Hi there, @ElishevaV.

You can track your loan from the third party by recording a journal entry of the total amount and the interest rate. First you'll have to create an account in the Chart of Accounts. I also suggest to consult your accountant to verify the account for this process to avoid having errors when you reconcile.

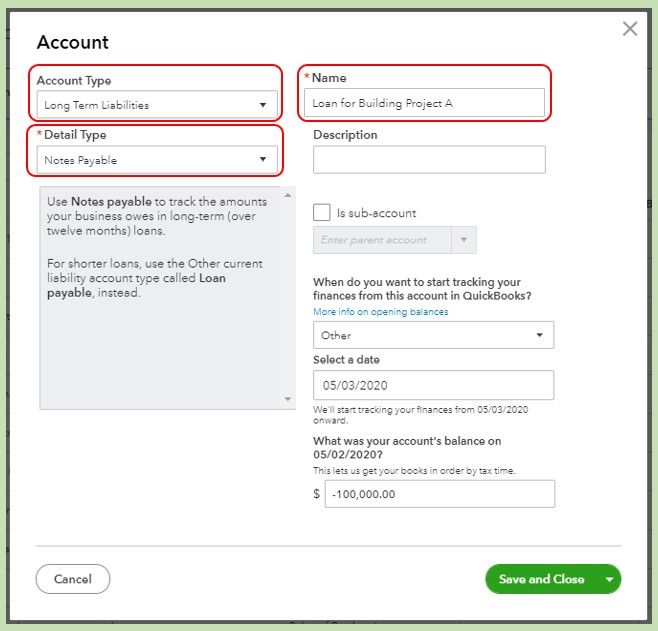

Step 1: Create a Liability account.

- Go to the Chart of Accounts and then click New.

- From the Account Type▼ drop-down menu, you can choose either Long Term Liabilities if you plan to pay it beyond one fiscal year or Other Current Liabilities if you plan to pay off loan within the current fiscal year.

- From the Detail Type drop-down, choose Note Payable.

- Enter the most applicable name like "Loan for Building Project A".

- Choose when you want to start tracking your finances from the drop-down.

- In the Amount field, enter the full negative amount.

- Verify the details then click Save and close.

Here's a screenshot for you reference:

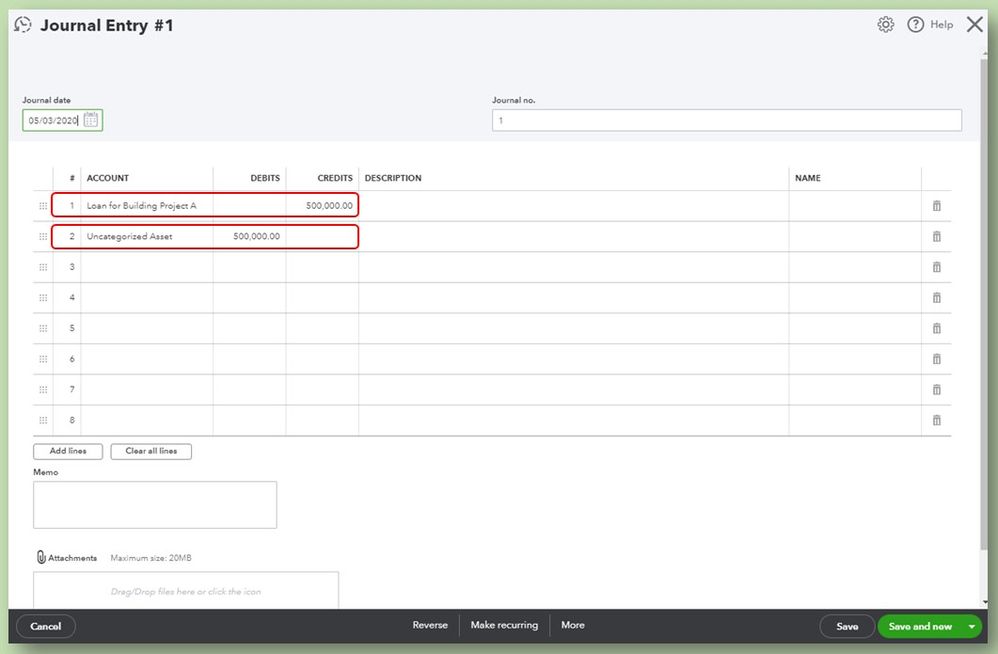

Step 2: To record the loan amount and the payments, you can enter it all at once or partially through Journal Entry:

- Switch to Accountant View first then go to the + New button.

- Select Journal Entry, on the first line under the account column, enter the Liability account you've made.

- Enter the amount in positive number under the Credit column.

- On the second line, enter the relevant asset account and then enter same amount In the Debits column.

I added a screenshot to see how it looks like.

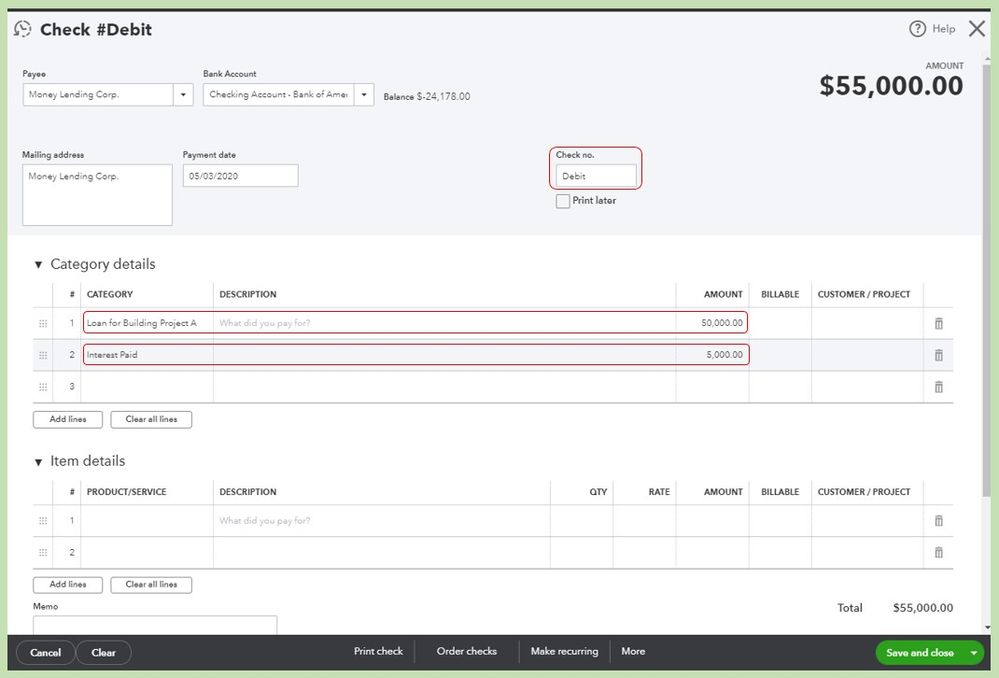

Step 3: To record your loan payment, you'll have to create a check transaction in QuickBooks Online. Before doing the steps below, make sure you have switched to Accountant view.

- Go to the + New button and choose Check.

- You can enter the Check number of the actual check or enter Debit or EF on the Check # field if it's direct withdrawal from Electronic Bank Transfer. You can check the screenshot below for additional reference.

- Verify Save and close.

You can also check out this article to help you enter your bank transactions in the future: Assign, categorize, edit, and add your downloaded banking transactions.

Count me in if you need anything else. I'll be here to help. Stay safe.