Good work in setting up your e-services, psw1.

Quickbooks offers two options in accessing the list of payments you've already processed. We can either check the payments through the Payroll Tax Center or run the Payroll Tax Payments report.

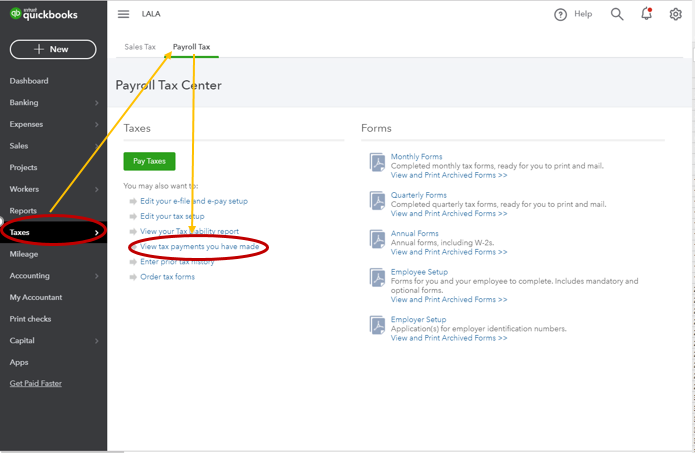

To access payments through the Payroll Tax Center:

- From the Taxes menu, select Payroll tax.

- Select the View tax payments you have made link.

- Select the payment date to show the details of the payment.

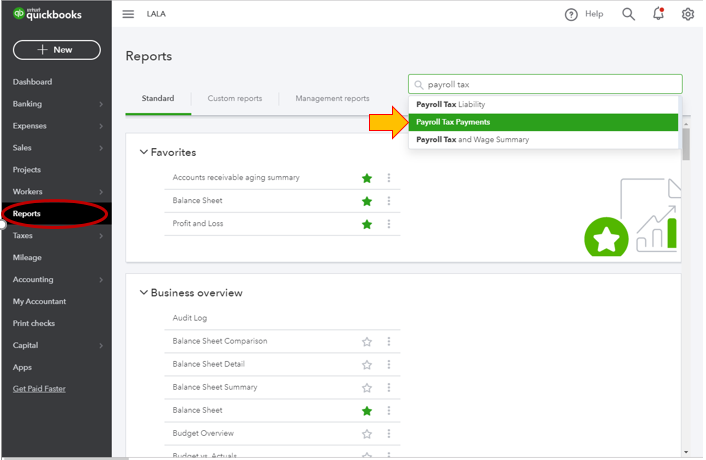

To run the report:

- From the left panel, select Reports.

- In the search field, enter Payroll Tax Payments.

Using the instructions above, you'll surely identify that your tax payments have been paid.

In case you want to track all the payments you've made to your employees, you can refer to this article in pulling up and customizing your payroll reports.

If there's anything else I can do to help with managing your QuickBooks, please feel free to comment below. Thanks!