Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI appreciate your time posting here in the Community, @mromano. It's my priority to help you remove adjustments made on the check.

Before that, can I ask how the adjustments were entered? This way, I can further guide how to it correctly. Additional info would be greatly appreciated.

I also suggest consulting your accountant before removing the adjustments made. This is to ensure that it will not affect your accounts and financial reports in QuickBooks.

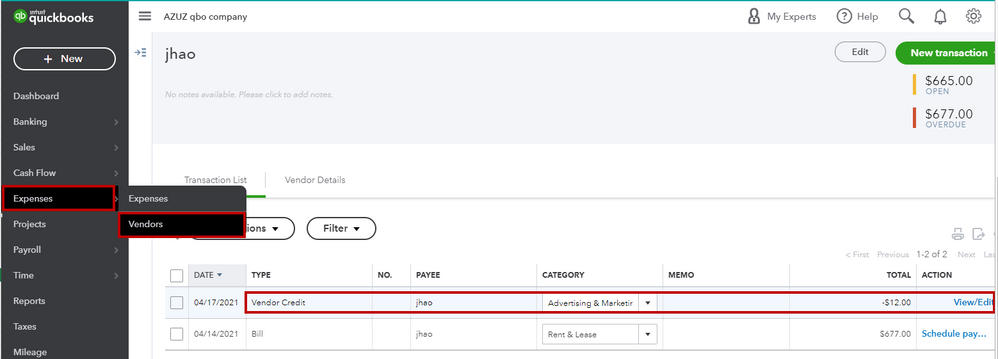

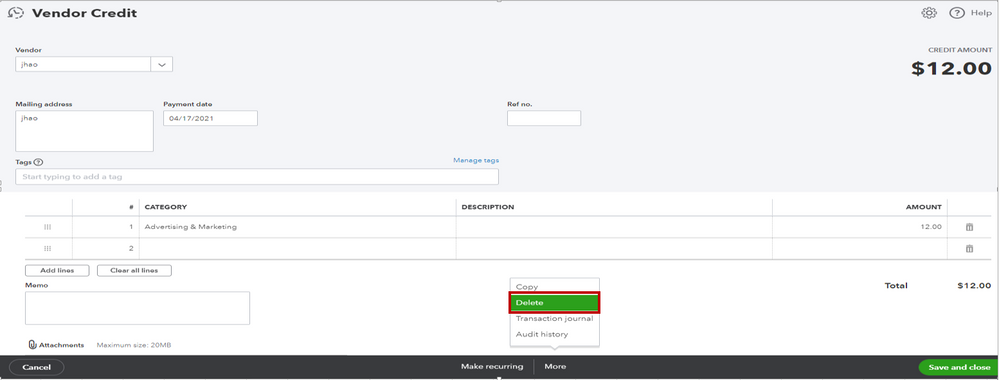

With regards to the old credits, if you enter them as vendor credits, you can delete them if they are not valid. But before doing so, it’s also best to consult your accountant to keep your book accurate.

Here's how:

I'm also adding this resource to guide you in managing vendor credits in QuickBooks Online.

I'm just a post away if you need my help managing vendor transactions in QuickBooks. I'll be around to assist you. Keep safe always.

Hi, @mromano.

Hope you’re doing great. I wanted to see how everything is going about the removing adjustments made by the accountant concern you had the other day. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I’d be happy to help you at any time.

Looking forward to your reply. Have a pleasant day ahead!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.