Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowA journal entry with AP to you is totally wrong way to pay vendors with personal money.

Add a cash clearing bank type account. Record vendor checks, bill pay, etc from that dummy account. Deposit to same from Owner Contribution equity account.

L

These are reciepts that i already paid last year out of my pocket that i want to get paid back for

These are reciepts that i already paid for last year that i want paid back for.

These are reciepts of expenses that i paid for personally last year because the business didnt have the funds to pay for them and i want to get paid back for them

Hi there, @jrdevelopment202.

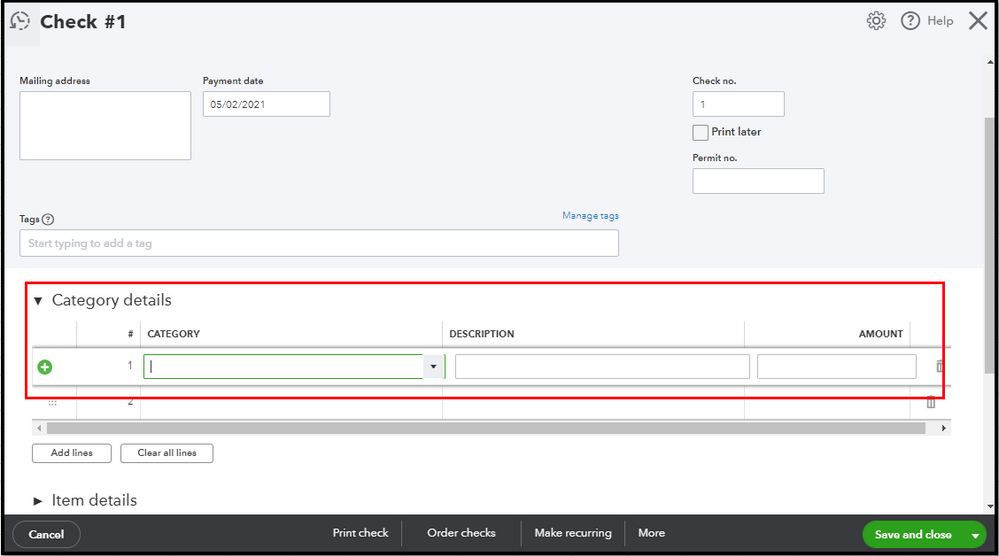

I'm here to share 2 ways on how you can get back the money paid for business expenses. First, you can record it as a check. Here's how:

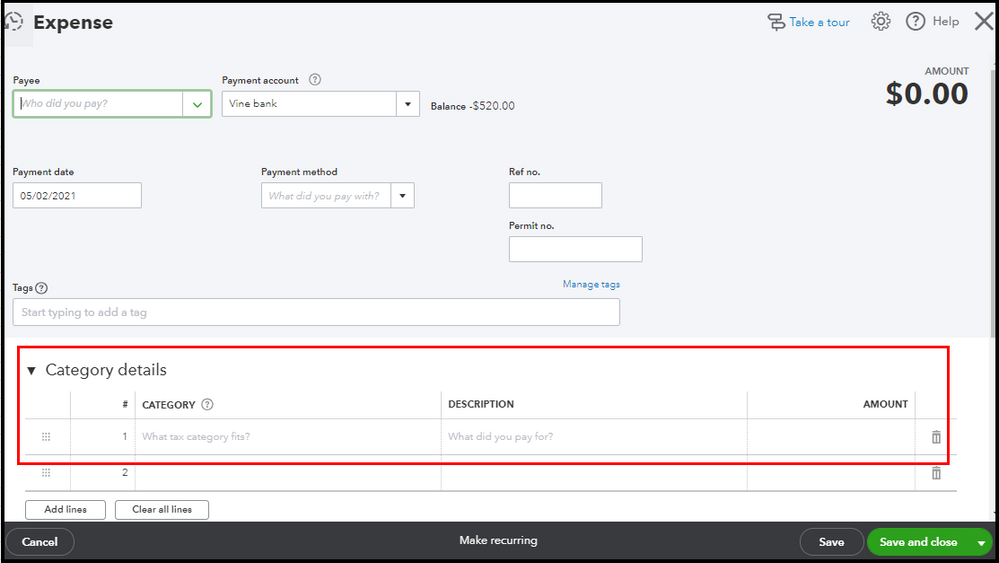

Another option is to record it as an expense:

For more info about the process, please see this article: Pay for business expenses with personal funds.

Then, to make sure that your transactions are under the correct account, you can easily categorize them in QuickBooks. For the detailed steps, please visit this article: Categorize and match online bank transactions in QuickBooks Online.

Don't hesitate to post again here if you have further questions about reimbursing the money paid for a business expense. I'll be around to help. Keep safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.