Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

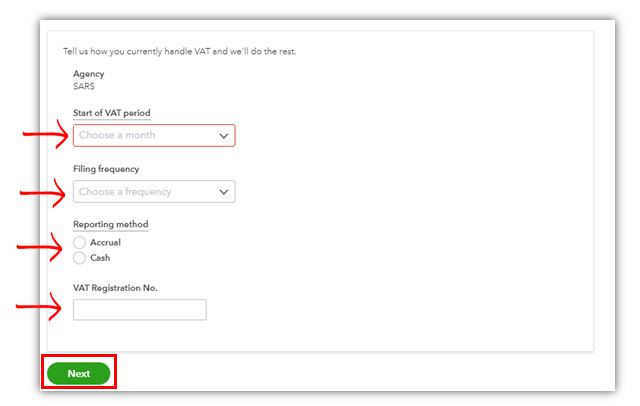

I can help you set up your VAT rates and use them on forms, @Cardiway2011.

First, you must turn on this feature from your VAT menu. Here's how:

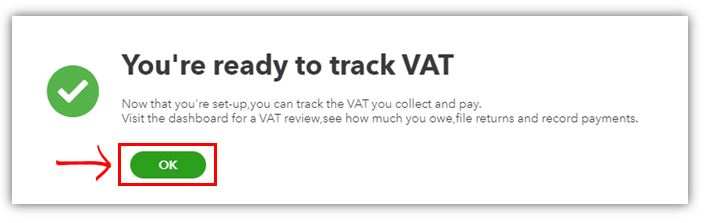

When you now create invoices, quotes, and all other sales forms, you'll now have this VAT column.

See these helpful articles to give you more insights about adding VAT rates in the system everything that you need to know once you're registered:

You can also check this article if you need assistance with filing and paying your taxes: Learn how to file and pay the Tax/GST you owe using QuickBooks Online International version.

Let me know if there's anything that you need in setting up your VAT and adding it on your sales forms. I'm always here ready to help. Have a great rest of the day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.