Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHello,

It all depends on how Clover brings the sales into QBO.

If it creates invoices, then Clover has already hit your income account and accounts receivable. You take the money and record it as a payment against the invoice. That will lower the AR and put the money in your bank account or in Undeposited Funds. If Undeposited Funds, then record the money going to your bank as a Bank Deposit.

Again, the key to this whole thing is recognizing how Clover is importing the sales into your QBO.

I'm not answering this question. I am wanting to know what do you do when the clover deposits into undeposited funds don't match the deposits on the bank statements?

Hi there, Lisa CA.

Thanks for dropping by the Community, I have a quick question, are you using QuickBooks Payments? If not I would highly recommend it. In the meantime, I'm happy to show you how to manually record the deposits from clover so they match your Undeposited funds.

Step 1: Put transactions into the Undeposited Funds account:

If you haven’t already, put the invoice payments and sales receipts you want to combine into the Undeposited Funds account. This account holds transactions before you record a deposit.

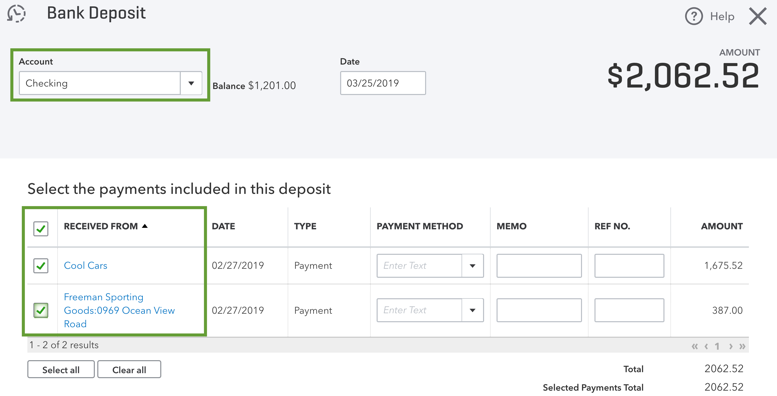

Step 2: Record a bank deposit in QuickBooks to combine payments:

Each bank deposit creates a separate record. Make deposits one at a time for each of your deposit slips.

You can find these steps and the next steps at the following link: Record and make deposits in QBO. If you have any other questions, feel free to post down below. Thank you and have a nice afternoon.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.