Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Yes, you can, @silverton-leeann.

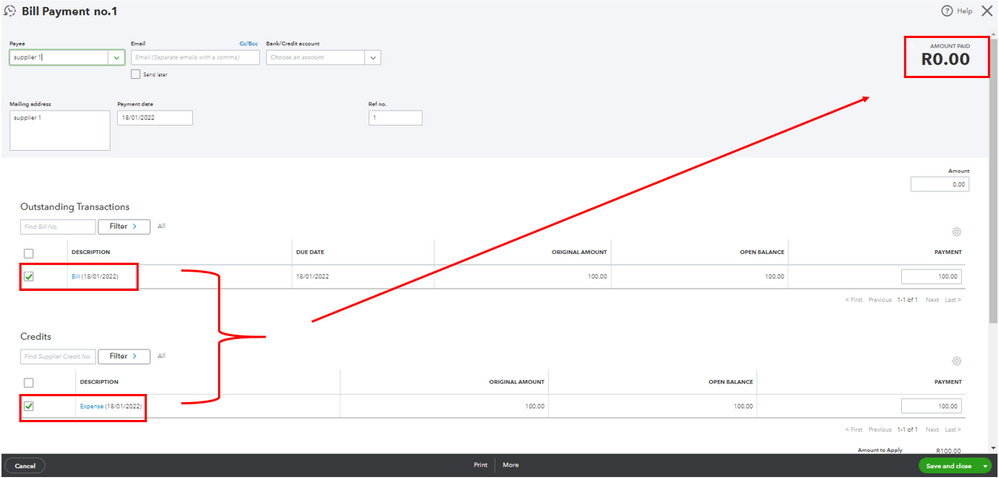

You'll want to open your expense transaction and change the category to Accounts Payable (A/P). This will make the amount of the expense an open credit and can be apply as a bill payment. And no, this will not affect your bank. I'll show you how.

In case you need to refund your supplier in QBO, you can refer to this article for the step by step process: Handle supplier credits and refunds in QuickBooks Online.

Whenever you need help managing your suppliers and bills, you can always count on me to back you up. Stay safe and have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.