You may be required to collect taxes for certain goods and services you offer. QuickBooks Desktop helps you keep an accurate record of these taxes so you can easily monitor and remit them to the appropriate tax collecting agency.

This article is part of a series on Sales Tax. It covers the usual sales tax workflow in QuickBooks Desktop. It also helps you complete other sales tax-related tasks.

If you encounter problems while working on your sales tax, see Resolve common sales tax issues. |

Adjust the sales tax amount you owe

When you make sales tax adjustments, you move money into or out of your Sales Tax Liability account. You adjust your sales tax liability for reasons like:

- A credit for previous over payment or early payment discount given by your sales tax agency.

- A fine charged to you by your tax agency for late or non-payment in the previous tax year.

- Corrections to sales in a previous period.

- Rounding differences between QuickBooks and your sales tax forms.

- Sales tax holiday declared by your agency.

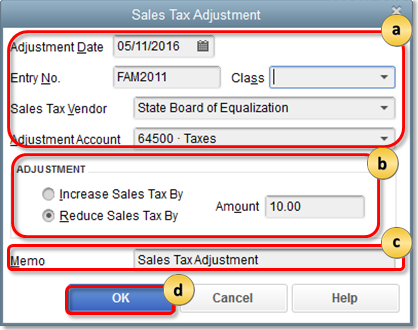

To adjust your sales tax due:

- Go to the Vendors menu and select Sales Tax then Adjust Sales Tax Due.

- In the Sales Tax Adjustment window:

- Enter the adjustment date, sales tax vendor, adjustment account and other relevant information.

Note: Do NOT use sales tax payable for the adjustment account. Choose an Income account if you are making the adjustment because you received a discount/credit or if you are entering a negative rounding error. Choose an Expense account if you are making the adjustment because you need to add penalties and fines or if you are entering a positive rounding error. - In the Adjustment section, choose if you need to increase or reduce sales tax then enter the adjustment amount.

- (Optional) In the Memo field, enter any additional note.

- Select OK.

- Enter the adjustment date, sales tax vendor, adjustment account and other relevant information.

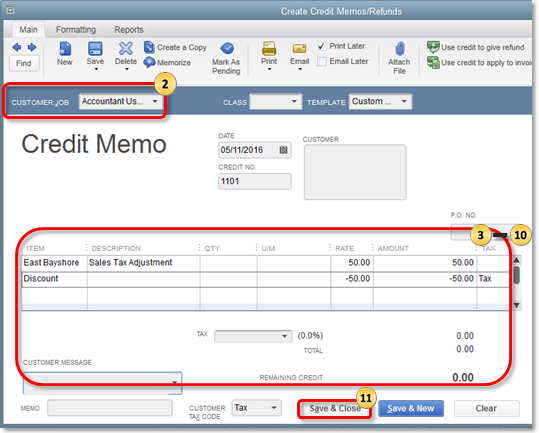

Adjust amounts for sales tax items

You need to make adjustments for specific sales tax items if there are several types of sales tax payable to the same tax vendor. Adjusting the sales tax items allows the allocated amount to match the reporting as well.