Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi, I need assistance please. I need to show a transaction between two companies (seperate quickbook accounts) that do not reflect on the bank balances, but generate vat. I was told to to an Invoice on the one company - but how do I show it on the other side?

Hello there, @Jennivdm.

You can create an invoice in Company A, then record it as bill in Company B. I can guide you on how to do it.

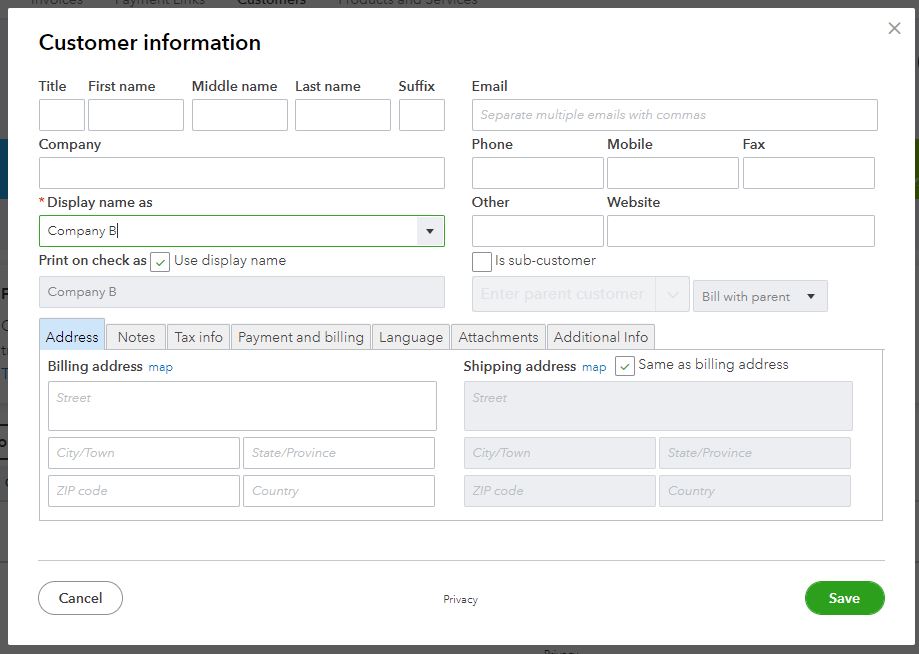

First, let's make sure to add Company B as a customer in Company A. Here's how:

Now, you can create an invoice.

On the other hand, you can enter Company A as vendor in Company B. You can follow these steps:

Now, you can create a bill to record the invoice you'd receive from Company A.

You can create a journal entry to record the invoice payments in Company A and bill payments in Company B. Lastly, I'd recommend consulting with an accountant so you'd be guided accurately in tracking your VAT-related transactions.

Get back to us here if you have other questions or concerns. I'm always here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.