How to adjust for Balance Sheet if first financial year is more than 12 months

by Intuit•1• Updated 1 month ago

It is common that for new businesses, the first financial year would last longer than 12 months. QuickBooks Online would automatically transfer the net profit and loss of the year to the Retained Earnings account, if the Balance Sheet is set with the start date to be on the 1st day of the financial year.

For example, a business's financial year starts in January and ends in December. On the first year, the financial year spans 13 months so the first financial year ends in January of the following year instead of December. To capture 13 months’ worth of net profit in the Retained Earnings account, we'll need to transfer all the sales and expense incurred on this 13th month to the Retained Earnings account (the first 12 months would be auto captured by QuickBooks Online).

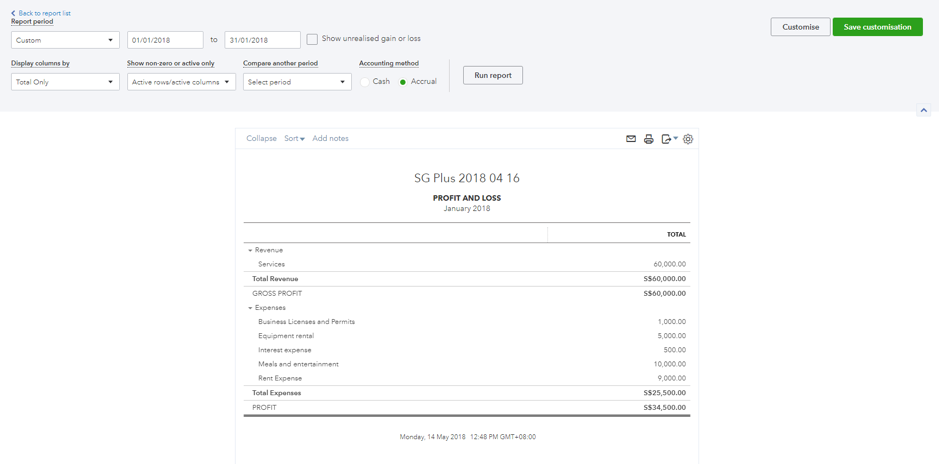

We'll first have to tabulate the total sales and expense incurred on the 13th month by simply running the Profit & Loss report. Referring to this screenshot below, the date range is set as 1st Jan - 31st Jan.

Make an adjustment:

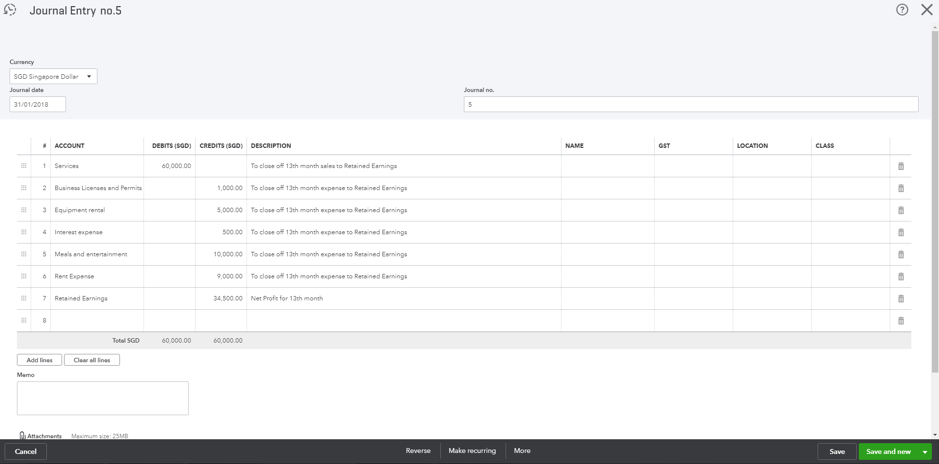

- Select + New or + Create.

- Select Journal entry.

In summary, we have to debit all the sales account and credit all the expense account (debit if it is a negative figure). The difference in total debit and credit would be your net profit and loss which is what goes into the Retained Earnings account.

More like this

- Run a Balance Sheet reportby QuickBooks

- Year-end guide for QuickBooks Onlineby QuickBooks

- Add and manage fixed assets in QuickBooks Online Advancedby QuickBooks

- Close your books in QuickBooks Onlineby QuickBooks