Handle cash basis sales tax

by Intuit•4• Updated 8 months ago

You may be required to collect taxes for certain goods and services you offer. QuickBooks helps you keep an accurate record of these taxes so you can easily monitor and remit them to the appropriate tax collecting agency.

This article is part of a series on Sales Tax. It covers the usual sales tax workflow in QuickBooks Desktop. If you encounter problems while working on your sales tax, see Resolve common sales tax issues. |

If your taxable sales amount seems off when you run the Sales Tax Liability report or if you have invoices from another month or period showing on the current report, then you may need to check if you are running the report on cash or accrual basis. Note that the accounting method or report basis you use affects the sales tax amount you owe.

- Accrual: QuickBooks calculates sales tax payable as soon as you invoice your customer. Regardless of the payment amount or date, the full sales tax amount will show on the month when the invoice was created.

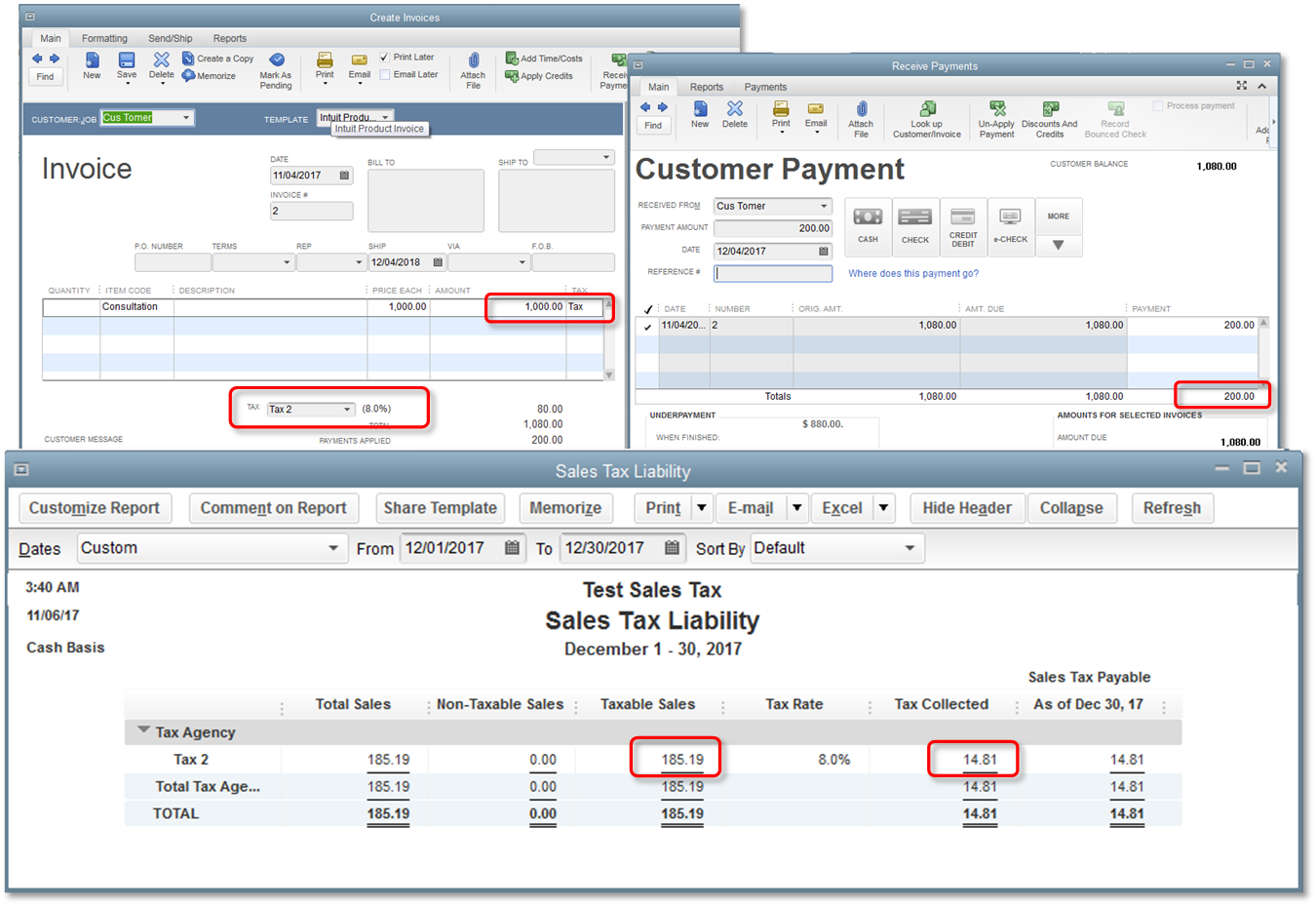

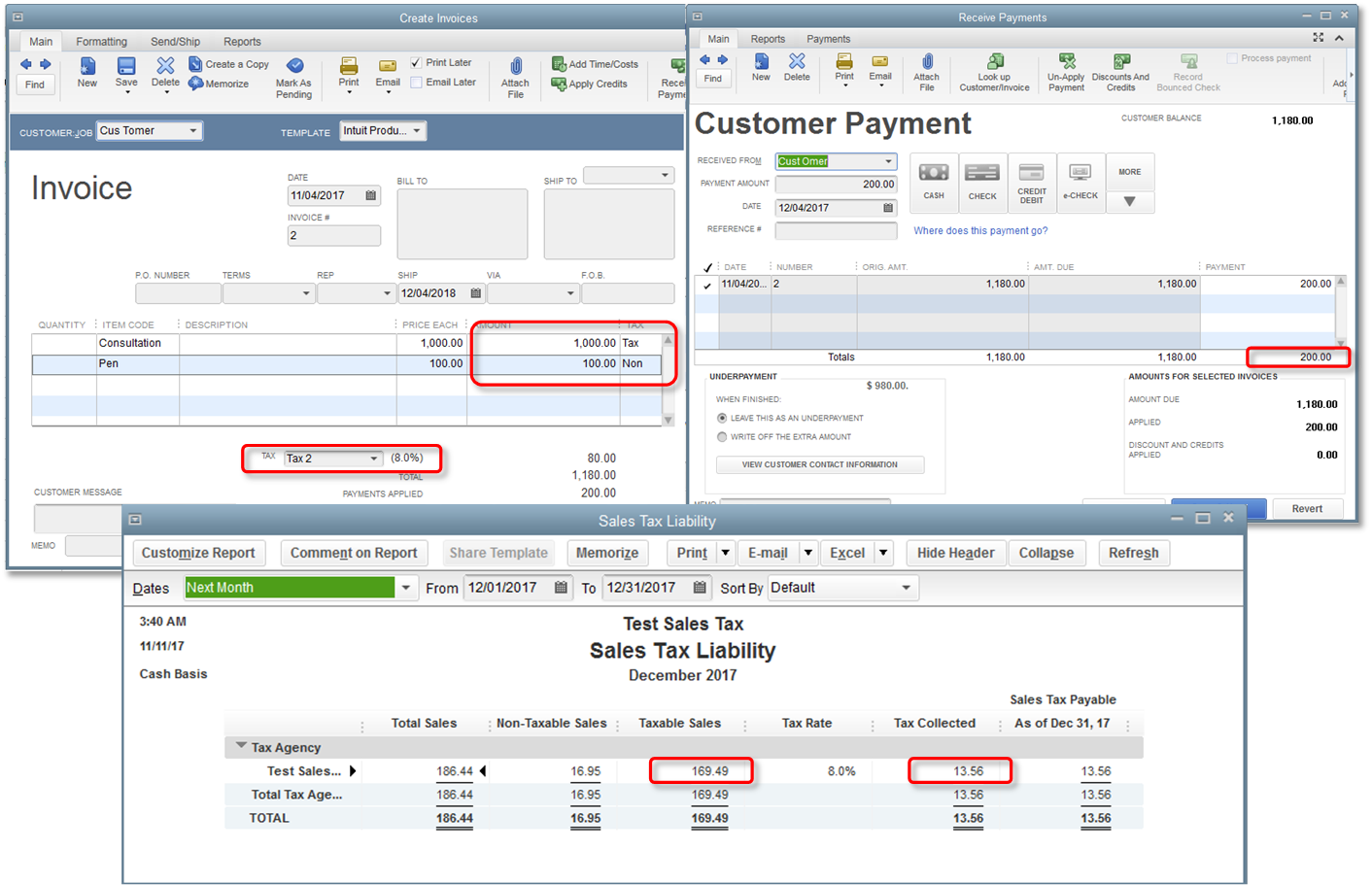

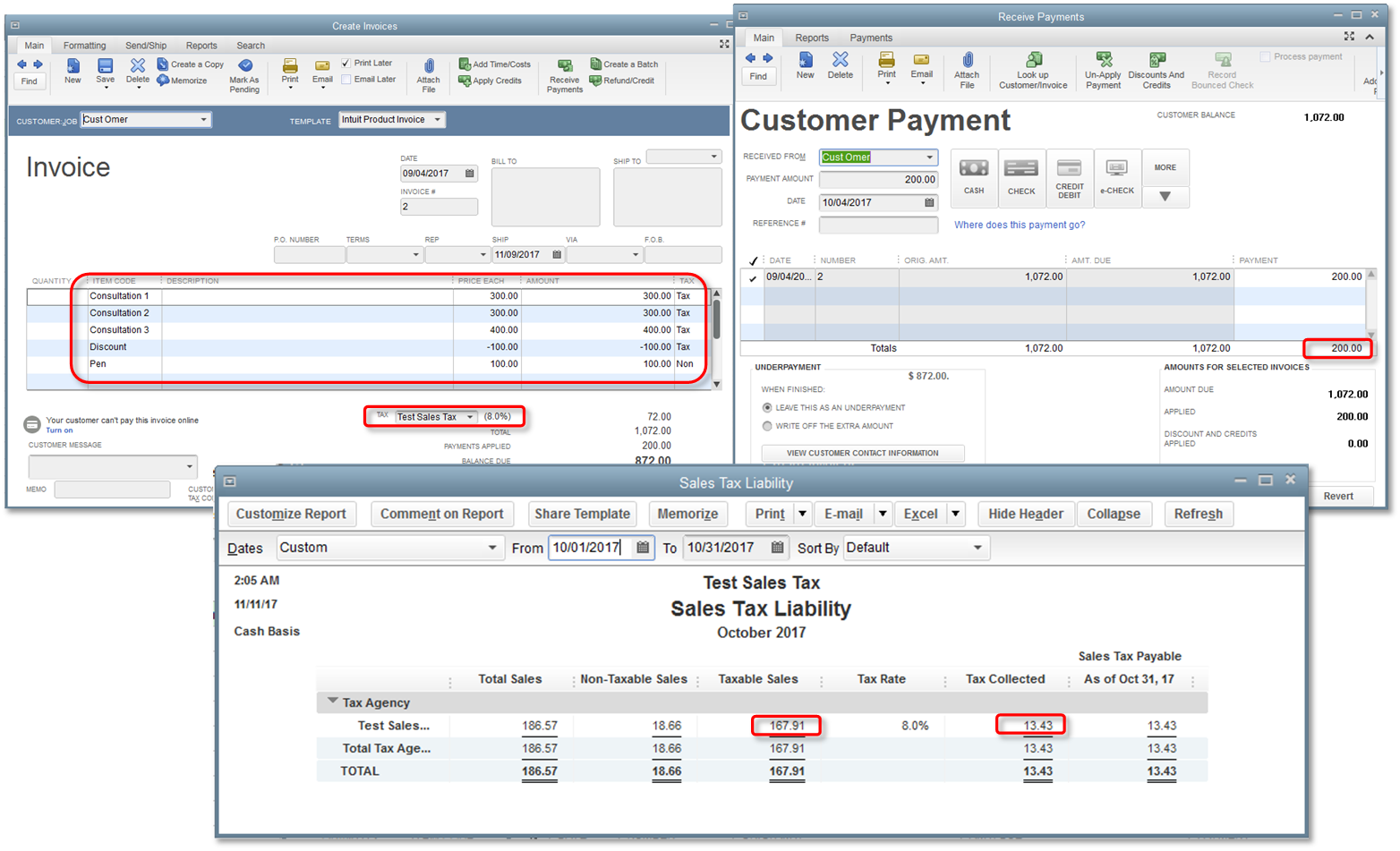

- Cash: QuickBooks calculates sales tax payable only when you receive the payment. When you receive a full payment for the invoice, the full sales tax amount will show on the month when the payment was received. No sweat! It becomes complicated, however, when there are non-taxable line items on the invoice or if you receive partial payments or if there are credits/discounts applied to the invoice.

Here are some of the common scenarios you may encounter when you receive partial payments for cash basis sales tax.

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.

More like this

- Track sales tax on purchases from vendorsby QuickBooks

- Process sales tax adjustmentby QuickBooks

- Collect sales taxby QuickBooks

- Show multiple sales tax items on an invoiceby QuickBooks