Take the guesswork out of collecting sales tax. If you charge sales tax for your products or services, you don't have to worry about calculating each tax rate yourself. QuickBooks can do all that for you. Here's how it works.

We're rolling out a new sales tax system for all QuickBooks users. If you use manual sales tax, check if you can now switch over to automated sales tax. If you don't have the option to switch, don't worry. It should be available to you soon.

How QuickBooks calculates the correct tax rate on each sale

QuickBooks automatically calculates the total tax rate for each sale based on the following:

- Your customer's tax-exempt status

- Where you sell and where you ship

- What you sell

Based on your customer's tax status

Not all customers need to pay sales tax, like churches, schools, and other non-profit organizations. Here's how to find out if your customer doesn't need to pay sales tax. Then, you can set up your customer as tax-exempt.

Because tax-exempt rules are not the same everywhere, QuickBooks will sometimes need to calculate sales tax for tax-exempt customers. You just need to map your items to their proper tax categories, and make sure your customer's address is correct on each transaction. Then, QuickBooks follows the correct tax-exempt rules based on what you sell and your customer's address.

Based on where you sell or where you ship

Total sales tax rates are the sum of states rates plus local rates (which may include city, county, and/or district rates). You don't have to keep track of all the rates you need to charge. QuickBooks does all that based on the location of sale or the "ship to" address you add in an invoice or receipt.

Note: Some states require sellers to charge tax based on business location, even when you sell or ship to a different address in your state. QuickBooks knows the tax rules, wherever you run your business.

Do you sell out of your state? If your business doesn't have a physical presence in other states, you generally don't need to charge taxes for out-of-state transactions. But if you have an economic nexus in another state, this means you are a remote seller. When you sell to that state, you charge tax rates at the place where your product is going. Because this can get a little complicated, we recommend talking to your accountant.

Based on your service or product's tax category

Rules for how to tax a product can change from state to state. You can assign tax categories to anything you sell. This lets QuickBooks know how much tax you need to charge based on what exactly you're selling.

Special tax scenarios

QuickBooks calculates your sales tax, even when the rules get a bit complicated. If you want to understand more about sales and use tax in the US, we offer a basic sales tax guide, or you can contact your accountant or visit your state's sales tax website.

See automated sales tax in action

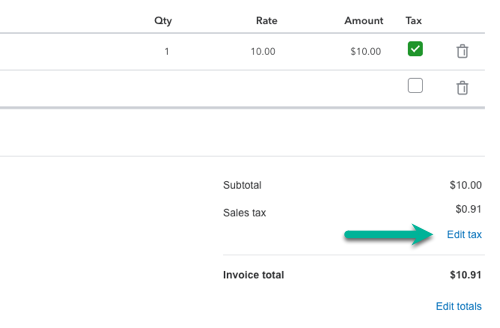

- When you create an invoice or sales receipt, check the total sales tax at the bottom.

- Select See the math or Edit tax. This opens the "How your sales tax is calculated" page where QuickBooks gives you a detailed breakdown of the sales tax.