiner.

Thanks for joining this thread here in the Community. I'm happy to provide some info about transactions that don't mess up in QuickBooks Online.

When you run into a situation where certain transactions aren't matching up in your accounts, the best way to get this resolved is to complete a reconciliation of the account. Doing so will allow you to align your transactions from your bank or credit card statement with those that are in your QuickBooks account. You'll then be able to decide what to do with the remaining transactions that weren't listed on your statement. The following article provides additional info about reconciling an account in QuickBooks Online.

It's always a good idea to consult with your accountant if you're unsure about what to do with the leftover transactions after reconciling.

Please don't hesitate to reach back out if you have any other questions. The Community always has your back.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here