Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowSolved! Go to Solution.

Run the Profit and Loss report. (Left Dashboard > Reports > Profit and Loss).

Change the Report period on the top left to ALL DATES.

Change Display columns by to YEARS.

Click Run Report.

You will see the Profit and Loss/Net Income spread by Year.

On the Balance Sheet, for the current year, you will see the Net Income.

For prior fiscal years, you will see it as Retained Earnings. See you mentioned, it doesn't any data (it means no manual transactions were added) when clicking the Retained Earnings account, most likely Retained Earnings data came from previous years' net income/loss line from the profit and report. That's how you will need to review the negative retained earnings.

Hope this helps!

Thanks for posting in the Community page, @Minikahda.

When you record a profit and loss, the amount is recorded in retained earnings is an Equity account.

If the amount of loss exceeds the amount of profit previously recorded in the retained earnings account as beginning retained earnings, then a company is said to have Negative Retained Earnings.

At the end of the year, QuickBooks Online uses a transfer called electronic swap to move money to retained earnings. This swap doesn’t show changes in any report unless there have been other entries added.

To see what makes up your Retained Earnings, you can view details for the Net Income and your loss amount: How to view Retained Earnings account details.

You can contact your Accountant regarding this and ask for further information.

Let me know how it goes and if you need anything else. I’m always here to help. Have a good one!

Using the Windows 10 app on the latest update.

Thanks for the response but I'm still confused. (I think) I'm good with the underlying accounting practices. My question regards the negative Retained Earnings shown at the conclusion of the first fiscal/calendar year. In this scenario, I can't see how there can be any "profit previously recorded" (?)

Please note the P&L for this reporting period (the first fiscal/calendar year) shows positive net income, and the retained earnings report for all data: "does not contain any data"

It’s our pleasure to help, @Minikahda.

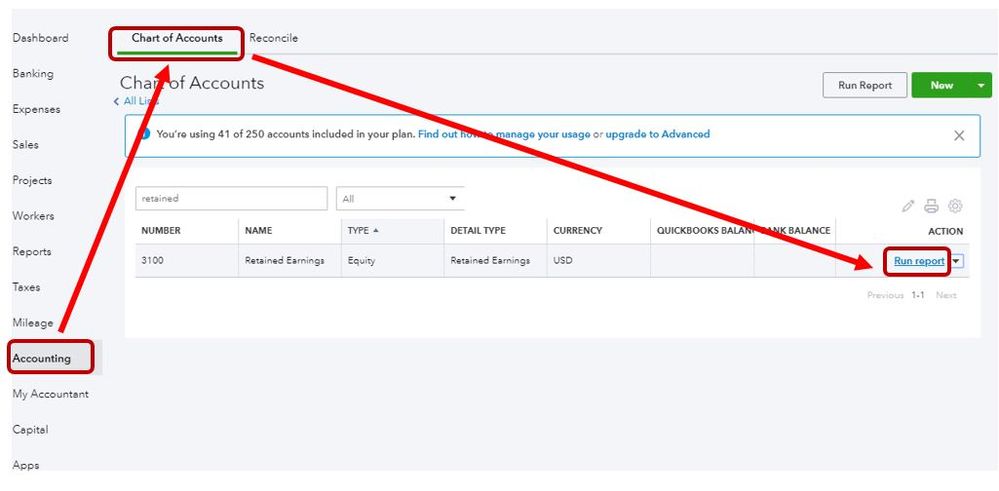

Let’s run a Retained Earnings account Quick Report to check if there were any transactions posted to that account.

Here’s how to do it:

This will show any user-created transactions affecting the Retained Earnings account figure. There should be no transaction posted on that account. However, if there were any, make sure to delete it.

Check this article for more information: How to view your Retained Earnings account.

If you still have follow-up questions about your retained earnings account, let me know by leaving a comment below. I’m always glad to help in any way I can. Take care and have a wonderful day!

Run the Profit and Loss report. (Left Dashboard > Reports > Profit and Loss).

Change the Report period on the top left to ALL DATES.

Change Display columns by to YEARS.

Click Run Report.

You will see the Profit and Loss/Net Income spread by Year.

On the Balance Sheet, for the current year, you will see the Net Income.

For prior fiscal years, you will see it as Retained Earnings. See you mentioned, it doesn't any data (it means no manual transactions were added) when clicking the Retained Earnings account, most likely Retained Earnings data came from previous years' net income/loss line from the profit and report. That's how you will need to review the negative retained earnings.

Hope this helps!

Thanks all for your help. The negative retained earnings, showing up on the first year's B/S, was a group of 1918 (not 2018) credit card transactions imported to QB via a .csv file. The date in the original Excel was 2-digit year and I must have overlooked the century during the import. I worked with QB chat help to ferret this out - they were patient and diligent. I intend to back out and exclude the offending transactions and re-import the corrected .csv

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.