Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI am working on a remodel project. I had the customer purchase some materials for the project while they were out of town. To keep their invoice and cost of job accurate for both of us, how can I enter the receipt for their materials but have it be paid from an outside source where I don't show the money came to me or went out from me? I was thinking entering the items as a bill, but even that requires an expense account to be used when paying that bill later. I can create a fake ACH debit and ACH credit for the amount they paid for materials to my LLC Checking account, but is there a better/cleaner system? This is in Quickbooks Desktop 2020

Hello there, @CCCBuilder.

I appreciate you reaching out to us here in the Community. I can share some information about tracking the materials.

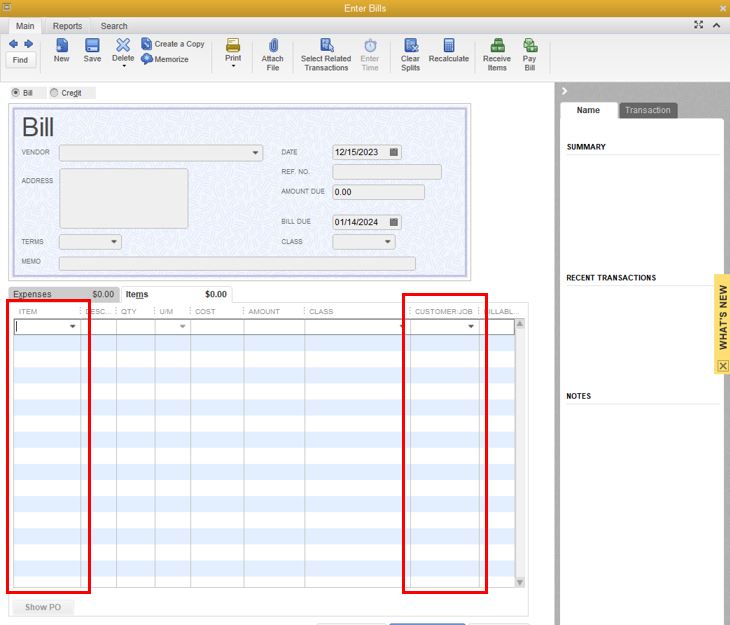

You can do job costing to track the expenses and income in QuickBooks Desktop. For job-related purchases (subcontracted services), you can use a bill, check, or credit card charge transaction.

Here's how:

Since it has to be paid by an outside source, I suggest setting it up as a vendor, then use a clearing account. This way, we'll be able to show in the system where the payment came from originally.

If you want to create a dummy ACH debit and credit, you can also consider doing it to avoid deducting amounts from your company's bank. Also, another option would be a journal entry and use the clearing account to transfer the payment from your bank to the clearing.

Additionally, here are some helpful references that you can check out about tracking job costs, as well as setting up a clearing account:

Please know that I'm just a post away if you have any other questions. Have a great day ahead.

So the customer who bought the materials while out of town, where do I show money coming from them to pay for the materials? The vendor will be where the materials were bought, what would be the expense account for this bill then?

Still not sure this was the answer...do I need to reword the question?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.